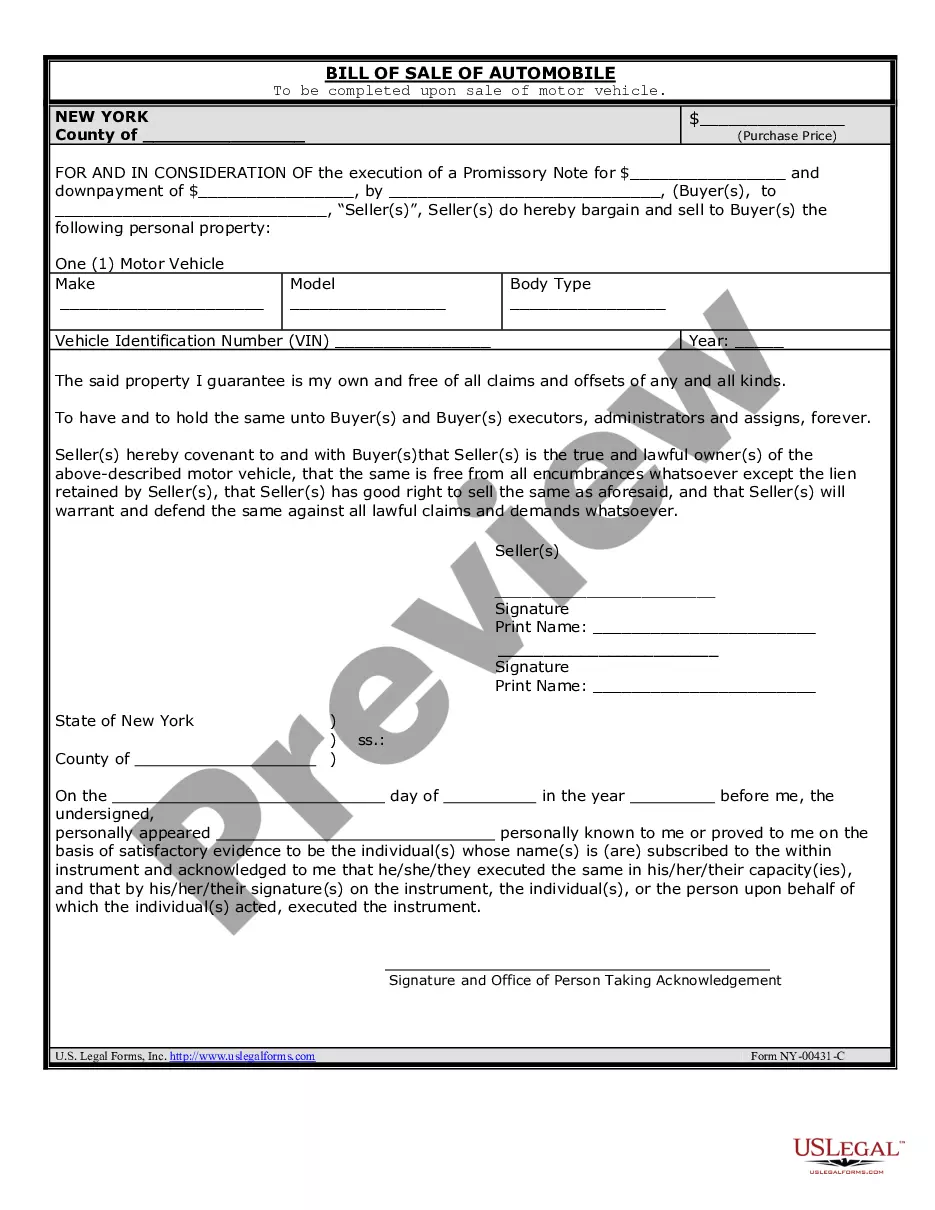

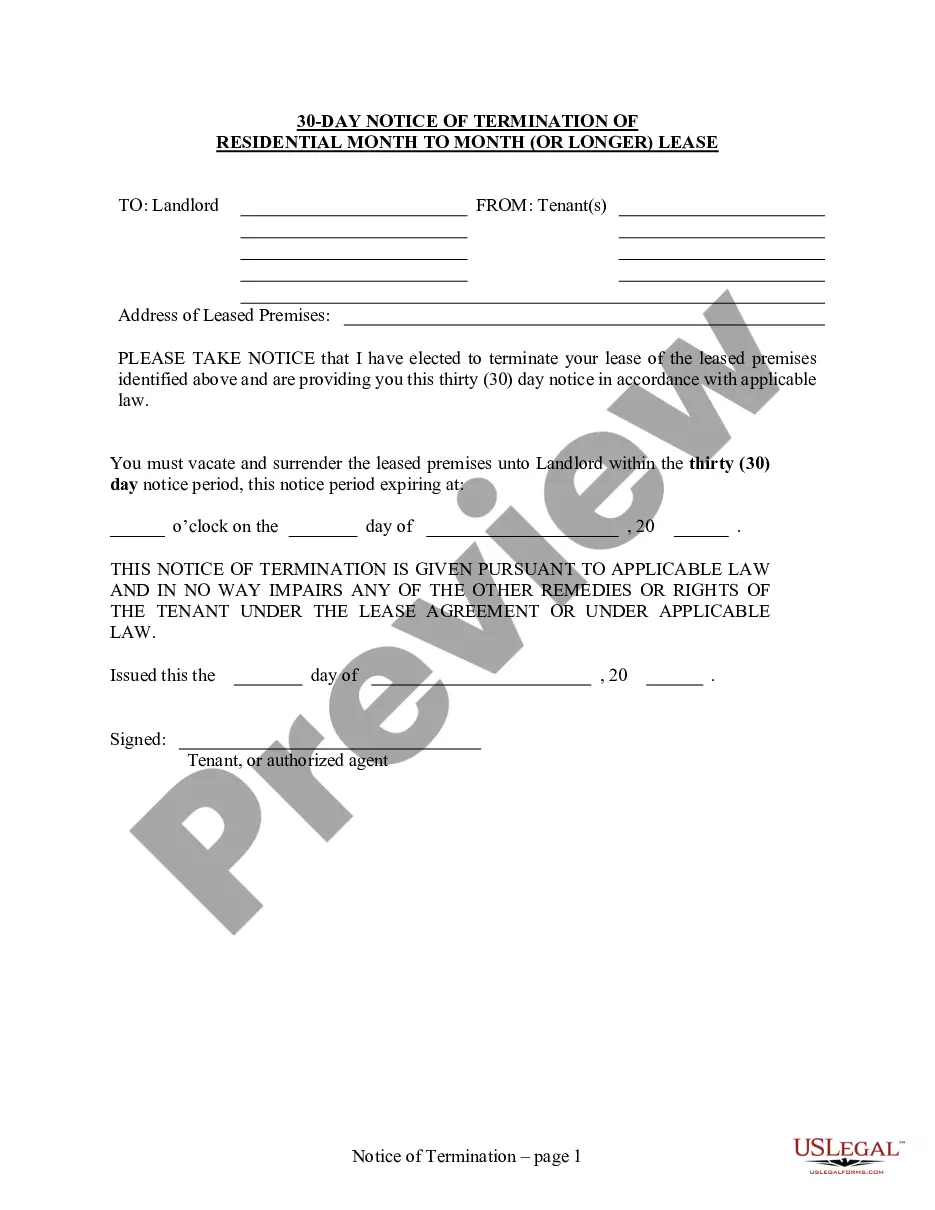

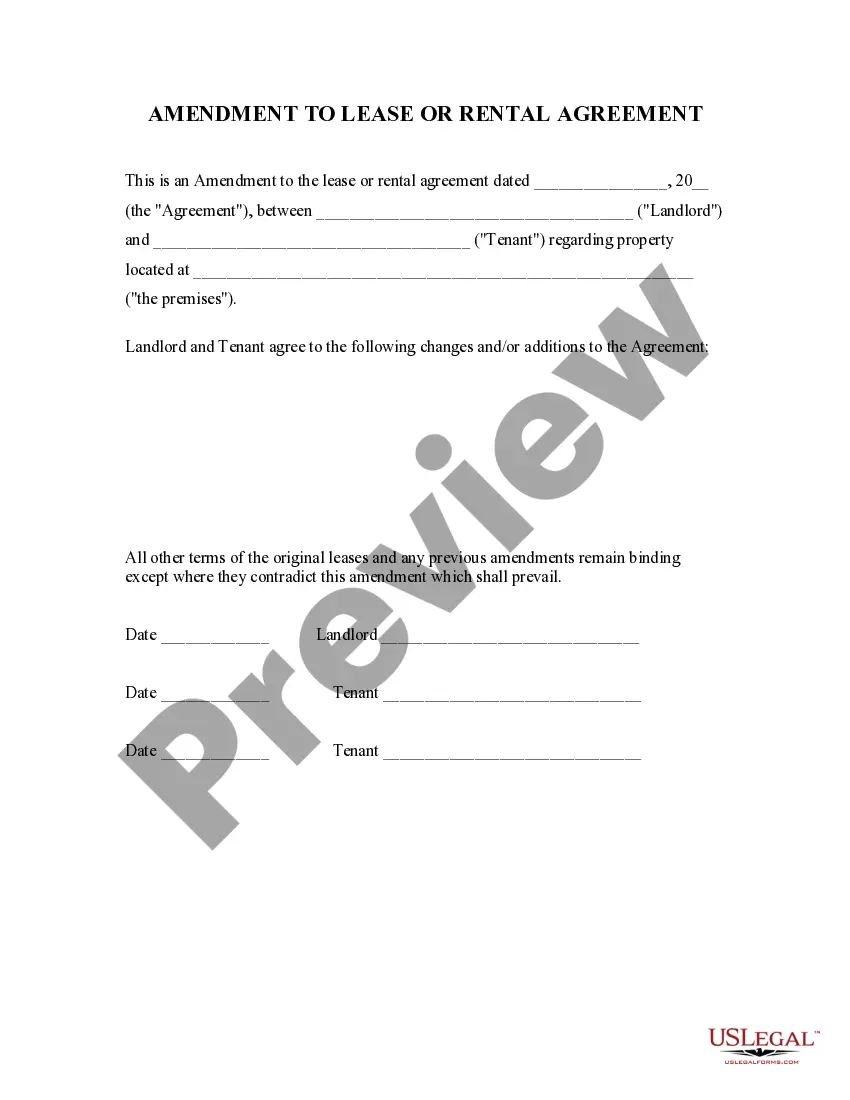

Title: Understanding Miami-Dade Florida Assignment and Bill of Sale to Corporation: A Comprehensive Overview Introduction: The Miami-Dade County in Florida offers various types of assignments and bills of sale specifically designed for corporations. In this article, we will provide a detailed description of what these documents entail, their significance, and highlight different types available. 1. Miami-Dade Florida Assignment to Corporation: An assignment is a legal transfer of ownership or rights from one entity to another. When it comes to Miami-Dade Florida, corporations often utilize assignments to transfer assets, contracts, or intellectual property. The assignment to corporation process involves the following essential elements: a. Identifying the Assignor and Assignee: The assignment document must clearly state the assigning party (assignor) and the corporation (assignee) that will assume ownership or rights. b. Detailed Description of Assets: A thorough and precise description of the assets being transferred must be included in the assignment document. It can encompass