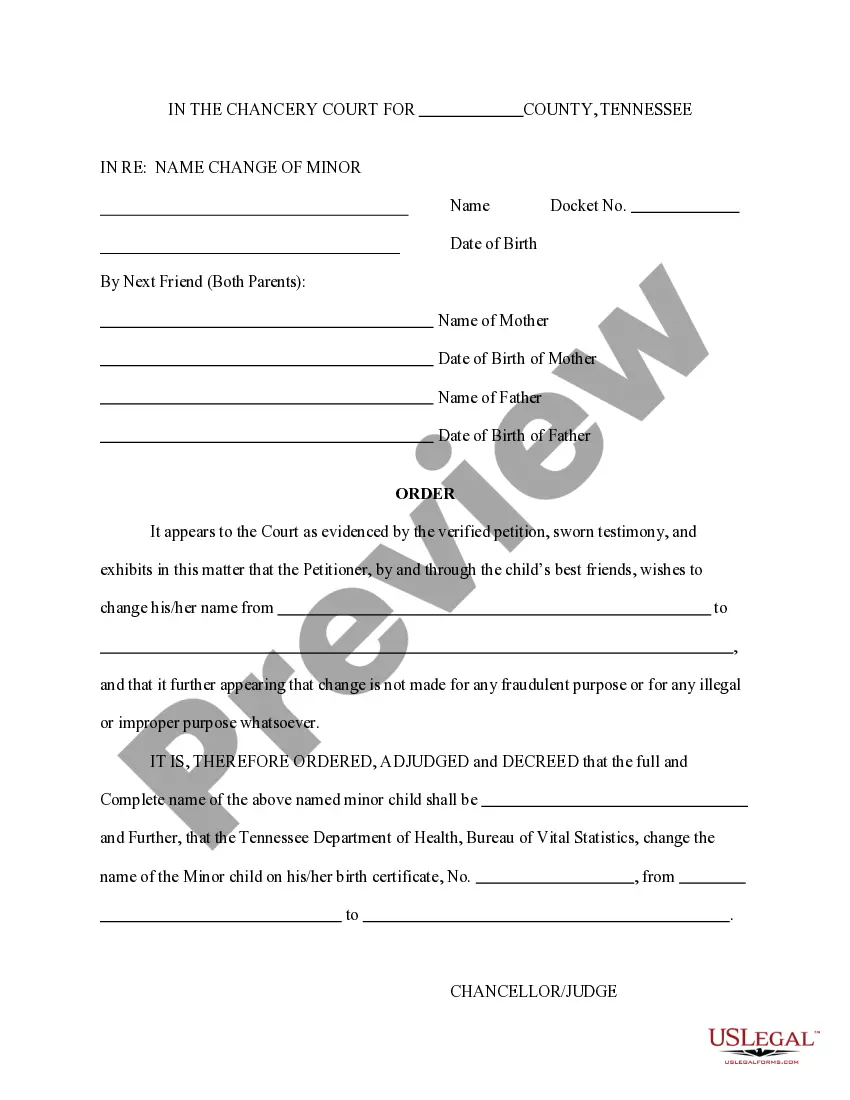

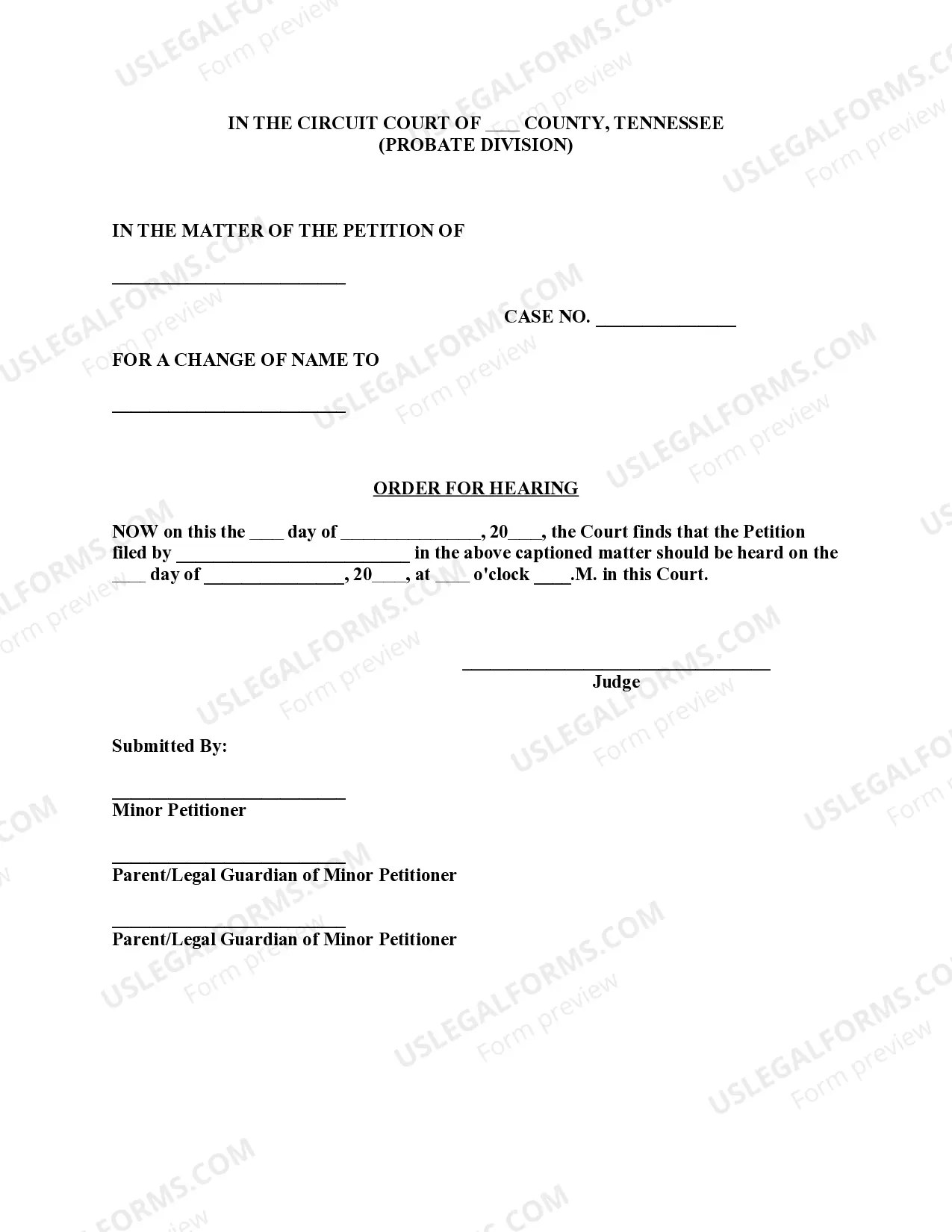

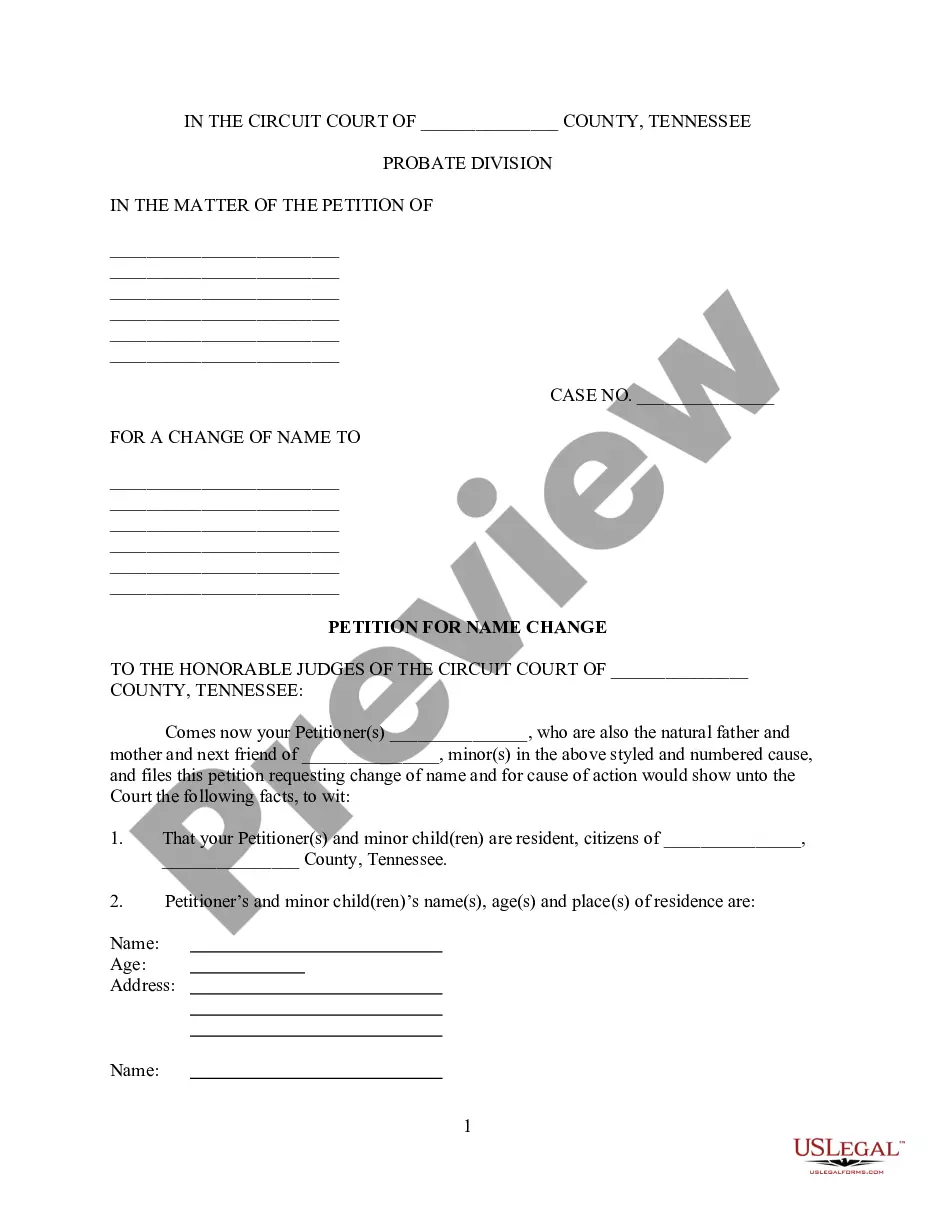

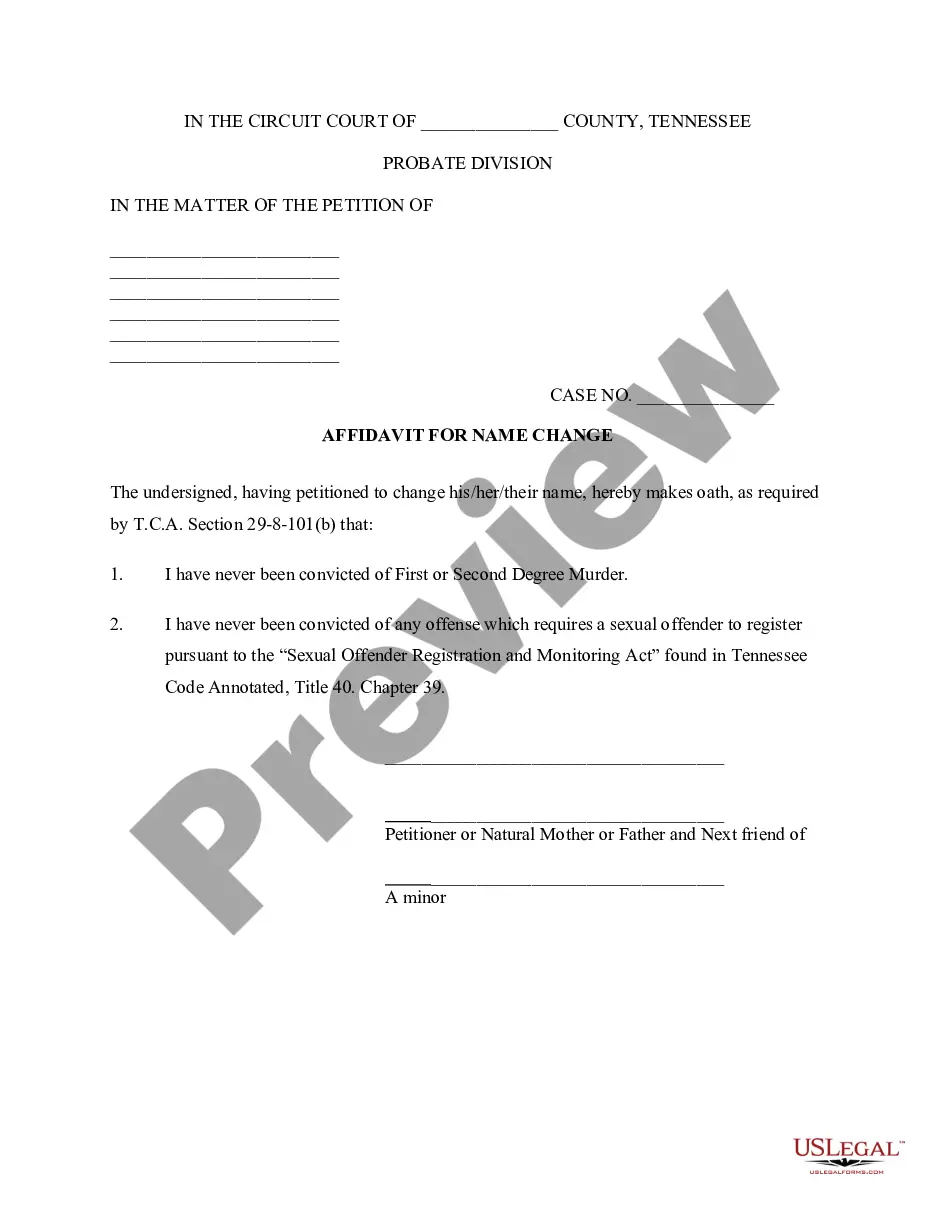

Maricopa, Arizona Assignment of Mortgage: Exploring the Different Types and Detailed Explanation In Maricopa, Arizona, the Assignment of Mortgage is a legal document that transfers the ownership of a mortgage from one party to another. This essential document outlines the specific terms and conditions of the mortgage, facilitating the lawful transfer of rights and responsibilities from the original lender to a new mortgagee. The Assignment of Mortgage is initiated when the original lender wants to sell or transfer the mortgage to another party. This process commonly occurs when loans are sold on the secondary market. By assigning