A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

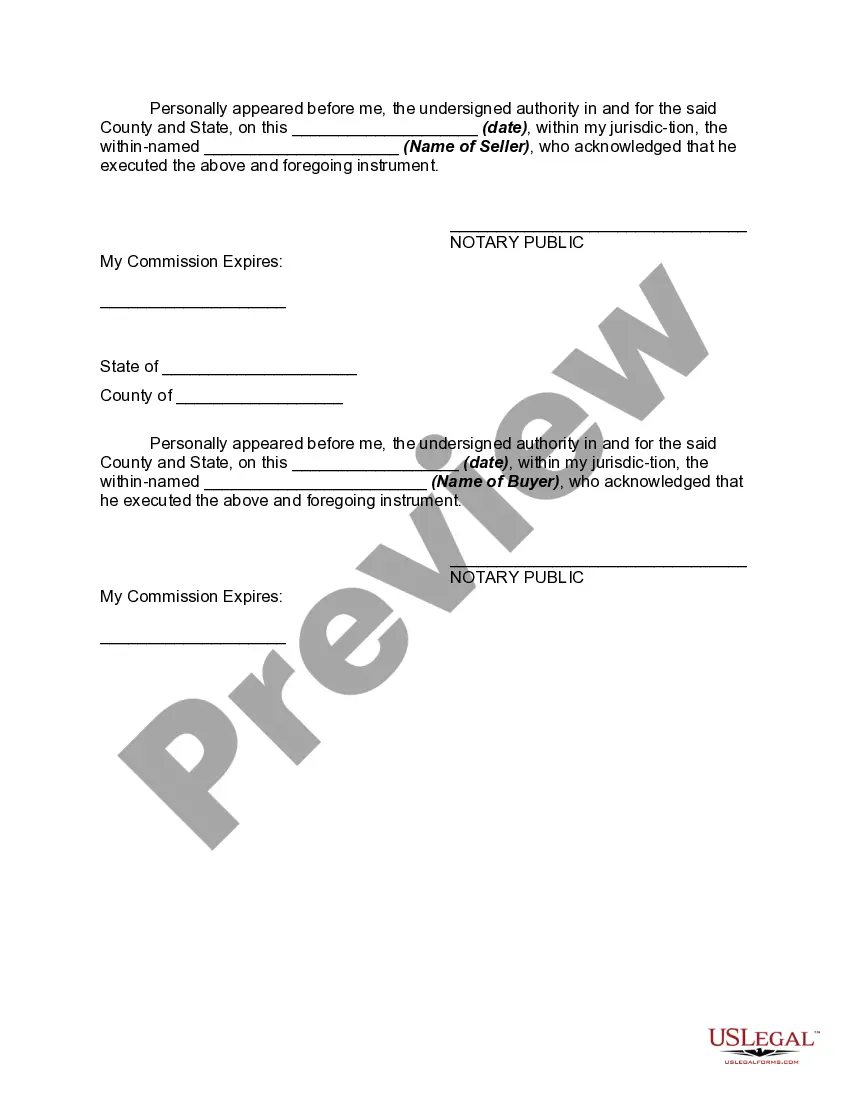

The Wayne Michigan Bill of Sale with Encumbrances is a legal document that serves as proof of the transfer of ownership rights from a seller to a buyer for a specific item with existing liens or encumbrances. This type of bill of sale is commonly used in Wayne County, Michigan, to facilitate the sale of property, such as vehicles, boats, real estate, or other valuable assets, despite outstanding debts or obligations tied to the item. The Wayne County Bill of Sale with Encumbrances includes vital information about the buyer, seller, and the encumbered property, ensuring a transparent and legally binding transaction. It typically includes details such as the parties' names and addresses, the purchase price, a description of the item being sold, any existing liens, encumbrances, or other financial obligations tied to the property. It is crucial to specify the type of encumbrance in the Bill of Sale. The most common types of encumbrances that might be mentioned in the Wayne Michigan Bill of Sale with Encumbrances are: 1. Mortgage: This refers to a loan secured by the property, commonly used for real estate transactions. The outstanding mortgage debt is transferred to the buyer upon purchase, making them responsible for the remaining payments. 2. Mechanic's Lien: This type of encumbrance usually occurs when a contractor or supplier hasn't been paid for work or materials used in improving or repairing the property. The lien ensures they can seek reimbursement by holding a claim against the property. 3. Judgment Lien: If a legal judgment has been issued against a property owner, it can create a lien on the property, ensuring the payment of any outstanding debts owed to the judgment creditor. 4. Tax Liens: When property taxes are not paid in a timely manner, the local municipality can place a tax lien on the property, creating an encumbrance. This may be reflected in the Wayne Michigan Bill of Sale with Encumbrances. It is important to note that the specific language and requirements of the Wayne Michigan Bill of Sale with Encumbrances may vary depending on the type of property being sold. To ensure accuracy and compliance, consulting with legal professionals or utilizing pre-existing templates from trusted sources is advisable. Ultimately, the Wayne Michigan Bill of Sale with Encumbrances protects both the buyer and seller by documenting the transfer of ownership despite existing encumbrances, ensuring transparency and legal security for all parties involved.The Wayne Michigan Bill of Sale with Encumbrances is a legal document that serves as proof of the transfer of ownership rights from a seller to a buyer for a specific item with existing liens or encumbrances. This type of bill of sale is commonly used in Wayne County, Michigan, to facilitate the sale of property, such as vehicles, boats, real estate, or other valuable assets, despite outstanding debts or obligations tied to the item. The Wayne County Bill of Sale with Encumbrances includes vital information about the buyer, seller, and the encumbered property, ensuring a transparent and legally binding transaction. It typically includes details such as the parties' names and addresses, the purchase price, a description of the item being sold, any existing liens, encumbrances, or other financial obligations tied to the property. It is crucial to specify the type of encumbrance in the Bill of Sale. The most common types of encumbrances that might be mentioned in the Wayne Michigan Bill of Sale with Encumbrances are: 1. Mortgage: This refers to a loan secured by the property, commonly used for real estate transactions. The outstanding mortgage debt is transferred to the buyer upon purchase, making them responsible for the remaining payments. 2. Mechanic's Lien: This type of encumbrance usually occurs when a contractor or supplier hasn't been paid for work or materials used in improving or repairing the property. The lien ensures they can seek reimbursement by holding a claim against the property. 3. Judgment Lien: If a legal judgment has been issued against a property owner, it can create a lien on the property, ensuring the payment of any outstanding debts owed to the judgment creditor. 4. Tax Liens: When property taxes are not paid in a timely manner, the local municipality can place a tax lien on the property, creating an encumbrance. This may be reflected in the Wayne Michigan Bill of Sale with Encumbrances. It is important to note that the specific language and requirements of the Wayne Michigan Bill of Sale with Encumbrances may vary depending on the type of property being sold. To ensure accuracy and compliance, consulting with legal professionals or utilizing pre-existing templates from trusted sources is advisable. Ultimately, the Wayne Michigan Bill of Sale with Encumbrances protects both the buyer and seller by documenting the transfer of ownership despite existing encumbrances, ensuring transparency and legal security for all parties involved.