The proper form and necessary content of a certificate of incorporation depend largely on the requirements of individual state statutes, which in many instances designate the appropriate form and content. While the certificate must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the certificate may usually be drafted so as to meet the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

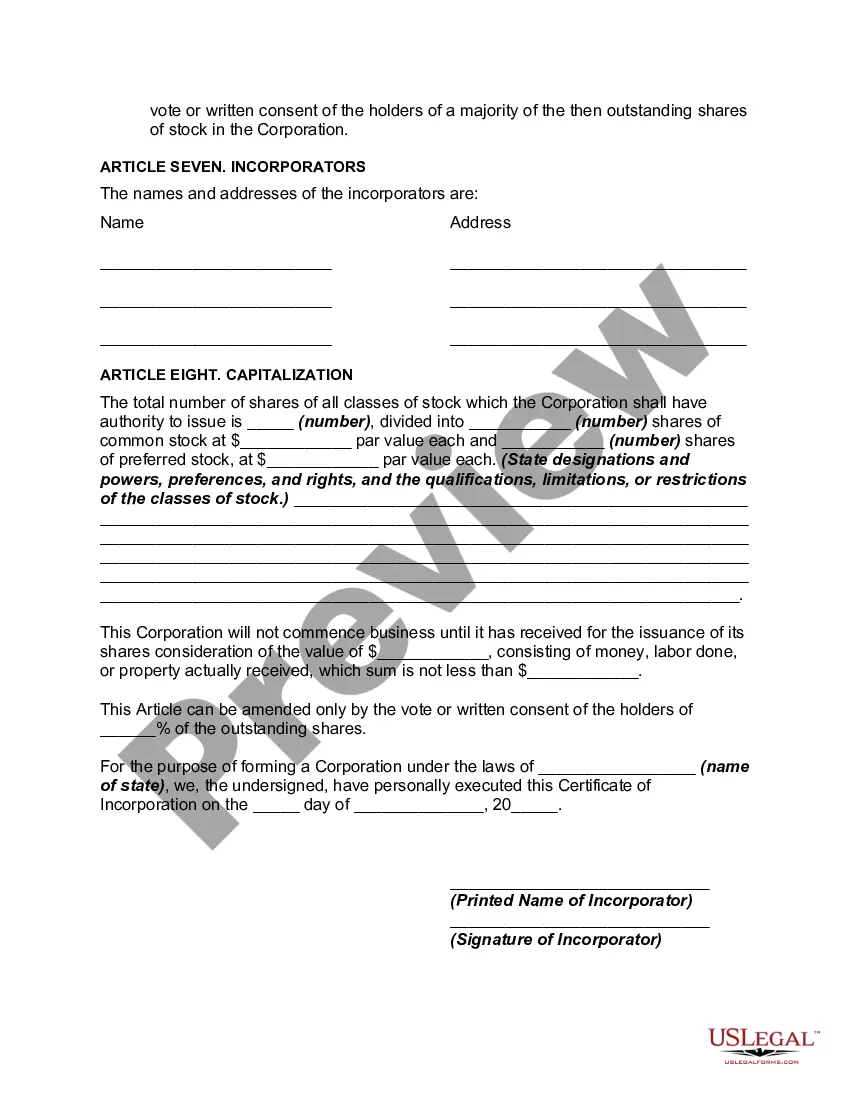

The Collin Texas Certificate of Incorporation — General Form is a legal document that outlines the formation of a corporation in Collin County, Texas. This document is a crucial step in starting a business as it officially establishes the existence of the company and grants it legal recognition. In detail, the Collin Texas Certificate of Incorporation — General Form includes important information such as the corporation's name, purpose, duration, registered agent, and registered office address. It also specifies the number and type of shares authorized and sets forth the powers, rights, and liabilities of the shareholders, directors, and officers. This general form of the Collin Texas Certificate of Incorporation caters to various types of corporations, including: 1. For-profit corporations: This refers to corporations formed with the intention of generating profits for their shareholders. Examples include technology startups, manufacturing companies, and retail businesses. 2. Non-profit corporations: These are corporations that are established for charitable, educational, religious, or scientific purposes. Non-profit organizations, foundations, and charities fall under this category. 3. Professional corporations: This type of corporation is specifically for professionals such as doctors, lawyers, architects, and engineers who want to form a corporation to provide their services. 4. Close corporations: A close corporation is a type of corporation with a limited number of shareholders who are often actively involved in the day-to-day operations of the company. It allows for a more flexible management structure and shareholder decision-making. 5. Benefit corporations: These are businesses that are formed with the purpose of creating a positive impact on society and the environment. The directors of benefit corporations are required to consider these social and environmental factors while making decisions, in addition to maximizing profits. When filing the Collin Texas Certificate of Incorporation — General Form, it is recommended to consult with an attorney or legal professional to ensure compliance with all relevant laws and regulations. Additionally, it is crucial to tailor the form to the specific needs and goals of the corporation to ensure accurate and comprehensive documentation.The Collin Texas Certificate of Incorporation — General Form is a legal document that outlines the formation of a corporation in Collin County, Texas. This document is a crucial step in starting a business as it officially establishes the existence of the company and grants it legal recognition. In detail, the Collin Texas Certificate of Incorporation — General Form includes important information such as the corporation's name, purpose, duration, registered agent, and registered office address. It also specifies the number and type of shares authorized and sets forth the powers, rights, and liabilities of the shareholders, directors, and officers. This general form of the Collin Texas Certificate of Incorporation caters to various types of corporations, including: 1. For-profit corporations: This refers to corporations formed with the intention of generating profits for their shareholders. Examples include technology startups, manufacturing companies, and retail businesses. 2. Non-profit corporations: These are corporations that are established for charitable, educational, religious, or scientific purposes. Non-profit organizations, foundations, and charities fall under this category. 3. Professional corporations: This type of corporation is specifically for professionals such as doctors, lawyers, architects, and engineers who want to form a corporation to provide their services. 4. Close corporations: A close corporation is a type of corporation with a limited number of shareholders who are often actively involved in the day-to-day operations of the company. It allows for a more flexible management structure and shareholder decision-making. 5. Benefit corporations: These are businesses that are formed with the purpose of creating a positive impact on society and the environment. The directors of benefit corporations are required to consider these social and environmental factors while making decisions, in addition to maximizing profits. When filing the Collin Texas Certificate of Incorporation — General Form, it is recommended to consult with an attorney or legal professional to ensure compliance with all relevant laws and regulations. Additionally, it is crucial to tailor the form to the specific needs and goals of the corporation to ensure accurate and comprehensive documentation.