A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

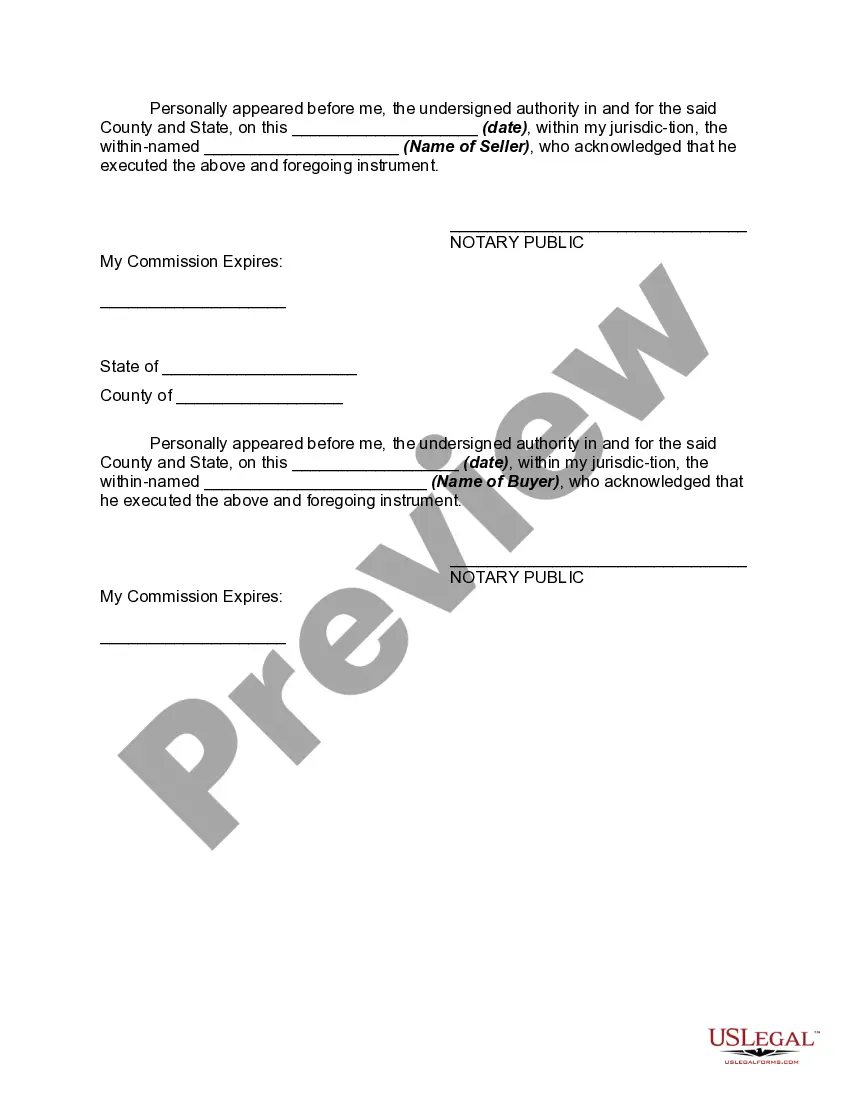

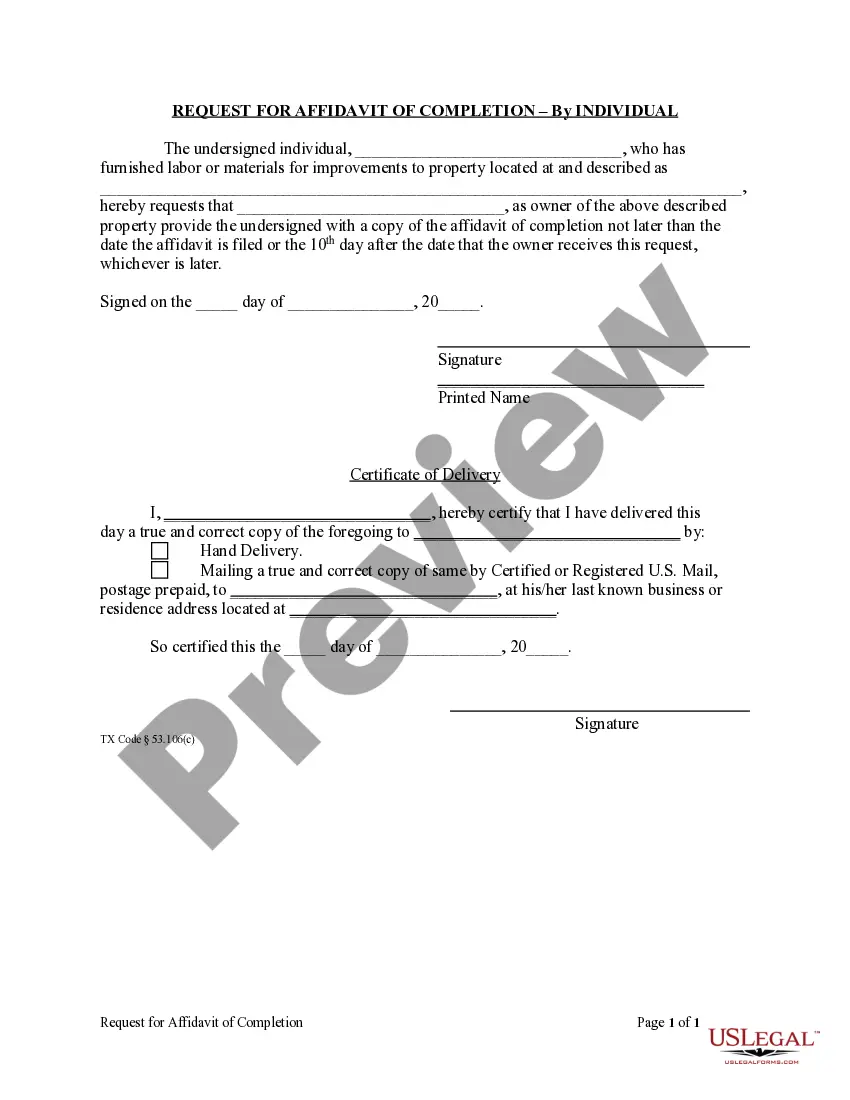

A San Diego California Bill of Sale with Encumbrances is a legal document that outlines the transfer of ownership of a property or asset that has existing liens or encumbrances. Encumbrances refer to any claims or liabilities on the property, such as mortgages, liens, or unpaid taxes. This Bill of Sale helps ensure that the buyer is aware of any encumbrances and agrees to take ownership of the property subject to those encumbrances. The San Diego California Bill of Sale with Encumbrances typically includes important details such as the names and addresses of the buyer and seller, a description of the property being sold (including its physical address and legal description), the purchase price, and a declaration that the property is being transferred with all existing encumbrances. The document may also include additional clauses about warranties, representations, and any conditions of the sale. In San Diego, California, there are different types of Bill of Sale with Encumbrances that can be used based on the type of property or asset being transferred. Some common examples include: 1. Real Estate Bill of Sale with Encumbrances: This type of bill of sale is used when selling a house, land, or any other real estate property in San Diego. It includes specific provisions related to the encumbrances on the property, such as mortgages, liens, or easements. 2. Vehicle Bill of Sale with Encumbrances: If someone is selling a car, motorcycle, boat, or any other type of vehicle in San Diego, this bill of sale is used. It includes information about any outstanding loans, liens, or leases on the vehicle that the buyer agrees to take responsibility for. 3. Personal Property Bill of Sale with Encumbrances: This type of bill of sale is used for the sale of personal items such as furniture, appliances, electronics, or other valuable assets that may have existing encumbrances, such as liens or security interests. 4. Business Bill of Sale with Encumbrances: In case of selling a business or its assets, this bill of sale is used to transfer ownership while acknowledging any encumbrances. It covers business assets like equipment, inventory, or intellectual property rights. It's important to note that to ensure a legally binding and valid Bill of Sale with Encumbrances, it is recommended to consult an attorney or use a reputable online