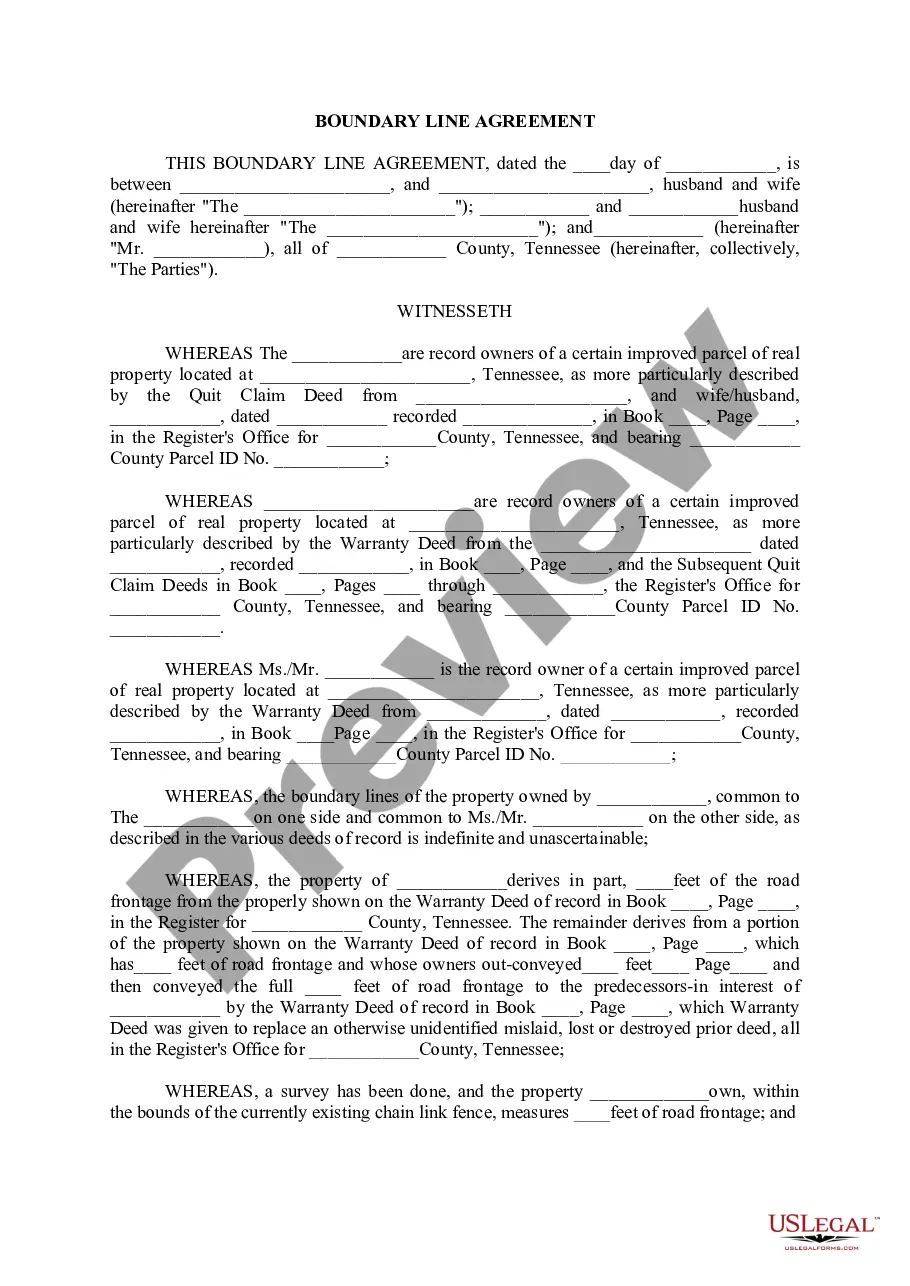

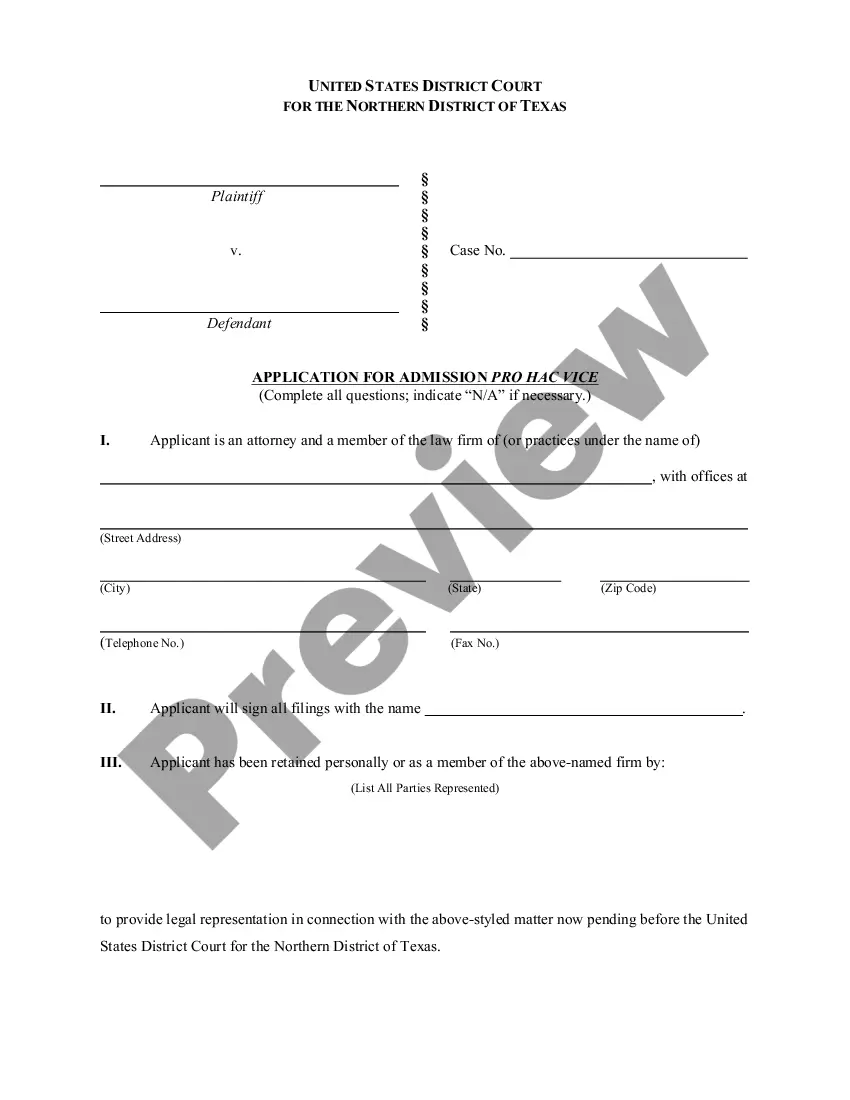

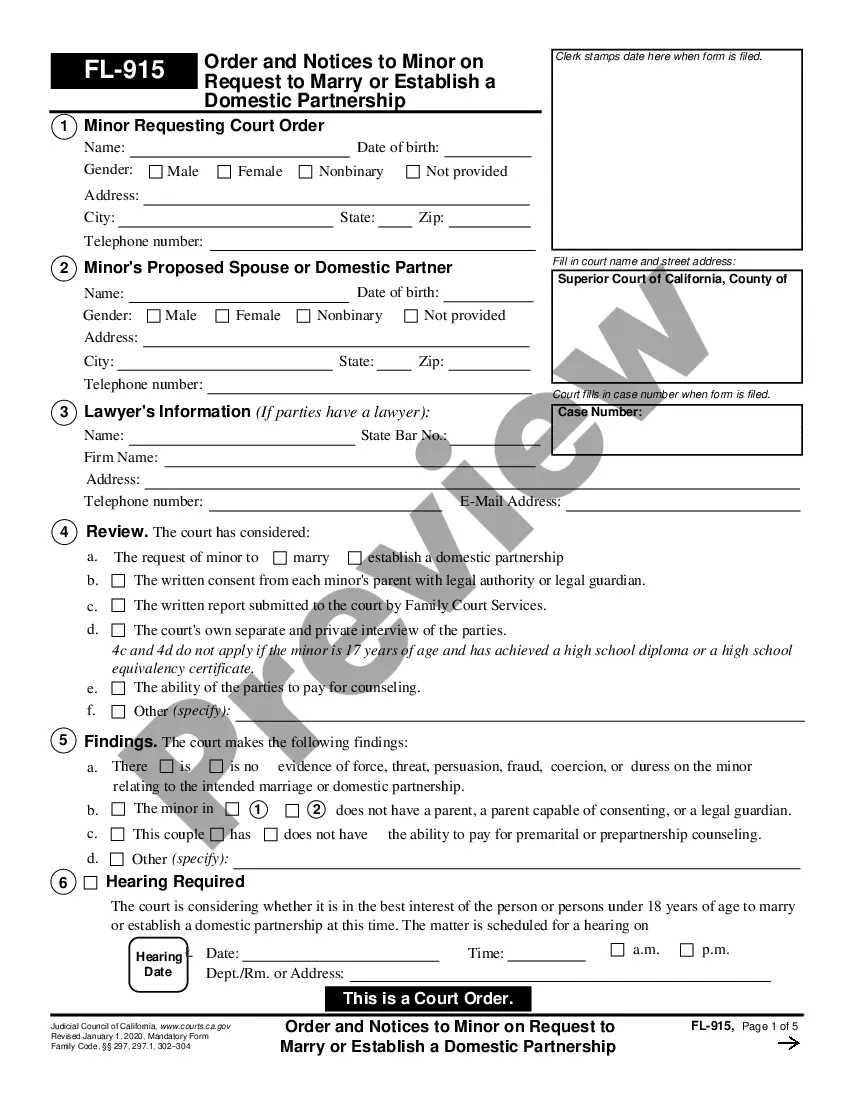

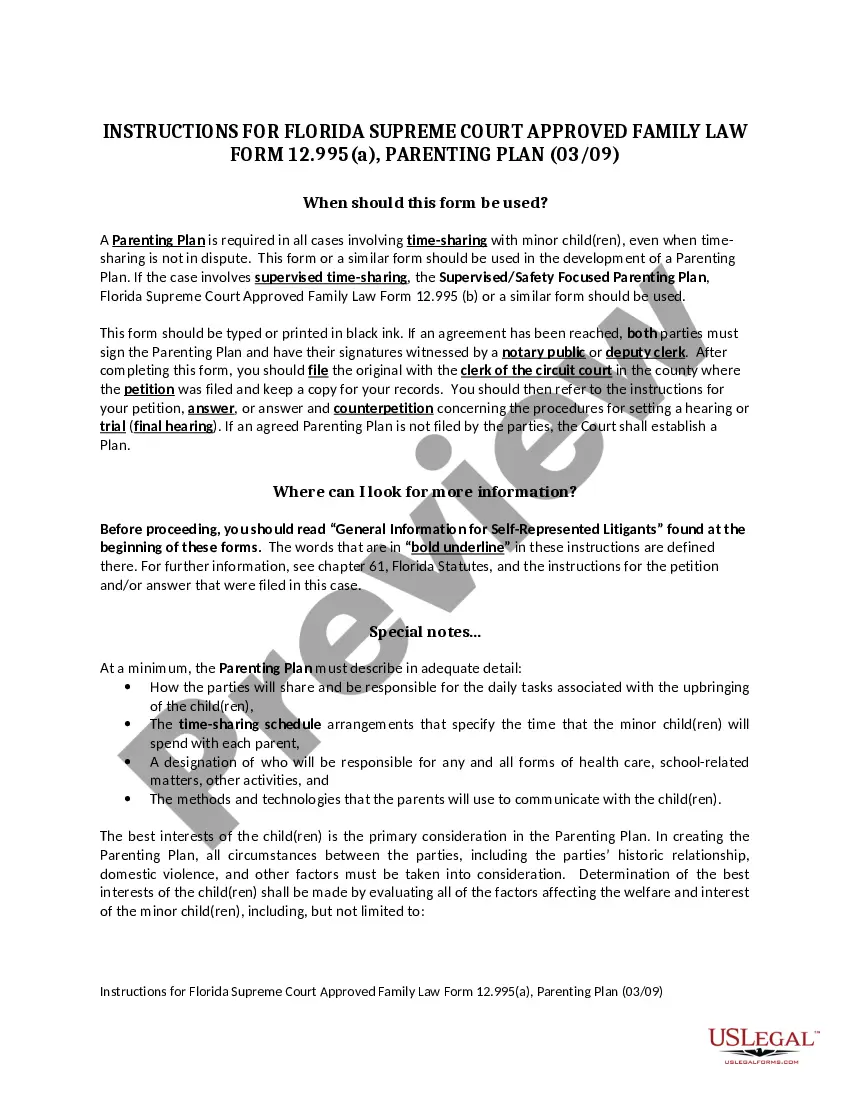

Maricopa, Arizona Assignment of Assets is a legal process that involves transferring ownership of assets from one party to another. This assignment can occur within various contexts, such as business transactions, estate planning, or debt settlement. It is essential to understand the different types of Maricopa Arizona Assignment of Assets to navigate the legal intricacies properly. 1. Business Assignment of Assets: In commercial settings, businesses often execute an Assignment of Assets to transfer ownership rights to a buyer or another entity. This could involve transferring tangible assets like property, inventory, equipment, or intangible assets like patents, trademarks, copyrights, or contractual rights. Such assignments are prevalent during mergers, acquisitions, or when selling a business. 2. Estate Planning Assignment of Assets: In the realm of estate planning, individuals may utilize an Assignment of Assets to distribute their property, investments, or other assets according to their wishes upon their death. This document outlines the beneficiaries and their respective inheritance portions, facilitating the smooth transfer of assets during probate. 