tangible assets, such as real estate, equipment, or intangible assets like patents, trademarks, or copyrights. c. Consideration or Compensation: The assignment document should outline the consideration or compensation agreed upon by both parties. This can be in the form of cash, stock options, assumption of liabilities, or a combination thereof. 2. Miami-Dade Florida Bill of Sale to Corporation: A bill of sale serves as evidence of the transfer of ownership of assets, typically involving the purchase and sale of tangible items. Corporations in Miami-Dade County rely on bills of sale to ensure a transparent and legally binding transaction. Here are some key elements to consider: a. Identification of Parties Involved: The bill of sale must identify the seller and the corporation (buyer) acquiring the assets. b. Detailed Description of Assets: Similar to the assignment document, a detailed list and description of the assets being sold should be included. This can include equipment, vehicles, office furniture, or any other tangible assets. c. Purchase Price and Payment Method: The bill of sale should specify the purchase price agreed upon and the payment method — whether it's an immediate lump sum payment or a structured payment plan. d. Warranties and Representations: If applicable, the bill of sale may contain warranties and representations made by the seller regarding the assets being sold, including their condition, quality, or ownership. Different Types of Miami-Dade Florida Assignment and Bill of Sale to Corporation: 1. Real Estate Assignment and Bill of Sale: Used when a corporation is purchasing or transferring ownership of real estate properties within Miami-Dade County. 2. Intellectual Property Assignment and Bill of Sale: Applicable when a corporation is acquiring or transferring trademarks, patents, copyrights, or other intellectual property rights. 3. Business Assets Assignment and Bill of Sale: Used when a corporation is purchasing or selling the assets of an existing business, such as inventory, equipment, contracts, or customer databases. Conclusion: Understanding the Miami-Dade Florida Assignment and Bill of Sale to Corporation is crucial for conducting business transactions efficiently and legally. These documents enable corporations to transfer ownership rights, assets, and intellectual property effectively, ensuring transparency and protecting the rights of all parties involved.

