A Convertible Note is a simple promissory note, usually bearing interest and payable at some future date. The unique aspects of a convertible note are:

A. It converts into equity in the company so long as certain agreed metrics are achieved;

B. Conversion rather than repayment is the usual intention of the parties

C. The usual events for conversion (a conversion event) could be some or all of:

1. Later financing acquired of an agreed minimum level;

2. Developmental milestones reached by the company; and/or

3. Strategic partnerships concluded with important companies;

The conversion into equity is usually at a valuation that is consistent with the valuation agreed to with investors in an investment round that occurs at a later time.

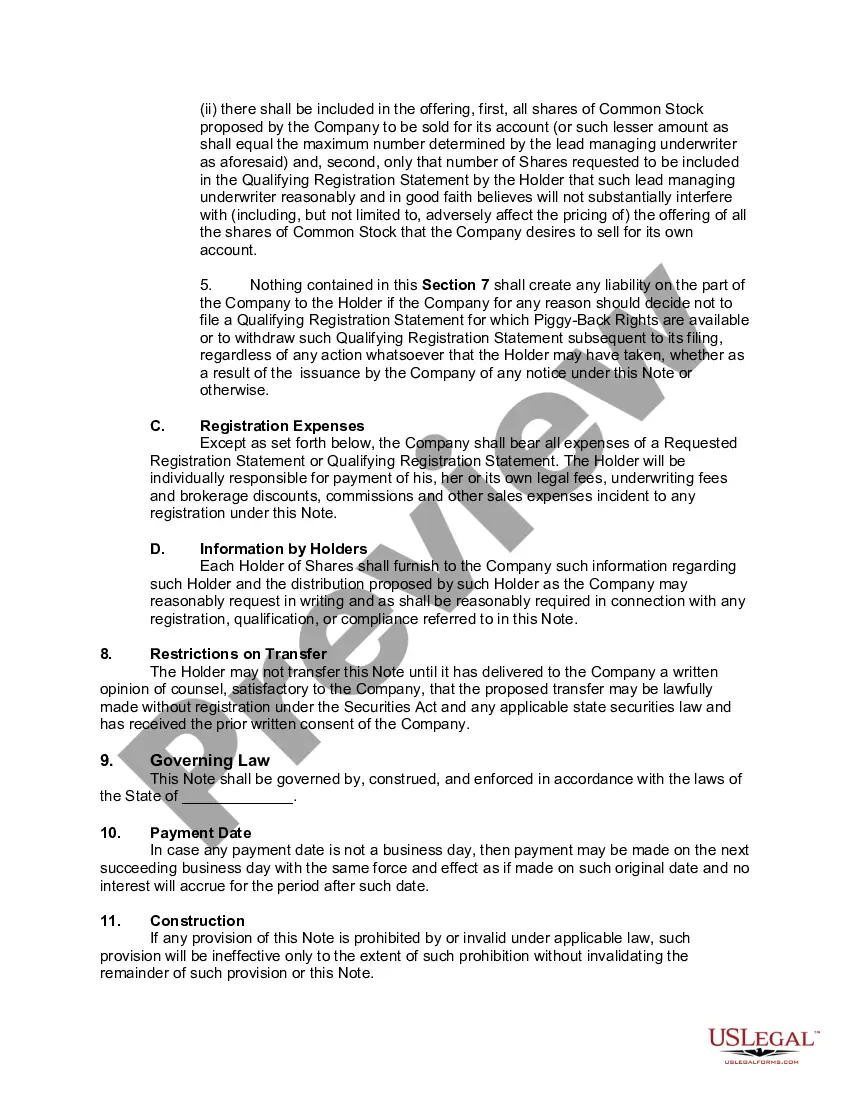

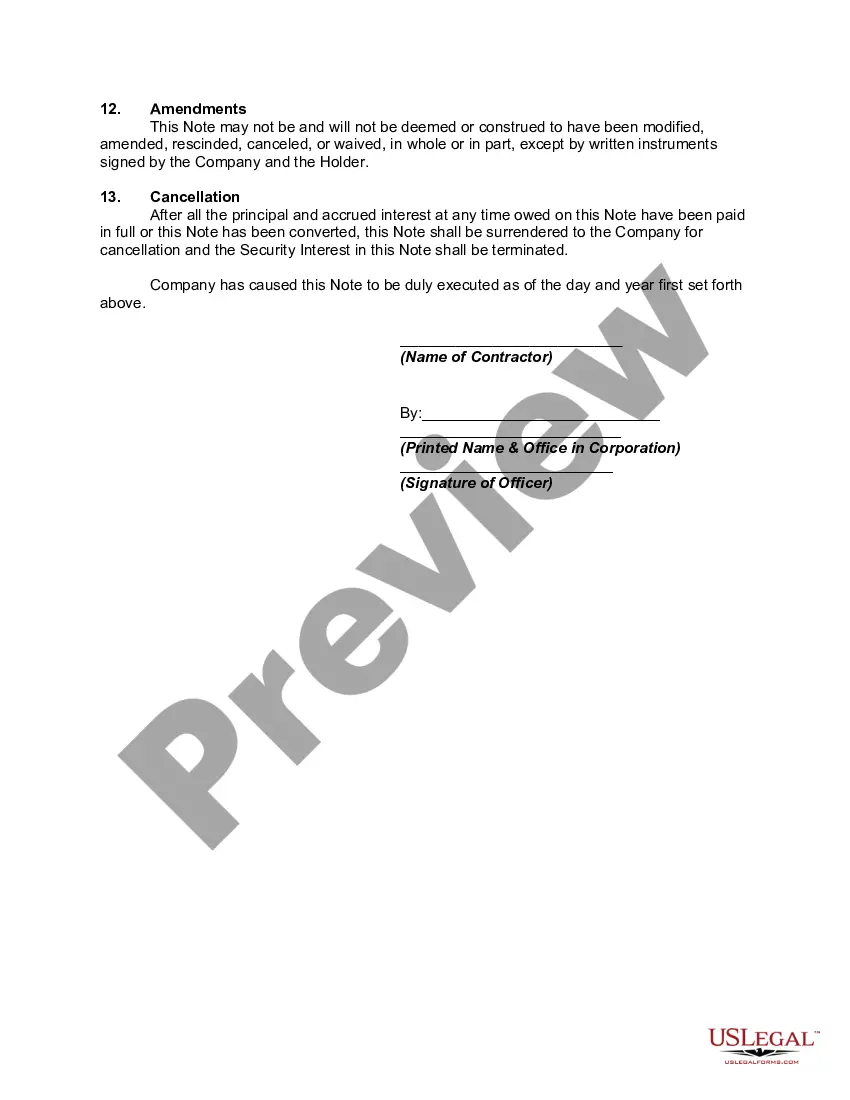

A Maricopa Arizona Convertible Promissory Note by Corporation is a legally binding document that outlines the terms and conditions of a loan agreement between a corporation (the issuer) and an investor (the holder). This type of note is one of a series of notes issued by the corporation pursuant to a Convertible Note Purchase Agreement. The note provides comprehensive details about the loan, including the principal amount borrowed, the interest rate, repayment terms, and any applicable penalties or fees. It serves as evidence of the corporation's indebtedness to the investor and outlines the rights and obligations of both parties. The Maricopa Arizona Convertible Promissory Note by Corporation allows for the conversion of the loan into equity or ownership shares in the corporation at a later date, based on agreed-upon terms. This feature provides the investor with the option to convert their debt into equity, potentially benefiting from future growth and increasing the potential return on investment. There may be different types of Maricopa Arizona Convertible Promissory Notes by Corporation, each tailored to meet specific requirements or circumstances. Some variations may include: 1. Senior Convertible Notes: These notes hold a higher priority compared to other debt instruments, meaning they must be repaid before other debts in the event of bankruptcy or liquidation. 2. Subordinated Convertible Notes: These notes have a lower priority compared to other debts and are paid after senior obligations in the case of bankruptcy or liquidation. 3. Floating Interest Rate Convertible Notes: These notes feature an interest rate that fluctuates based on an agreed-upon benchmark, such as the prime rate or LIBOR. 