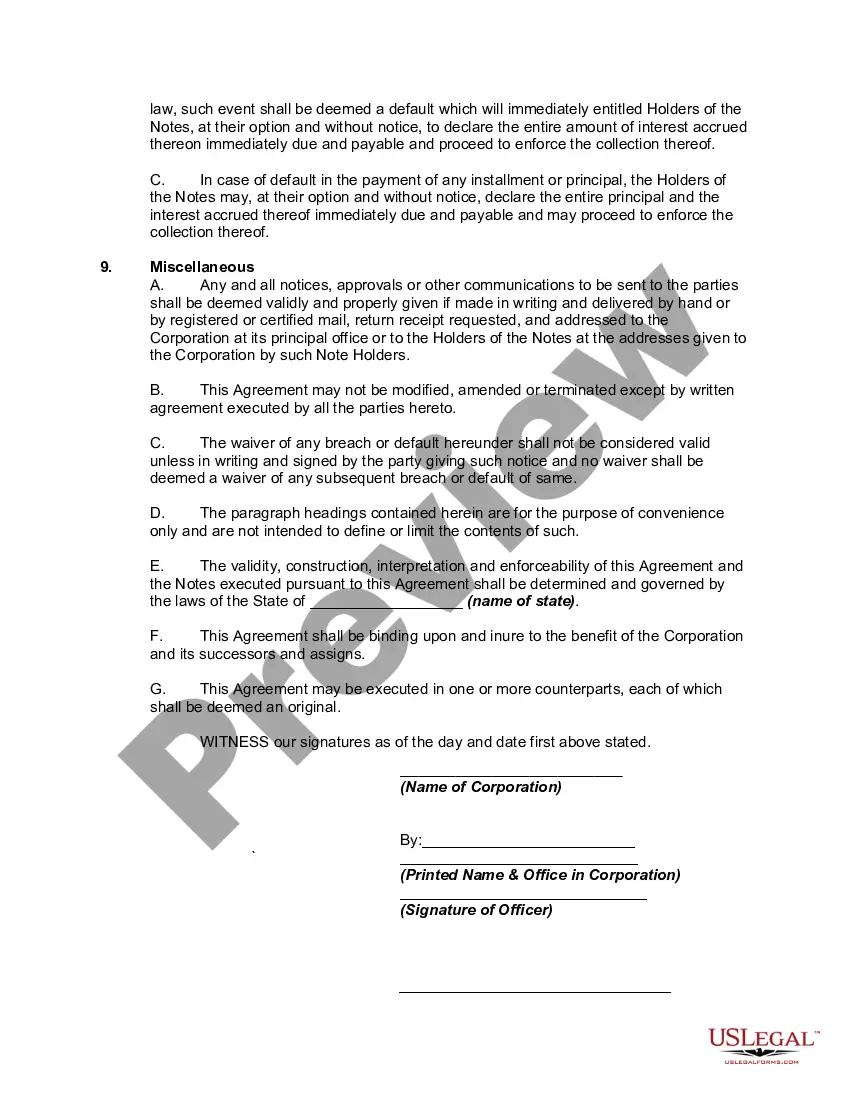

The Mecklenburg North Carolina Convertible Note Agreement is a legal document that outlines the terms and conditions between an investor and a startup company in Mecklenburg County, North Carolina. This agreement is commonly used in the context of financing rounds and represents a debt instrument that can be converted into equity at a later stage. Keywords: Mecklenburg North Carolina, Convertible Note Agreement, investor, startup company, financing rounds, debt instrument, equity. There are various types of Mecklenburg North Carolina Convertible Note Agreements, such as: 1. Simple Convertible Note Agreement: This is the most common type of agreement, which outlines the basic terms and conditions of the loan, including the interest rate, repayment schedule, valuation cap, and discount rate. 2. Safe Convertible Note Agreement: SAFE (Simple Agreement for Future Equity) is another type of convertible note agreement that has gained popularity in recent years. In this agreement, the investor provides a loan to the startup, and instead of specifying an interest rate and a maturity date, it converts into equity at the occurrence of a specific triggering event, such as a subsequent equity financing round. 3. Qualified Financing Convertible Note Agreement: This agreement is contingent upon the startup successfully raising a certain amount of capital in a subsequent financing round. If this condition is met, the loan will automatically convert into equity at predetermined terms. 4. Multiple Conversion Price Convertible Note Agreement: In this type of agreement, there may be different conversion prices based on specific milestones or events. For example, the conversion price may be lower if the startup achieves certain performance targets or reaches a certain valuation. 5. Extendable Maturity Date Convertible Note Agreement: This agreement allows for the extension of the maturity date of the note if certain conditions are met, such as the startup's failure to raise additional funding within a specified timeframe. These different types of Mecklenburg North Carolina Convertible Note Agreements offer flexibility to both investors and startup companies, allowing them to customize the terms based on their specific circumstances and needs.

Mecklenburg North Carolina Convertible Note Agreement

Description

How to fill out Mecklenburg North Carolina Convertible Note Agreement?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Mecklenburg Convertible Note Agreement meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Mecklenburg Convertible Note Agreement, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Mecklenburg Convertible Note Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Mecklenburg Convertible Note Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!