Miami-Dade Florida Assignment and Bill of Sale to Corporation

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02851BG

Format:

Word;

Rich Text

Instant download

Description

In this assignment, Assignor sells and assigns assets to a Corporation for common stock in the Corporation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Miami-Dade Florida Assignment and Bill of Sale to Corporation: A Comprehensive Overview Introduction: The Miami-Dade County in Florida offers various types of assignments and bills of sale specifically designed for corporations. In this article, we will provide a detailed description of what these documents entail, their significance, and highlight different types available. 1. Miami-Dade Florida Assignment to Corporation: An assignment is a legal transfer of ownership or rights from one entity to another. When it comes to Miami-Dade Florida, corporations often utilize assignments to transfer assets, contracts, or intellectual property. The assignment to corporation process involves the following essential elements: a. Identifying the Assignor and Assignee: The assignment document must clearly state the assigning party (assignor) and the corporation (assignee) that will assume ownership or rights. b. Detailed Description of Assets: A thorough and precise description of the assets being transferred must be included in the assignment document. It can encompass tangible assets, such as real estate, equipment, or intangible assets like patents, trademarks, or copyrights. c. Consideration or Compensation: The assignment document should outline the consideration or compensation agreed upon by both parties. This can be in the form of cash, stock options, assumption of liabilities, or a combination thereof. 2. Miami-Dade Florida Bill of Sale to Corporation: A bill of sale serves as evidence of the transfer of ownership of assets, typically involving the purchase and sale of tangible items. Corporations in Miami-Dade County rely on bills of sale to ensure a transparent and legally binding transaction. Here are some key elements to consider: a. Identification of Parties Involved: The bill of sale must identify the seller and the corporation (buyer) acquiring the assets. b. Detailed Description of Assets: Similar to the assignment document, a detailed list and description of the assets being sold should be included. This can include equipment, vehicles, office furniture, or any other tangible assets. c. Purchase Price and Payment Method: The bill of sale should specify the purchase price agreed upon and the payment method — whether it's an immediate lump sum payment or a structured payment plan. d. Warranties and Representations: If applicable, the bill of sale may contain warranties and representations made by the seller regarding the assets being sold, including their condition, quality, or ownership. Different Types of Miami-Dade Florida Assignment and Bill of Sale to Corporation: 1. Real Estate Assignment and Bill of Sale: Used when a corporation is purchasing or transferring ownership of real estate properties within Miami-Dade County. 2. Intellectual Property Assignment and Bill of Sale: Applicable when a corporation is acquiring or transferring trademarks, patents, copyrights, or other intellectual property rights. 3. Business Assets Assignment and Bill of Sale: Used when a corporation is purchasing or selling the assets of an existing business, such as inventory, equipment, contracts, or customer databases. Conclusion: Understanding the Miami-Dade Florida Assignment and Bill of Sale to Corporation is crucial for conducting business transactions efficiently and legally. These documents enable corporations to transfer ownership rights, assets, and intellectual property effectively, ensuring transparency and protecting the rights of all parties involved.

Free preview