San Jose, California, Annual Expense Report is a comprehensive financial document that provides a detailed breakdown of the city's expenses incurred over a one-year period. This report aims to provide transparency and accountability in financial management for the city of San Jose. Keywords: San Jose, California, annual expense report, financial document, expenses, transparency, accountability, financial management. The San Jose California Annual Expense Report includes various categories of expenses, covering essential aspects of the city's operations. These categories include: 1. Salaries and Benefits: This section outlines the costs associated with salaries, wages, and employee benefits for the city's workforce, including both full-time and part-time employees. 2. Utilities and Services: These expenses cover various utility services such as water, electricity, gas, and other related costs necessary for the city's day-to-day operations. 3. Maintenance and Repairs: This category encompasses expenses related to the maintenance and repair of infrastructure, public facilities, vehicles, and equipment owned by the city, ensuring their proper functioning and longevity. 4. Transportation and Logistics: This section details expenses related to public transportation services, fleet management, fuel costs, and other logistical expenses required to move people and goods efficiently within the city. 5. Public Safety: This category includes expenses connected to police and fire departments, emergency services, and other public safety measures aimed at ensuring the well-being and security of San Jose's residents. 6. Education and Community Services: This section outlines expenses associated with educational programs, community development initiatives, recreational facilities, libraries, and other services provided for the betterment of the community. 7. Infrastructure and Public Works: This category covers expenses related to the construction, maintenance, and improvement of roads, bridges, parks, public buildings, and other infrastructure projects undertaken by the city. 8. Administrative Costs: This section includes expenses associated with the city's administrative functions, including office supplies, professional services, legal fees, and other administrative overheads. 9. Debt Servicing: This category highlights expenses related to servicing outstanding debts, including interest payments, principal repayments, and fees associated with borrowing capital for infrastructure projects or other initiatives. 10. Miscellaneous Expenses: This section captures any other significant expenses that do not fit within the aforementioned categories but contribute to the city's overall annual expenditure. By presenting these detailed expense categories, the San Jose California Annual Expense Report allows stakeholders, including citizens, government officials, and investors, to assess how city resources are allocated and to evaluate the city's financial health and priorities. Note: The specific categorization and presentation of expenses may vary depending on the format and structure adopted by the city administration for its annual expense report.