legal service that provides San Diego-specific templates and guidance.A San Diego California Bill of Sale with Encumbrances is a legal document that outlines the transfer of ownership of a property or asset that has existing liens or encumbrances. Encumbrances refer to any claims or liabilities on the property, such as mortgages, liens, or unpaid taxes. This Bill of Sale helps ensure that the buyer is aware of any encumbrances and agrees to take ownership of the property subject to those encumbrances. The San Diego California Bill of Sale with Encumbrances typically includes important details such as the names and addresses of the buyer and seller, a description of the property being sold (including its physical address and legal description), the purchase price, and a declaration that the property is being transferred with all existing encumbrances. The document may also include additional clauses about warranties, representations, and any conditions of the sale. In San Diego, California, there are different types of Bill of Sale with Encumbrances that can be used based on the type of property or asset being transferred. Some common examples include: 1. Real Estate Bill of Sale with Encumbrances: This type of bill of sale is used when selling a house, land, or any other real estate property in San Diego. It includes specific provisions related to the encumbrances on the property, such as mortgages, liens, or easements. 2. Vehicle Bill of Sale with Encumbrances: If someone is selling a car, motorcycle, boat, or any other type of vehicle in San Diego, this bill of sale is used. It includes information about any outstanding loans, liens, or leases on the vehicle that the buyer agrees to take responsibility for. 3. Personal Property Bill of Sale with Encumbrances: This type of bill of sale is used for the sale of personal items such as furniture, appliances, electronics, or other valuable assets that may have existing encumbrances, such as liens or security interests. 4. Business Bill of Sale with Encumbrances: In case of selling a business or its assets, this bill of sale is used to transfer ownership while acknowledging any encumbrances. It covers business assets like equipment, inventory, or intellectual property rights. It's important to note that to ensure a legally binding and valid Bill of Sale with Encumbrances, it is recommended to consult an attorney or use a reputable online legal service that provides San Diego-specific templates and guidance.