A Suffolk New York Convertible Note Agreement is a legal document that outlines the terms and conditions of a financial agreement between an investor and a company based in Suffolk County, New York. This agreement typically relates to the issuance of Convertible Notes, which are a type of debt instrument that can be converted into equity at a later date. The Suffolk New York Convertible Note Agreement contains essential details such as the names of the parties involved, the principal amount of the loan, the interest rate, the maturity date, and the conversion terms. It also includes provisions for default, governing law, dispute resolution, and other important clauses that protect the rights and interests of both parties. There are different types of Suffolk New York Convertible Note Agreements, each with its own unique features and provisions. These may include: 1. Seed Convertible Note Agreement: This type of agreement is typically used in the early stages of a startup, where the investor provides funding in the form of a convertible note. The note can convert into equity upon the occurrence of certain events, such as a subsequent financing round or the achievement of specific milestones. 2. Bridge Convertible Note Agreement: In situations where a company needs short-term financing to bridge the gap between funding rounds, a bridge convertible note agreement can be used. This type of agreement allows the company to secure funds quickly while providing the investor with the potential for equity conversion in the future. 3. Growth Convertible Note Agreement: As a company expands and requires additional capital for growth purposes, a growth convertible note agreement can be utilized. This agreement enables the investor to lend money to the company with the expectation of converting the debt into equity when the company achieves specific growth targets. 4. Mezzanine Convertible Note Agreement: Mezzanine financing typically occurs when a company is preparing for an initial public offering (IPO) or a significant corporate event. A mezzanine convertible note agreement allows the investor to provide capital to the company in anticipation of the upcoming event, with the potential for conversion into equity once the event takes place. These various types of Suffolk New York Convertible Note Agreements provide flexibility for both investors and companies seeking funding. By utilizing such legal agreements, they can structure financing arrangements that align with their specific needs and goals while mitigating risks associated with debt and equity investments.

Suffolk New York Convertible Note Agreement

Description

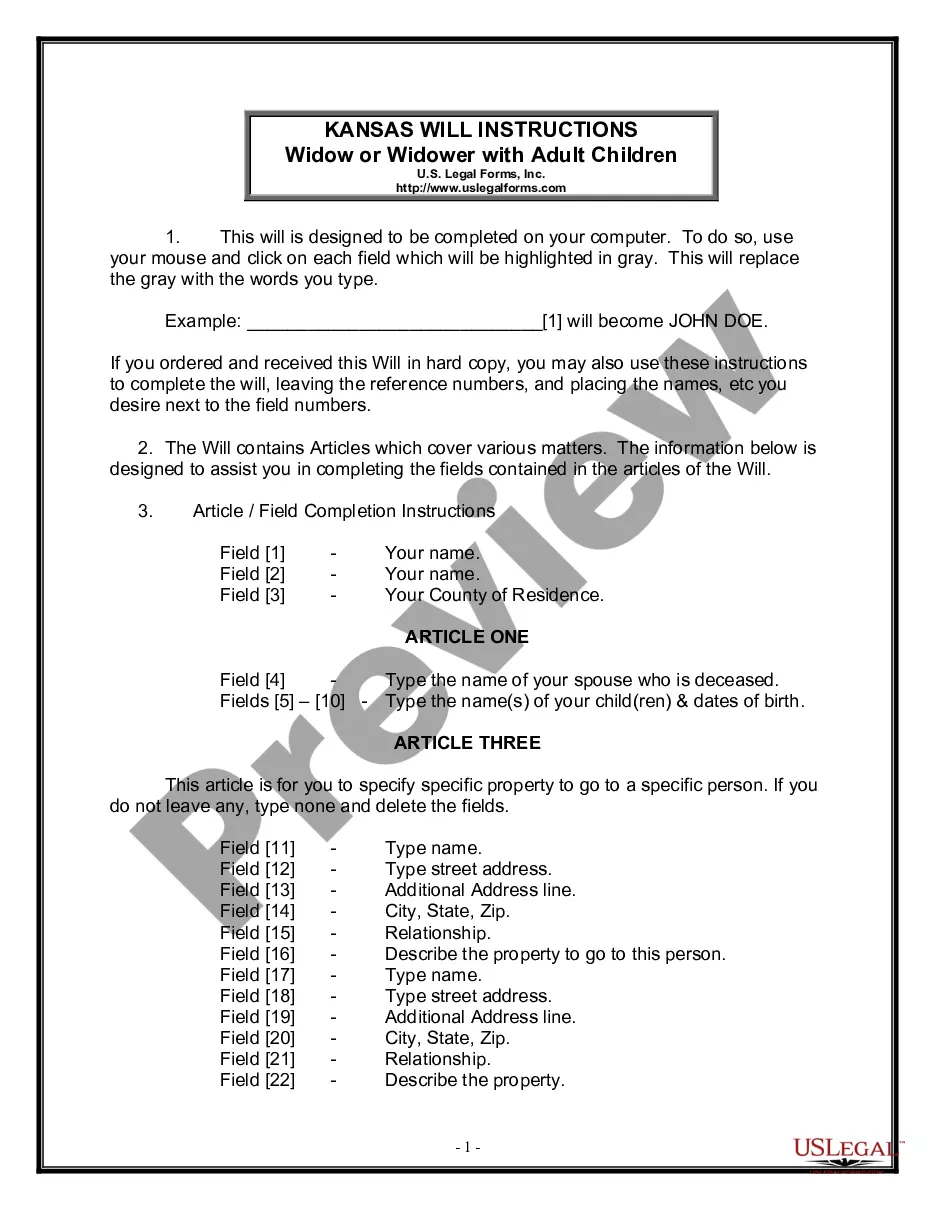

How to fill out Suffolk New York Convertible Note Agreement?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Suffolk Convertible Note Agreement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how to purchase and download Suffolk Convertible Note Agreement.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Suffolk Convertible Note Agreement.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Suffolk Convertible Note Agreement, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to deal with an exceptionally complicated case, we recommend getting a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and get your state-specific paperwork with ease!