San Jose California Annual Expense Report

Description

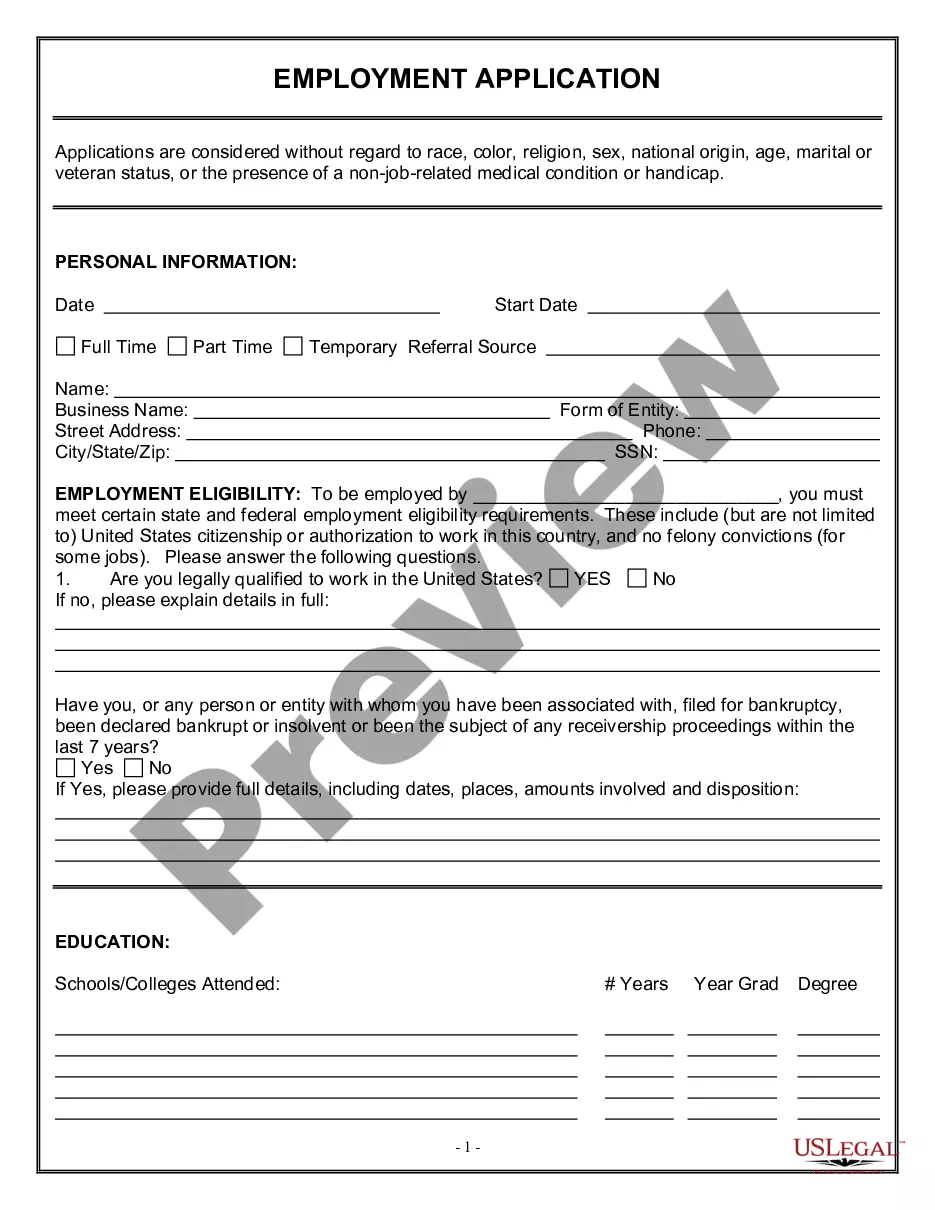

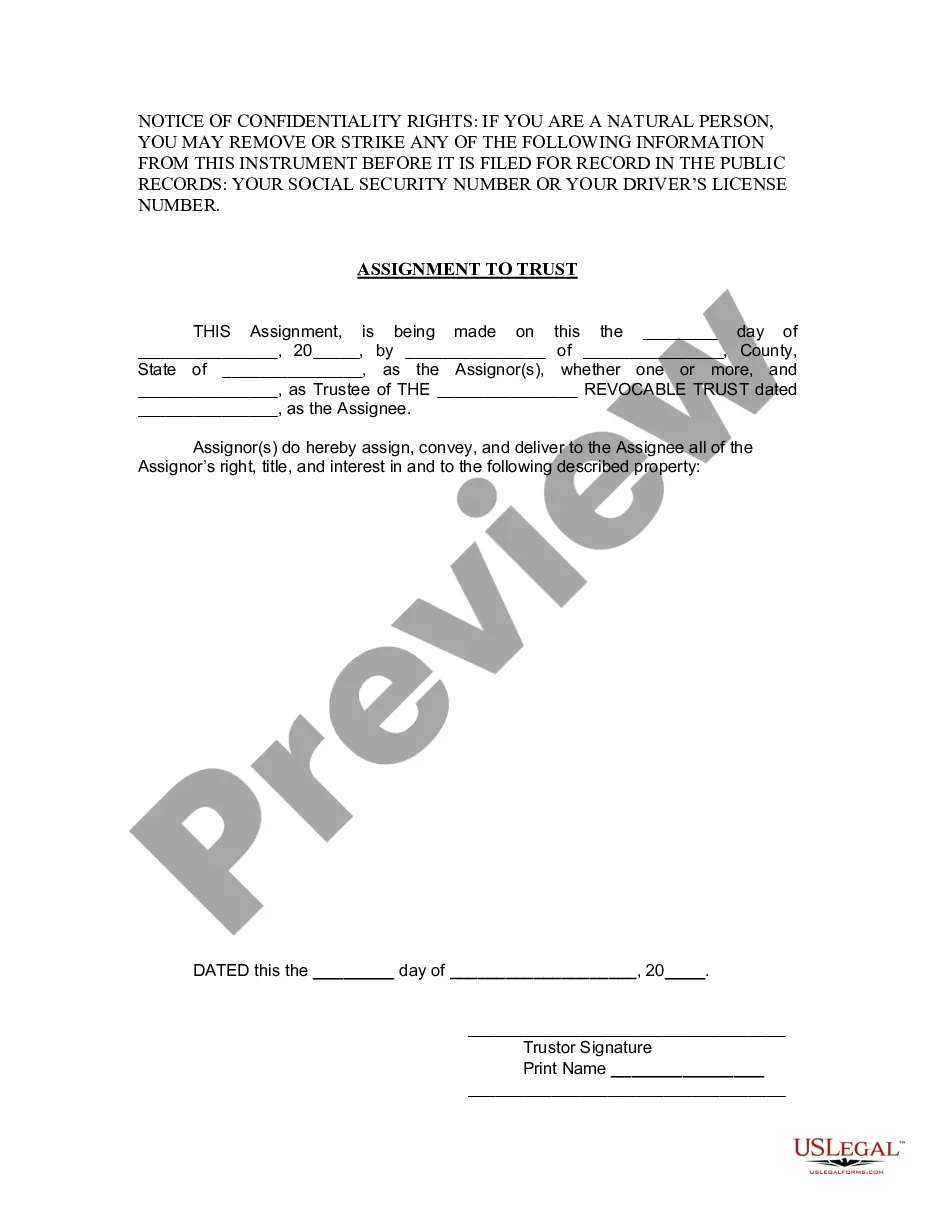

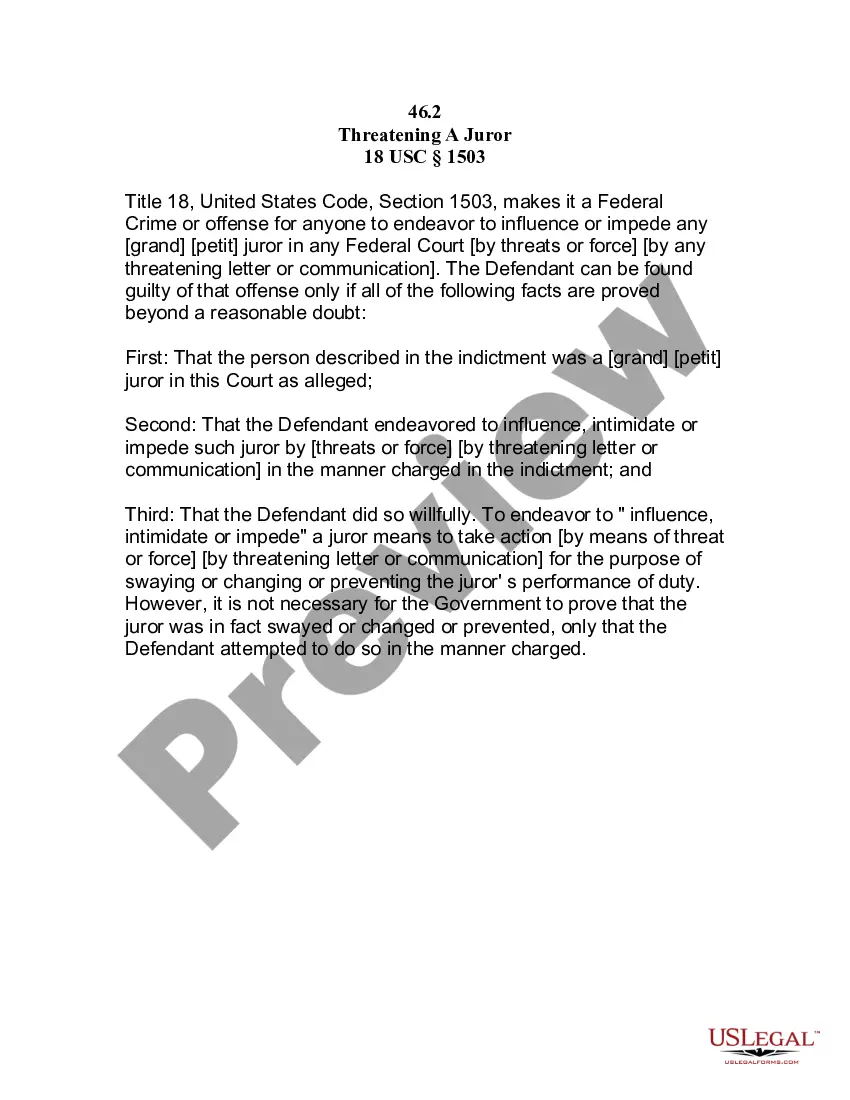

How to fill out San Jose California Annual Expense Report?

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Jose Annual Expense Report, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the latest version of the San Jose Annual Expense Report, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Jose Annual Expense Report:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your San Jose Annual Expense Report and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Financial reports are available on ASIC's public register. To locate a specific company's financial report you can complete a company name search on Organisations & Business Names at ASIC Connect.

US EDGAR EDGAR is the main database for public company filings in the United States and contains all documents that companies are required to file.

Where to Find Latest Annual Reports of Indian Companies Company Website. Stock Exchange Website. Stock Exchanges in India. How to find annual reports on BSE website. Free Information Website. Screener.in. Moneycontrol.com. Paid Information Website.

Free Resources for Financial Information EDGAR--SEC Website.Company's Website.Public Register's Annual Reports.Yahoo Finance.Google Finance.Company Spotlight from Investopedia.Investor Relations Information Network (IRIN)The Annual Reports Service.

The easiest way to find information on public companies is to perform a Google search for their investor relations website. Companies will provide their most recent documents including their annual report, 10-K. The filing provides a comprehensive summary of a company's performance for the year.

The AR is usually available on the company's website (in the investor's section) as a PDF document, or one can contact the company to get a hard copy of the same. Since the company's annual report, whatever is mentioned in the AR is assumed to be official.

You can often find a company's annual reports on the company's own website. Annual reports can generally be found in the area of the company's website that contains information for investors.

For 2020-2021, General Fund revenue estimates (excluding fund balance) total $1.15 billion, representing a 2.7% decrease from the 2019-2020 Adopted Budget level. When Fund Balance- Carryover is included, General Fund resources total $1.27 billion, which is 13.6% below the prior year.

You can often find a company's annual reports on the company's own website. Annual reports can generally be found in the area of the company's website that contains information for investors.

You can often find a company's annual reports on the company's own website. Annual reports can generally be found in the area of the company's website that contains information for investors.