A Riverside California Convertible Note Agreement is a legal document that outlines the terms and conditions of a financial arrangement between a company and an investor. This agreement focuses specifically on convertible notes, which are a type of debt investment that can be converted into equity in the future. This instrument is popular among startups and early-stage companies seeking funding. The Riverside California Convertible Note Agreement typically includes key provisions such as the principal amount of the loan, interest rate, maturity date, conversion terms, and other important details. It serves as a bridge financing tool, enabling companies to secure immediate capital while deferring the valuation and issuance of equity until a later round of funding or a specific event. The agreement may also specify different variations of convertible notes, depending on the terms and preferences of both the company and the investor. One common type is a "discount note," which provides the investor with a predetermined discount on the conversion price when converting the debt into equity. A "valuation cap note" includes a maximum valuation at which the investor can convert the note into equity, protecting them from dilution in case the company's valuation skyrockets before the conversion. Furthermore, a "qualified financing note" comes into play if the company raises a certain amount of funding in a subsequent financing round. In this case, the investor's convertible note can be automatically converted into equity under specific conditions defined in the agreement. Riverside, located in Southern California, is a vibrant city known for its diverse economy, thriving business community, and entrepreneurial spirit. It is home to numerous high-tech startups, biotech companies, and educational institutions. The Riverside California Convertible Note Agreement is commonly used within this local ecosystem to facilitate capital flow and fuel innovation. In conclusion, the Riverside California Convertible Note Agreement is an essential legal document that enables companies in the region to secure financing through convertible notes. It provides a flexible financing option for both entrepreneurs and investors, fostering economic growth and supporting the development of innovative ideas.

Riverside California Convertible Note Agreement

Description

How to fill out Riverside California Convertible Note Agreement?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Riverside Convertible Note Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities associated with document execution straightforward.

Here's how you can purchase and download Riverside Convertible Note Agreement.

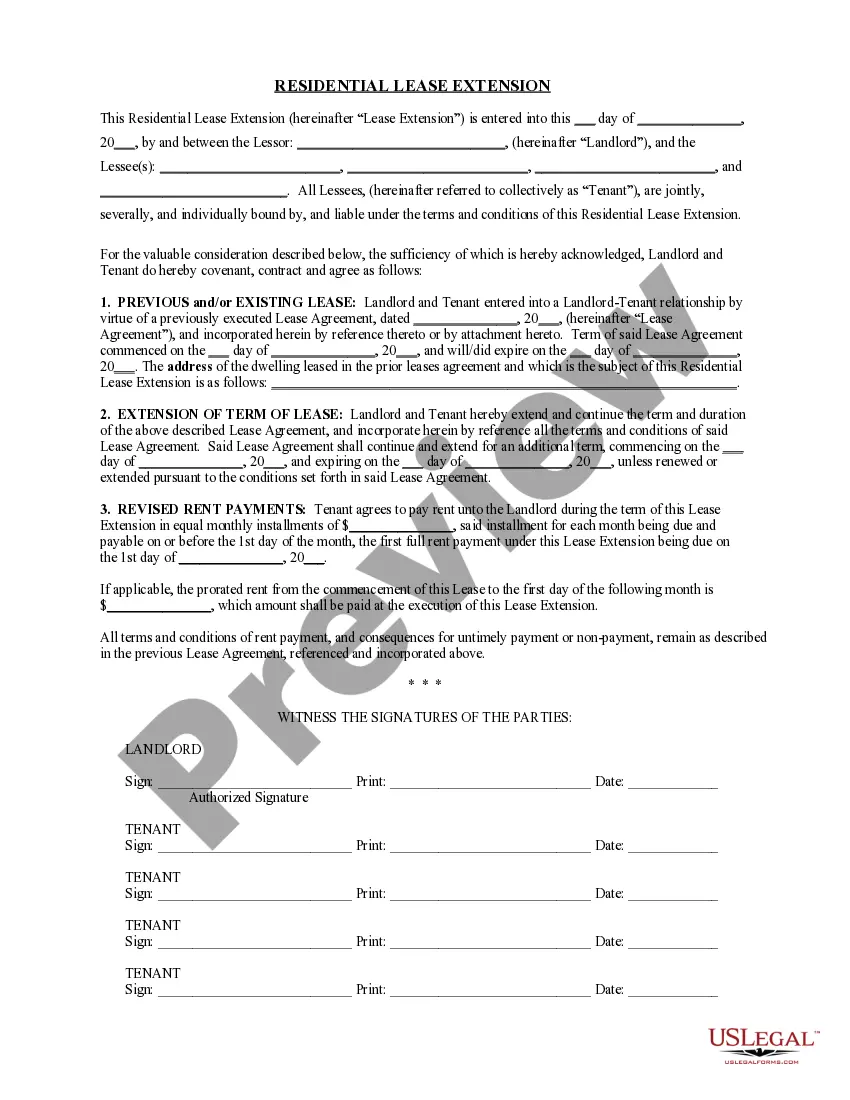

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the related document templates or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Riverside Convertible Note Agreement.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Riverside Convertible Note Agreement, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you need to deal with an exceptionally difficult situation, we advise using the services of an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork effortlessly!