Wake North Carolina Assignment of Rents by Lessor is a legal document provided by landlords to assign the rental income of a property to a designated party. This contractual agreement ensures the reliable collection and transfer of rental payments, providing a layer of security for lenders and property owners. The Wake North Carolina Assignment of Rents by Lessor serves as a guarantee for lenders in the event of default on a mortgage or loan. By assigning the rental income to the lender, they possess the right to collect rent directly from tenants until the debt is repaid. This arrangement provides lenders with an added level of protection and reduces the risk associated with financing rental properties. Furthermore, this document also allows property owners to transfer the rights to the rental income to another party, such as an investor, in case of partnership agreements or the sale of the property. It serves as a way to allow individuals or entities to participate in the rental income stream without the burdens of property management. There might be various types of Wake North Carolina Assignment of Rents by Lessor, tailored to specific circumstances or objectives. Some may include: 1. Absolute Assignment of Rents: This type grants the assignee complete control and ownership of the rental income. The assignee can directly collect rent from tenants and exercise full rights over the income. 2. Conditional Assignment of Rents: This type is typically implemented when the property owner has a specific obligation or condition to fulfill. Until the condition is met, the assignor retains rights to collect the rental income. 3. Partial Assignment of Rents: In this scenario, only a portion of the rental income is assigned to the designated party. Property owners may choose this type to maintain control over a portion of the income stream while benefiting from additional funds generated by the assignment. In conclusion, the Wake North Carolina Assignment of Rents by Lessor is a legal agreement that enables the transfer of rental income from landlords to lenders or other designated parties. It serves as a mechanism for lenders to protect themselves in case of default and allows property owners to assign the rights to rental income for various reasons. Understanding the different types available can help individuals make informed decisions based on their specific needs and circumstances.

Wake North Carolina Assignment of Rents by Lessor

Description

How to fill out Wake North Carolina Assignment Of Rents By Lessor?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Wake Assignment of Rents by Lessor, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities related to paperwork execution simple.

Here's how to locate and download Wake Assignment of Rents by Lessor.

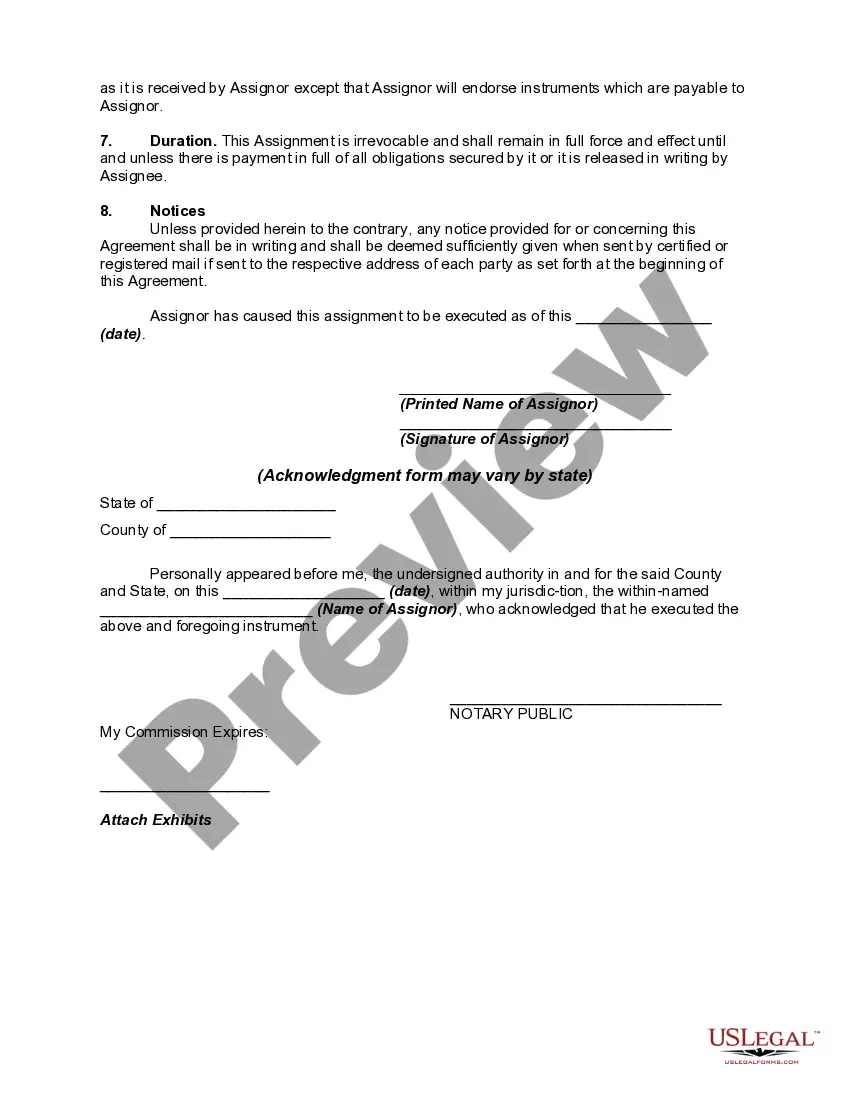

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Wake Assignment of Rents by Lessor.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Wake Assignment of Rents by Lessor, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to deal with an extremely difficult case, we advise using the services of an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific documents with ease!