Hennepin County, located in Minnesota, is the most populous county in the state and home to various cities such as Minneapolis, Bloomington, and Minnetonka. When it comes to legal matters involving the transfer and allocation of assets, Hennepin Minnesota Assignment of Assets plays a crucial role. An Assignment of Assets is a legal document that outlines the transfer of ownership or rights to specific assets from one party to another. It can take different forms and serve different purposes within Hennepin County, including: 1. Assignment of Real Estate Assets: This type of assignment involves the transfer of ownership or rights related to real property, such as land, buildings, or homes, within Hennepin County. It may be used in various situations, such as sales agreements, estate planning, or property exchanges. 2. Assignment of Intellectual Property Assets: Hennepin County is known for its thriving business environment and innovative industries. When it comes to intellectual property, such as patents, trademarks, or copyrights, an Assignment of Assets can be used to transfer ownership, licensing rights, or other interests in these valuable assets. 3. Assignment of Financial Assets: In financial transactions within Hennepin County, an Assignment of Assets may be used to transfer ownership or rights to various financial instruments. This can include assignment of stocks, bonds, bank accounts, investment portfolios, or insurance policies. 4. Assignment of Business Assets: Hennepin County is home to a diverse range of businesses, from small startups to large corporations. When a business changes ownership, merges, or goes through bankruptcy, an Assignment of Assets is often involved. It allows for the allocation of business assets such as equipment, inventory, contracts, or intellectual property rights. 5. Assignment of Trust Assets: Individuals residing in Hennepin County may create trusts as part of their estate planning and wealth management strategies. An Assignment of Assets can be utilized to allocate trust assets, ensuring they are properly distributed to beneficiaries or utilized for specific purposes. The Hennepin Minnesota Assignment of Assets involves the meticulous documentation of the parties involved, details of the assets being assigned, and any relevant conditions or restrictions. It is essential to consult with a qualified attorney familiar with Hennepin County laws and regulations to ensure the validity and enforceability of the Assignment of Assets. In summary, Hennepin Minnesota Assignment of Assets encompasses the legal transfer and allocation of various assets, such as real estate, intellectual property, financial holdings, business assets, and trust assets. Each type serves a different purpose and requires careful consideration and documentation to ensure compliance with Hennepin County's laws and regulations.

Hennepin Minnesota Assignment of Assets

Description

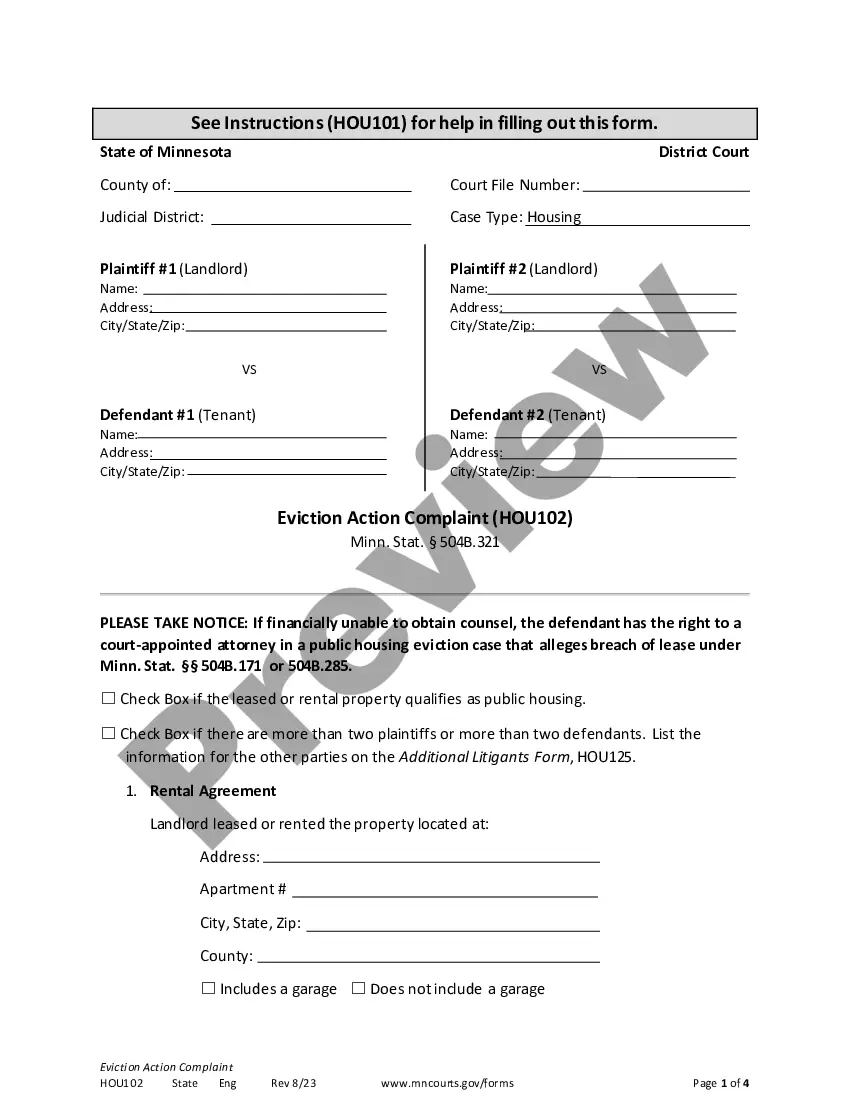

How to fill out Hennepin Minnesota Assignment Of Assets?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Hennepin Assignment of Assets, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the latest version of the Hennepin Assignment of Assets, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Assignment of Assets:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Hennepin Assignment of Assets and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

State deed tax (SDT) SDT is paid when recording an instrument conveying Minnesota real property. The rate is 0.0033 of the purchase price. SDT for deeds with consideration of $3,000 or less is $1.70.

How Much Are Transfer Taxes in Minnesota? Now let's get to how much you'll pay in transfer taxes selling a house in Minnesota. As this Minnesota Department of Revenue website states, the deed tax rate in the state is 0.33% of the net consideration, i.e. the price that was paid for the property in question.

How to Write a Minnesota Quitclaim Deed Preparer's name and address. Name and address of the person to whom the recorded deed should be returned. County where the property is located. The consideration paid for the property. Grantor's name and address. The legal description of the property. Well disclosure statement.

Minnesota Statute 287.21 provides for deed tax to be paid on deeds to be recorded. The rate is 0.0033 of the purchase price (Example: $105,250 X 0.0033 = $347.33 deed tax). The minimum deed tax amount is $1.65.

In a tax planning context, putting someone 'on the property deeds' often involves giving the property, or an interest in it, to a spouse (or civil partner) or close family member. The recipient invariably pays tax at a lower rate, or none at all.

After marriage, joining assets is a way to express unity together. In Minnesota, you can't simply add a person to a deed, a new deed needs to be created and filed showing the additional person.

Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person.

How to Write a Minnesota Quitclaim Deed Preparer's name and address. Name and address of the person to whom the recorded deed should be returned. County where the property is located. The consideration paid for the property. Grantor's name and address. The legal description of the property. Well disclosure statement.

Typically, the deed tax is paid by the seller of a property. In the case of property transfer by quit claim deed, the deed tax may be paid by the grantor and would amount to 0.0033 times the net consideration.

We determine a value for each property by analyzing sales and market conditions. The state of Minnesota requires us to value properties at their market value, as of January 2 each year. Our purpose is to determine the amount the property would sell for.