the mortgage, the original lender effectively transfers all their rights and interests in the loan, including the right to collect principal, interest, and enforce the terms of the mortgage. When it comes to the types of Maricopa, Arizona Assignment of Mortgage, there are two primary categories: 1. Individual Assignment of Mortgage: This refers to an assignment where a single mortgage is transferred from one party to another. It often occurs when a mortgage lender sells the loan to a new financial institution or private investor. The individual assignment ensures that all rights, interests, and obligations related to the mortgage are transferred accurately to the new party. 2. Bulk Assignment of Mortgage: Unlike the individual assignment, the bulk assignment involves the transfer of multiple mortgages simultaneously. Financial institutions, like banks or mortgage companies, typically use bulk assignment when selling a large portfolio of loans. This allows them to efficiently transfer a substantial number of mortgages to the buyer in a single transaction. The Maricopa, Arizona Assignment of Mortgage document contains essential information, including: 1. Names of Parties: It identifies the original lender (assignor) and the new mortgagee (assignee). Any subsequent assignments would be outlined as well. 2. Mortgage Information: The legal description of the property, loan amount, interest rate, and other mortgage terms are mentioned in this section. 3. Assignment Clause: This is where the assignor irrevocably transfers all rights, title, and interest in the mortgage to the assignee, ensuring the new mortgagee assumes all responsibilities attached to the mortgage. 4. Signatures: Both parties involved, along with the date of execution, should sign the Assignment of Mortgage. It is crucial to follow the required legal procedures to ensure the document's validity. The Maricopa, Arizona Assignment of Mortgage plays a vital role in the real estate industry, enabling the smooth transfer of mortgage ownership. Whether it is an individual assignment or a bulk assignment, this legal document ensures transparent and enforceable transactions in the mortgage market. Keywords: Maricopa Arizona, Assignment of Mortgage, individual assignment, bulk assignment, transfer of ownership, secondary market, portfolio of loans, assignor, assignee, mortgage terms, legal document, real estate industry.

