A San Bernardino California Convertible Note Agreement is a legal document that outlines the terms and conditions of a financial instrument known as a convertible note. This agreement is typically entered into between a start-up company in need of funding and an investor willing to provide the funds in exchange for potential equity in the company. In the context of San Bernardino, California, several types of Convertible Note Agreements may exist, including: 1. Seed Stage Convertible Note Agreement: This type of agreement is commonly used in the early stages of a start-up's funding, often when it is not yet fully operational or generating significant revenue. The agreement allows the start-up to raise capital quickly without the need for a formal valuation. 2. Series A Convertible Note Agreement: This agreement is typically used for more mature start-ups that have already raised some initial capital and are ready to scale their operations. Series A Convertible Notes are often negotiated with more complex terms, including valuation caps, discounts, and conversion triggers, to accommodate the larger investment size. 3. Bridge Convertible Note Agreement: This type of agreement is often utilized when a start-up needs short-term capital to bridge a funding gap between financing rounds. The Bridge Convertible Note allows for quick access to necessary funds while providing investors the opportunity to convert their investment into equity in the future financing round. 4. Growth Stage Convertible Note Agreement: As start-ups continue to grow and expand, they may require additional financing to support their growth initiatives. Growth Stage Convertible Note Agreements are structured to attract investors who believe in the start-up's potential and are willing to provide funding to support the company's growth trajectory. Regardless of the specific type, a San Bernardino Convertible Note Agreement typically includes essential provisions such as the principal amount, interest rate, maturity date, conversion terms, repayment terms, and representations and warranties of the start-up. The agreement aims to protect the interests of both the start-up and the investor by clearly defining the rights and obligations of each party. It is important to seek legal advice when entering into any type of Convertible Note Agreement in San Bernardino, California, as the specifics of the agreement can vary based on the unique circumstances and needs of the start-up and the investor involved.

San Bernardino California Convertible Note Agreement

Description

How to fill out San Bernardino California Convertible Note Agreement?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Bernardino Convertible Note Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the San Bernardino Convertible Note Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Bernardino Convertible Note Agreement:

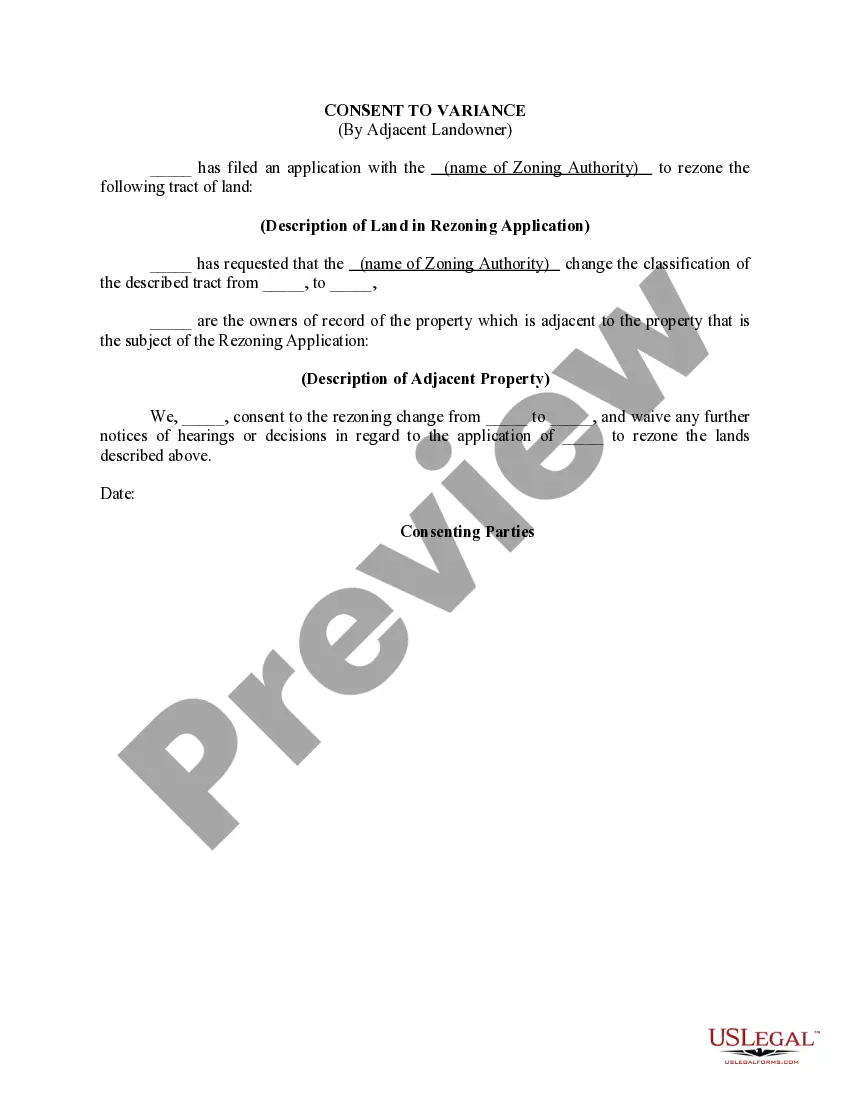

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!