A Convertible Note is a simple promissory note, usually bearing interest and payable at some future date. The unique aspects of a convertible note are:

A. It converts into equity in the company so long as certain agreed metrics are achieved;

B. Conversion rather than repayment is the usual intention of the parties

C. The usual events for conversion (a conversion event) could be some or all of:

1. Later financing acquired of an agreed minimum level;

2. Developmental milestones reached by the company; and/or

3. Strategic partnerships concluded with important companies;

The conversion into equity is usually at a valuation that is consistent with the valuation agreed to with investors in an investment round that occurs at a later time.

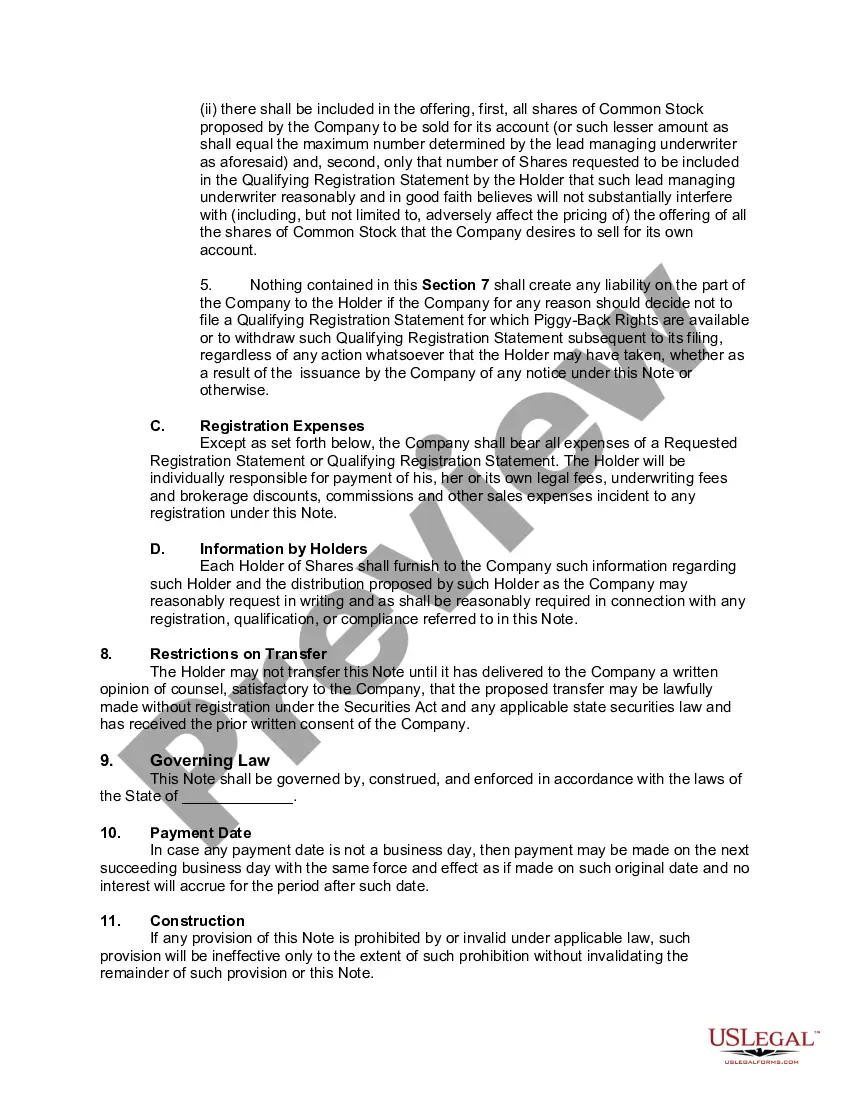

The Mecklenburg North Carolina Convertible Promissory Note by Corporation is a legal document that outlines the terms and conditions of a loan agreement between a corporation and a lender. It is one of the series of notes issued in accordance with the Convertible Note Purchase Agreement. This type of promissory note is designed to provide flexibility to both the corporation and the lender. It allows the lender to convert the outstanding amount of the loan into shares of the corporation's stock at a predetermined conversion price. This ensures that the lender has an opportunity to participate in any potential future growth and value appreciation of the corporation. The Mecklenburg North Carolina Convertible Promissory Note by Corporation includes various important provisions and details relating to the loan agreement. These may include: 1. Principal Amount: The document specifies the principal amount of the loan, which is the initial amount borrowed by the corporation from the lender. 2. Interest Rate: The note sets forth the interest rate at which the loan will accrue interest. This rate is usually fixed or variable, and it can be specified as a percentage. 3. Conversion Terms: The note outlines the conversion terms, including the conversion price at which the lender can convert the loan into shares of the corporation's stock. It also defines the circumstances under which conversion can occur, such as a specific event or a predetermined period. 4. Maturity Date: The note specifies the maturity date, which is the date by which the loan, along with any accrued interest, must be repaid in full. This date marks the end of the loan agreement. 5. Repayment Terms: The document may include details on how the loan will be repaid if conversion does not occur or by the maturity date. It may outline a repayment schedule, including interest payments and principal repayments. Additional types of Mecklenburg North Carolina Convertible Promissory Notes by Corporation — One of Series of Notes Issued Pursuant to Convertible Note Purchase Agreement may include variations specific to different series of notes issued under the same agreement. These variations can relate to different tranches of financing, varying interest rates, conversion prices, or maturity dates. Each series of notes may be issued to provide funding for different purposes or at different stages of the corporation's growth. It is important to consult with legal professionals and review the specific terms of the Mecklenburg North Carolina Convertible Promissory Note by Corporation before entering into any loan agreement to ensure compliance with local laws and regulations.The Mecklenburg North Carolina Convertible Promissory Note by Corporation is a legal document that outlines the terms and conditions of a loan agreement between a corporation and a lender. It is one of the series of notes issued in accordance with the Convertible Note Purchase Agreement. This type of promissory note is designed to provide flexibility to both the corporation and the lender. It allows the lender to convert the outstanding amount of the loan into shares of the corporation's stock at a predetermined conversion price. This ensures that the lender has an opportunity to participate in any potential future growth and value appreciation of the corporation. The Mecklenburg North Carolina Convertible Promissory Note by Corporation includes various important provisions and details relating to the loan agreement. These may include: 1. Principal Amount: The document specifies the principal amount of the loan, which is the initial amount borrowed by the corporation from the lender. 2. Interest Rate: The note sets forth the interest rate at which the loan will accrue interest. This rate is usually fixed or variable, and it can be specified as a percentage. 3. Conversion Terms: The note outlines the conversion terms, including the conversion price at which the lender can convert the loan into shares of the corporation's stock. It also defines the circumstances under which conversion can occur, such as a specific event or a predetermined period. 4. Maturity Date: The note specifies the maturity date, which is the date by which the loan, along with any accrued interest, must be repaid in full. This date marks the end of the loan agreement. 5. Repayment Terms: The document may include details on how the loan will be repaid if conversion does not occur or by the maturity date. It may outline a repayment schedule, including interest payments and principal repayments. Additional types of Mecklenburg North Carolina Convertible Promissory Notes by Corporation — One of Series of Notes Issued Pursuant to Convertible Note Purchase Agreement may include variations specific to different series of notes issued under the same agreement. These variations can relate to different tranches of financing, varying interest rates, conversion prices, or maturity dates. Each series of notes may be issued to provide funding for different purposes or at different stages of the corporation's growth. It is important to consult with legal professionals and review the specific terms of the Mecklenburg North Carolina Convertible Promissory Note by Corporation before entering into any loan agreement to ensure compliance with local laws and regulations.