Maricopa Arizona Assignment of Mortgage

Description

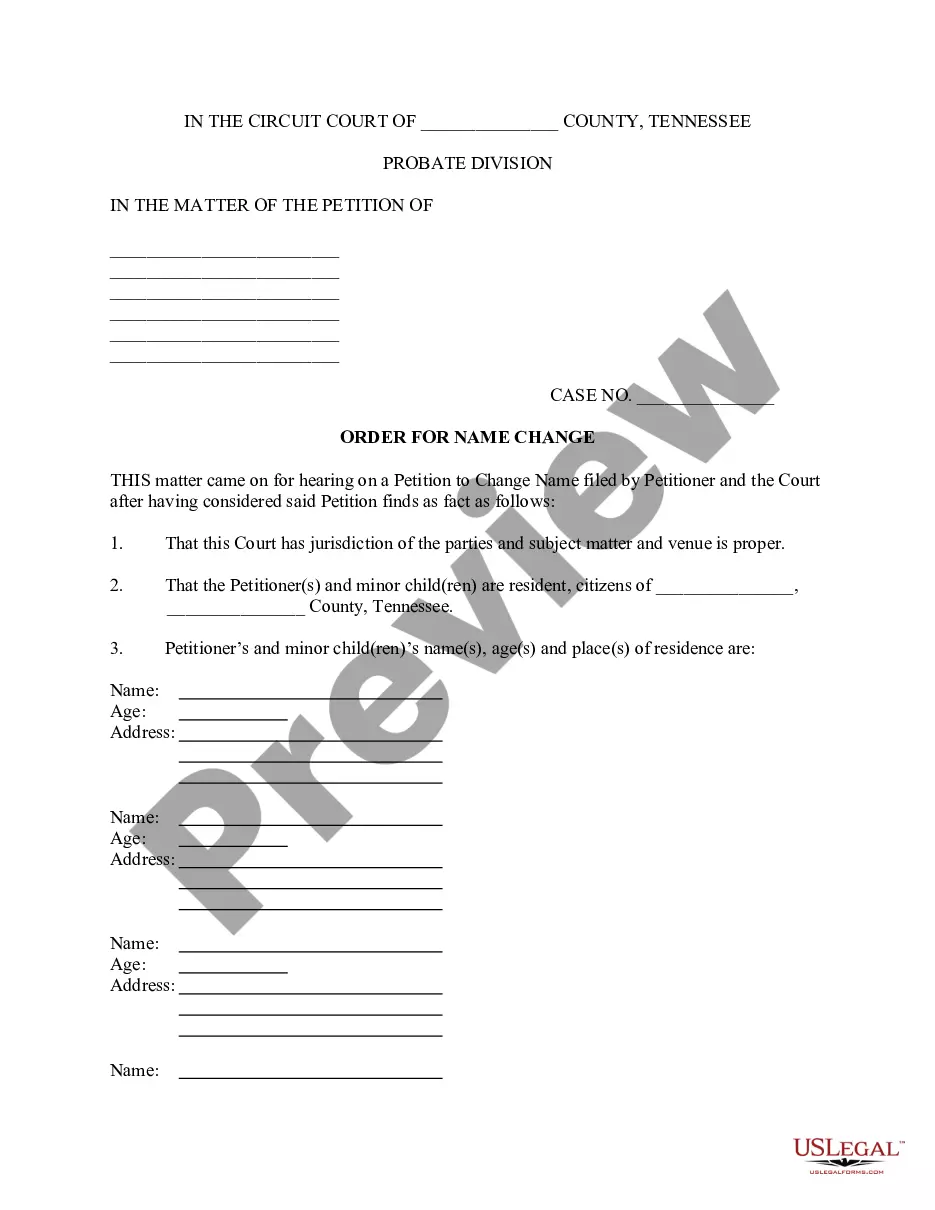

How to fill out Maricopa Arizona Assignment Of Mortgage?

Draftwing forms, like Maricopa Assignment of Mortgage, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for different cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Maricopa Assignment of Mortgage form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Maricopa Assignment of Mortgage:

- Ensure that your form is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Maricopa Assignment of Mortgage isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and download the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!