4. Non-Convertible Promissory Notes: These notes do not offer the conversion option and are repaid solely as a loan with interest. It is crucial for both the corporation and the investor to carefully review and understand the terms outlined in the Maricopa Arizona Convertible Promissory Note by Corporation before entering into the agreement. Seeking legal advice is highly recommended ensuring compliance with applicable laws and regulations and to protect the interests of both parties involved.A Maricopa Arizona Convertible Promissory Note by Corporation is a legally binding document that outlines the terms and conditions of a loan agreement between a corporation (the issuer) and an investor (the holder). This type of note is one of a series of notes issued by the corporation pursuant to a Convertible Note Purchase Agreement. The note provides comprehensive details about the loan, including the principal amount borrowed, the interest rate, repayment terms, and any applicable penalties or fees. It serves as evidence of the corporation's indebtedness to the investor and outlines the rights and obligations of both parties. The Maricopa Arizona Convertible Promissory Note by Corporation allows for the conversion of the loan into equity or ownership shares in the corporation at a later date, based on agreed-upon terms. This feature provides the investor with the option to convert their debt into equity, potentially benefiting from future growth and increasing the potential return on investment. There may be different types of Maricopa Arizona Convertible Promissory Notes by Corporation, each tailored to meet specific requirements or circumstances. Some variations may include: 1. Senior Convertible Notes: These notes hold a higher priority compared to other debt instruments, meaning they must be repaid before other debts in the event of bankruptcy or liquidation. 2. Subordinated Convertible Notes: These notes have a lower priority compared to other debts and are paid after senior obligations in the case of bankruptcy or liquidation. 3. Floating Interest Rate Convertible Notes: These notes feature an interest rate that fluctuates based on an agreed-upon benchmark, such as the prime rate or LIBOR. 4. Non-Convertible Promissory Notes: These notes do not offer the conversion option and are repaid solely as a loan with interest. It is crucial for both the corporation and the investor to carefully review and understand the terms outlined in the Maricopa Arizona Convertible Promissory Note by Corporation before entering into the agreement. Seeking legal advice is highly recommended ensuring compliance with applicable laws and regulations and to protect the interests of both parties involved.