The Phoenix Arizona Cash Receipts Journal serves as a comprehensive record document that tracks the inflow of cash for various transactions happening in businesses and organizations located in the vibrant city of Phoenix, Arizona. This essential financial tool provides an organized and meticulous account of cash payments received by companies, helping them effectively monitor and manage their financial activities. The Phoenix Arizona Cash Receipts Journal is typically used by businesses of all sizes, including retail stores, restaurants, service providers, and nonprofit organizations, to keep track of cash transactions such as sales receipts, payments from customers, rental income, and other types of cash inflows. Within the realm of the Phoenix Arizona Cash Receipts Journal, there can be several types that cater to different industries or specific business needs. Some notable variations include: 1. Retail Cash Receipts Journal: This specialized form of the Cash Receipts Journal primarily focuses on recording cash inflows resulting from sales transactions occurring in retail establishments across Phoenix, Arizona. It helps retailers monitor their daily sales revenue, identify top-selling items, and reconcile cash balances. 2. Service Cash Receipts Journal: This type of Cash Receipts Journal is designed for service-based businesses operating in Phoenix, Arizona, such as consulting firms, hair salons, repair shops, and freelancers. It enables them to track cash received from clients for rendered services, facilitating accurate income reporting and financial analysis. 3. Rental Cash Receipts Journal: Specifically aimed at landlords, property managers, and real estate agencies in Phoenix, Arizona, this Cash Receipts Journal variant focuses on documenting rental income received from tenants. It helps property owners maintain organized records of rental payments, monitor vacancies, and handle tenant-related financial matters efficiently. 4. Nonprofit Cash Receipts Journal: For nonprofit organizations based in Phoenix, Arizona, this specialized journal assists in tracking cash inflows from donations, grants, fundraising events, and membership fees. It is crucial for these organizations to maintain transparent records to ensure compliance with legal and financial regulations. Regardless of the specific type of Phoenix Arizona Cash Receipts Journal, its purpose remains consistent: to provide an accurate and detailed account of cash received. By utilizing this financial tool, businesses and organizations can effectively manage their cash inflows, detect potential discrepancies, and generate valuable insights necessary for informed decision-making within the dynamic business landscape of Phoenix, Arizona.

Phoenix Arizona Cash Receipts Journal

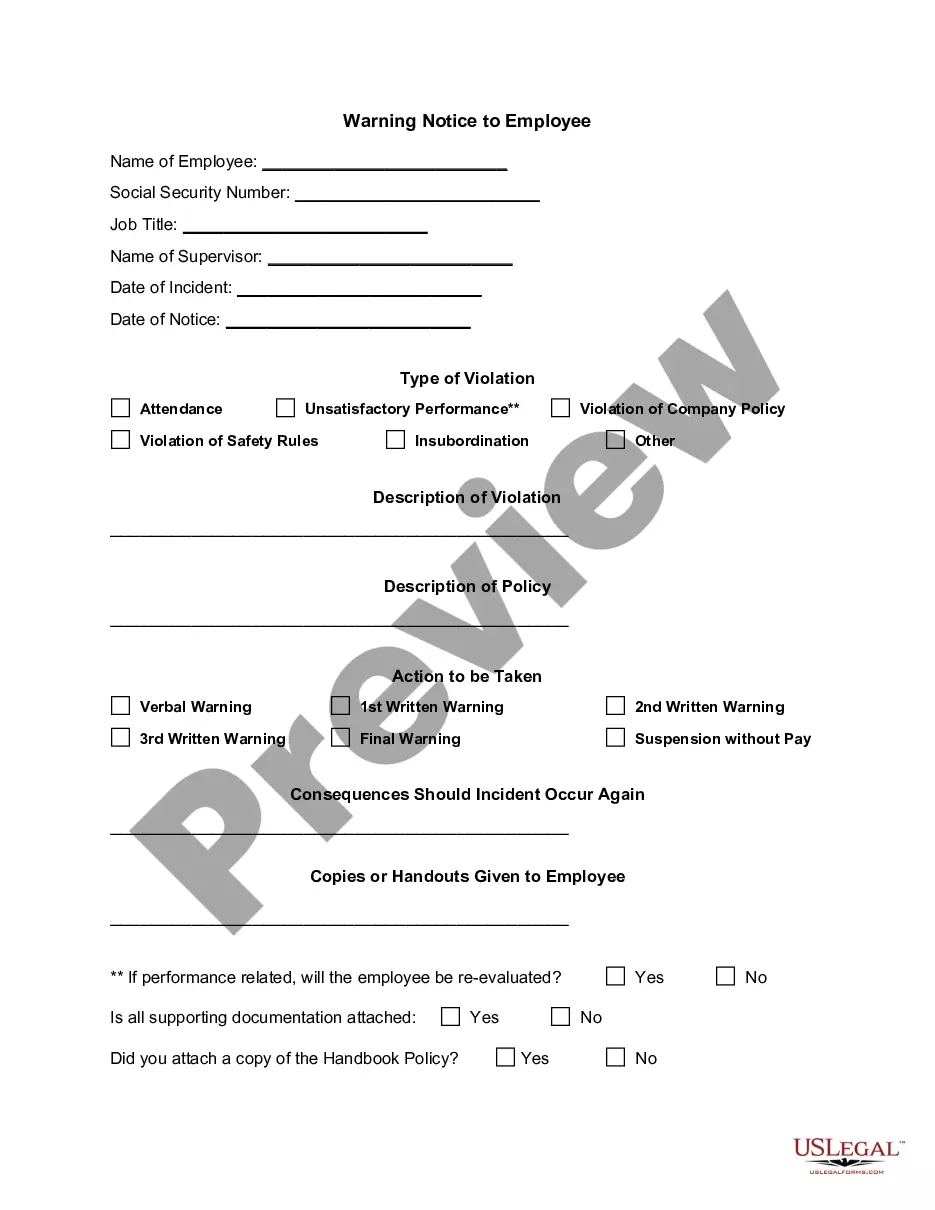

Description

How to fill out Phoenix Arizona Cash Receipts Journal?

Are you looking to quickly create a legally-binding Phoenix Cash Receipts Journal or maybe any other form to manage your personal or business affairs? You can select one of the two options: hire a legal advisor to draft a legal document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Phoenix Cash Receipts Journal and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Phoenix Cash Receipts Journal is adapted to your state's or county's laws.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Phoenix Cash Receipts Journal template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!