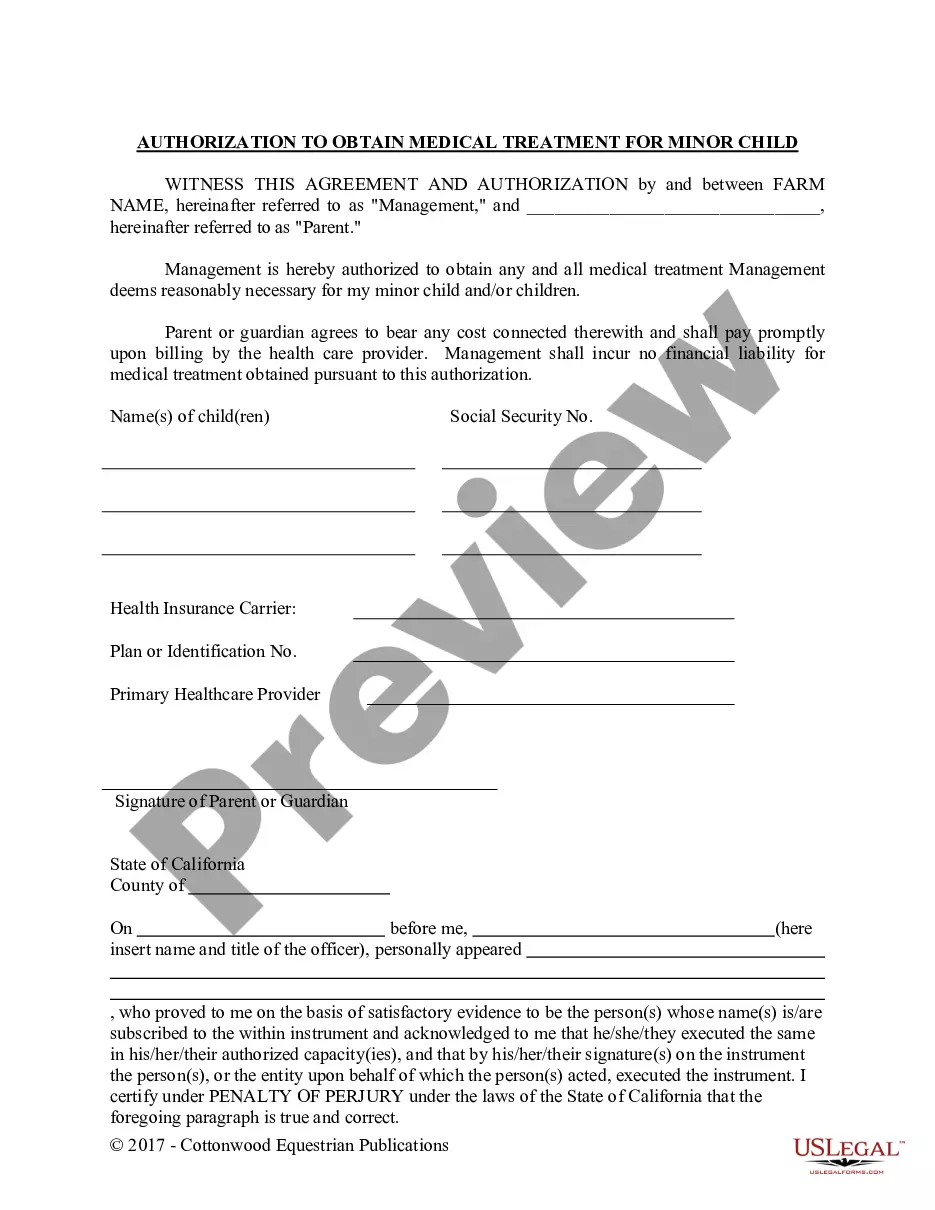

Franklin Ohio Assignment of Mortgage is a legal document that transfers the rights and responsibilities of a mortgage from one party to another. This transfer typically occurs when a mortgage lender sells or transfers the loan to another entity. The Assignment of Mortgage is an essential component of the mortgage market as it allows lenders to freely trade mortgage loans, which helps in increasing liquidity and maintaining a stable mortgage market. It is filed in the county recorder's office where the property is located. In Franklin Ohio, there are a few different types of Assignment of Mortgage: 1. Absolute Assignment: This type of assignment involves the complete transfer of the mortgage, including all rights, interests, and obligations, to the assignee. The assignee becomes the new mortgage holder and assumes all duties and responsibilities associated with the mortgage. 2. Collateral Assignment: In this type of assignment, the assignor transfers certain specific rights or interests in the mortgage to the assignee, while still retaining ownership of the underlying debt. The assignee receives the right to collect mortgage payments or enforce the mortgage if the borrower defaults. 3. Assignment in Blank: This type of assignment occurs when the mortgage assignment does not specify the name of the assignee. Instead, it allows the mortgage to be transferred multiple times without having to update the assignment document each time. 4. Partial Assignment: A partial assignment involves the transfer of a portion of the mortgage, typically a percentage or a specific amount, to a new assignee. The original mortgage holder retains ownership of the remaining portion. It is important to note that the Assignment of Mortgage must be properly executed and recorded to be legally valid and enforceable. Both parties involved in the assignment should carefully review the terms and conditions of the assignment before signing, as it may impact their rights and obligations. In conclusion, Franklin Ohio Assignment of Mortgage is a legal document that facilitates the transfer of mortgage rights and responsibilities from one party to another. Different types of assignments, such as absolute assignment, collateral assignment, assignment in blank, and partial assignment, cater to various scenarios and requirements in the mortgage market. Proper execution and recording of the assignment are crucial to ensure its validity and enforceability.

Franklin Ohio Assignment of Mortgage

Description

How to fill out Franklin Ohio Assignment Of Mortgage?

Are you looking to quickly create a legally-binding Franklin Assignment of Mortgage or probably any other document to manage your own or business affairs? You can select one of the two options: hire a professional to write a valid paper for you or draft it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including Franklin Assignment of Mortgage and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Franklin Assignment of Mortgage is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Franklin Assignment of Mortgage template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!