3. Debt Settlement Assignment of Assets: In cases of debt settlement, a person or business facing financial difficulties may enter into an agreement with creditors to resolve outstanding debts. As part of this process, the debtor might agree to assign certain assets to the creditors as collateral or to satisfy the debt. This Assignment of Assets ensures a predetermined method of payment and provides security to creditors. 4. Intellectual Property Assignment: When it comes to intellectual property rights, such as patents, trademarks, or copyrights, individuals or businesses may assign these assets to someone else. This assignment could occur due to various reasons, such as selling the IP rights to another party, transferring it as part of a business acquisition, or licensing it to others for usage. The Maricopa, Arizona Assignment of Assets is a legally binding document that must be prepared accurately and reviewed by competent attorneys to ensure its validity. It is highly advisable to consult legal professionals specializing in the specific context of the asset assignment to ensure compliance with Maricopa County's laws and regulations. Careful consideration of the specific assets involved, their valuation, and potential tax implications is crucial during the assignment process. Additionally, parties involved in an asset assignment should prioritize maintaining proper documentation and recording the assignment appropriately to protect their interests and avoid future disputes.

Maricopa Arizona Assignment of Assets

Description

How to fill out Maricopa Arizona Assignment Of Assets?

Are you looking to quickly create a legally-binding Maricopa Assignment of Assets or probably any other form to take control of your personal or business matters? You can go with two options: contact a professional to write a valid paper for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Maricopa Assignment of Assets and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the Maricopa Assignment of Assets is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Maricopa Assignment of Assets template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Under Arizona law, you have two years from the date of the decedent's passing to probate a Will.

First, you'll need to initiate probate. File a petition with the county court where the decedent lived or owned property, and include a list all of the potential heirs to the estate. If there is a family member or trusted advisor who would like to serve as the estate's administrator, indicate that in the petition.

The total value of the estate's real estate must be less than $100,000. you must wait at least six months after the death. the court must not have appointed a personal representative or the one who was appointed has not been active for at least a year and didn't give file a closing statement with the court.

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

The following categories of assets are usually subject to probate. To qualify for Small Estate Probate the total value of real property must be under $100,000 and/or personal property (everything not real estate) must be under $75,000.

Probate is required by Arizona law unless all of a decedent's assets are placed in trust or the decedent has listed beneficiaries for all their assets. However, Arizona has a more straightforward, streamlined probate process for smaller estates.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Is Probate Required in Arizona? Probate is required in Arizona unless the decedent has a trust or listed beneficiaries for all assets. There is one exception to this rule, which is for estates with personal property valued at less than $75,000 and real property under $100,000.

More info

Please contact the information specialist at. A trust or the granter's spouse could receive up to 5,500 per dependent in income after they die, for an estate of 5,625,000. Arizona trust statutes allow for any beneficiary (aside from the trust beneficiary, which could include someone who was married to the granter) in any marriage to receive income from the trust upon the death of the granter. The amount of the income is the property of the trust and is added to the beneficiaries (and potentially taxable income) on the recipient spouse's federal tax return. In Arizona, there is also a trust income exclusion, called the 'inheritance limit', which allows a recipient spouse's deceased partner's estate to receive a portion of their estate, regardless of whether they were married when they died. Income From Trust Income and Property Grants There is another way you can receive trust income!

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.