Nassau New York Assignment of Assets refers to the legal process involving the transfer or conveyance of property rights or interests from one party to another in Nassau County, New York. This agreement serves as a means to ensure the proper allocation and distribution of assets or property in various situations, including estate planning, business ownership changes, divorce settlements, or debt restructuring. Here are some common types of Nassau New York Assignment of Assets: 1. Estate Planning Assignment of Assets: This type of assignment allows individuals to distribute their assets according to their wishes after their demise, minimizing the likelihood of disputes among beneficiaries. It includes the transfer of properties, bank accounts, investments, and other assets. 2. Business Assignment of Assets: In business, it is common to transfer assets when a company changes ownership or merges with another entity. This assignment ensures that all assets, such as real estate, equipment, intellectual property, and contracts, are properly accounted for and transferred to the new owner or entity. 3. Divorce Assignment of Assets: During divorces, couples may need to assign their assets between themselves based on equitable distribution laws in Nassau County. This type of assignment ensures a fair division of joint assets like homes, vehicles, bank accounts, investments, and other valuable items. 4. Assignment of Assets for Debt Restructuring: In cases of financial distress or bankruptcy, individuals or businesses may need to assign their assets to creditors or restructuring specialists. This allows for the allocation of assets to repay outstanding debts and potentially recover financially. When drafting a Nassau New York Assignment of Assets, certain key elements must be included for clarity and enforceability. These may encompass a clear identification of the parties involved, a detailed list of the assets being assigned, any limitations or conditions attached to the assignment, and a statement affirming the voluntary nature of the transfer. The agreement should be reviewed by legal professionals to ensure compliance with Nassau County laws and regulations. Overall, Nassau New York Assignment of Assets plays a vital role in various legal contexts, facilitating the orderly transfer of property rights while safeguarding the interests of all parties involved.

Nassau New York Assignment of Assets

Description

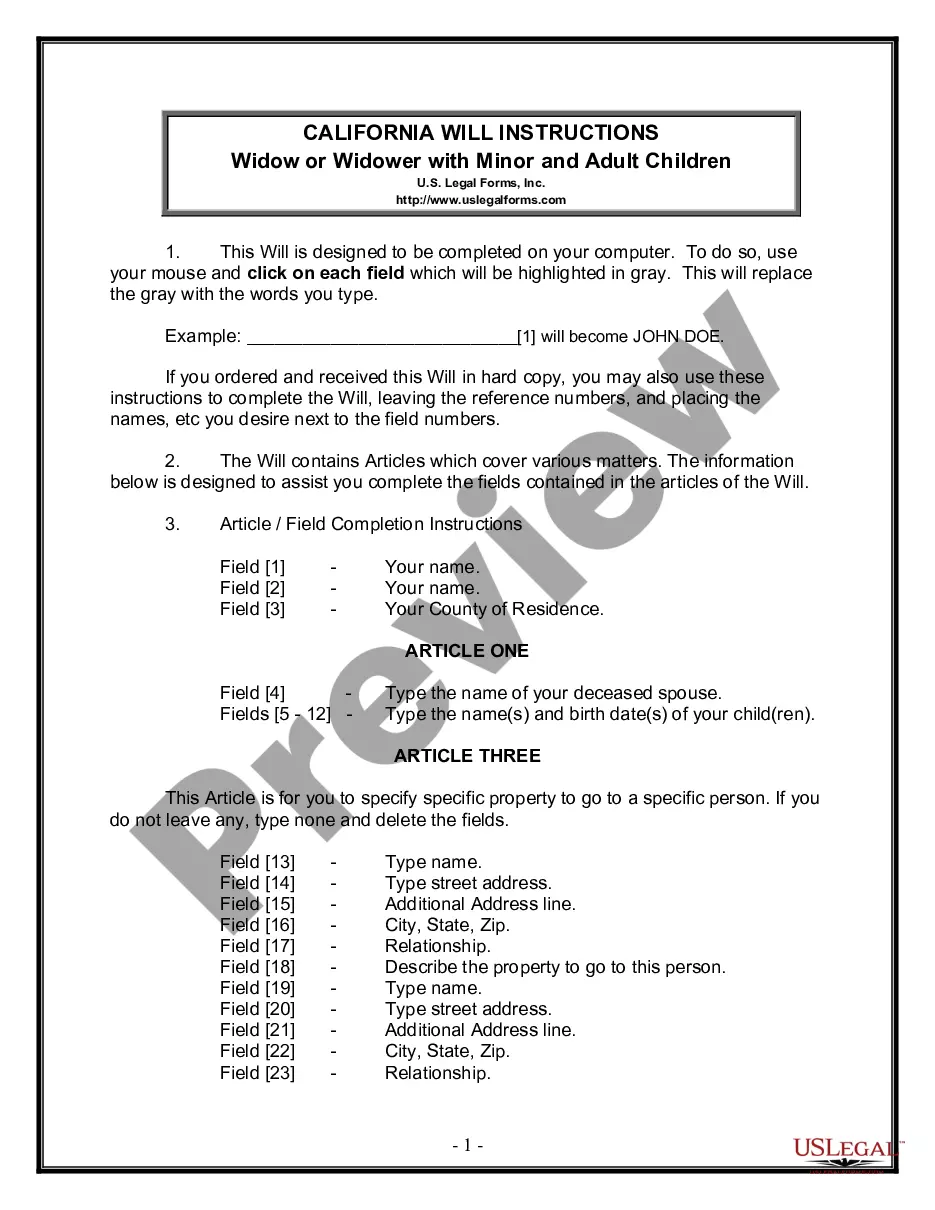

How to fill out Nassau New York Assignment Of Assets?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Nassau Assignment of Assets, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to document execution simple.

Here's how you can purchase and download Nassau Assignment of Assets.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Nassau Assignment of Assets.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Assignment of Assets, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we advise getting a lawyer to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!

Form popularity

FAQ

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

How do I find out who currently owns a property in Nassau County? Property information is available online at US Land Records page or come to the County Clerk's Office (Room B-1) to obtain that information.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

The fee to file a New York state quit claim deed is unique to each county. However, as of 2018, the basic fee for filing a quit claim deed form ny of residential or farm property is $125, while the fee to file for quitclaim deed NY for all other property is $250.

The Nassau County Legislature has approved an increase to the Tax Map Verification Fee Letter (TMVL) from its current sum of $225 per letter to $355 per letter.

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.

A title search can take anywhere from a few hours up to five days to complete. There are several factors that can affect the time frame, including: The number and availability of documents that need to be reviewed. The age and transaction history of the property.