Collin Texas Daily Cash Report is a financial document that provides a comprehensive summary of the daily cash activities of a business or organization located in Collin County, Texas. This report is crucial for businesses to accurately track and effectively manage their daily cash flow, ensuring smooth financial operations. The Collin Texas Daily Cash Report includes various sections and details pertaining to the cash transactions that occur within a specific day. It outlines the inflow and outflow of cash, providing a clear picture of the company's revenue, expenses, and overall financial performance on a daily basis. Key elements typically covered in a Collin Texas Daily Cash Report may include: 1. Opening and Closing Balances: The report begins with the opening cash balance at the start of the day and concludes with the closing cash balance at the end of the day. These balances indicate the actual amount of cash available at the beginning and end of the day. 2. Cash Receipts: This section documents all the cash inflows received throughout the day. It includes records of cash sales, customer payments, cash advances, returns, and any other sources of cash received during the defined period. 3. Cash Disbursements: This portion outlines all cash outflows made by the business. It includes expenses such as rent, salaries, utilities, inventory purchases, loan repayments, taxes, and any other cash payments made during the day. 4. Petty Cash Expenses: If applicable, this section records any small cash expenses made from the petty cash fund, such as office supplies, employee reimbursements, or miscellaneous business expenditures. 5. General Ledger Reconciliation: To ensure accuracy, the daily cash report should reconcile the cash amounts recorded in the report with the corresponding entries in the general ledger, minimizing discrepancies and maintaining financial integrity. Collin Texas may not have different types of Daily Cash Reports specifically designated for different industries or businesses. However, the format and level of detail within the report may vary depending on the organization's size, industry, or specific reporting requirements. A Collin Texas Daily Cash Report serves as a vital financial management tool, enabling businesses to monitor their cash flow, identify trends, and make informed decisions. By conducting regular analysis and comparisons of daily cash reports, companies can effectively manage their finances, identify areas of improvement, and ensure the healthy financial sustenance of their operations in Collin County, Texas.

Collin Texas Daily Cash Report

Description

How to fill out Collin Texas Daily Cash Report?

Preparing papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Collin Daily Cash Report without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Collin Daily Cash Report by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Collin Daily Cash Report:

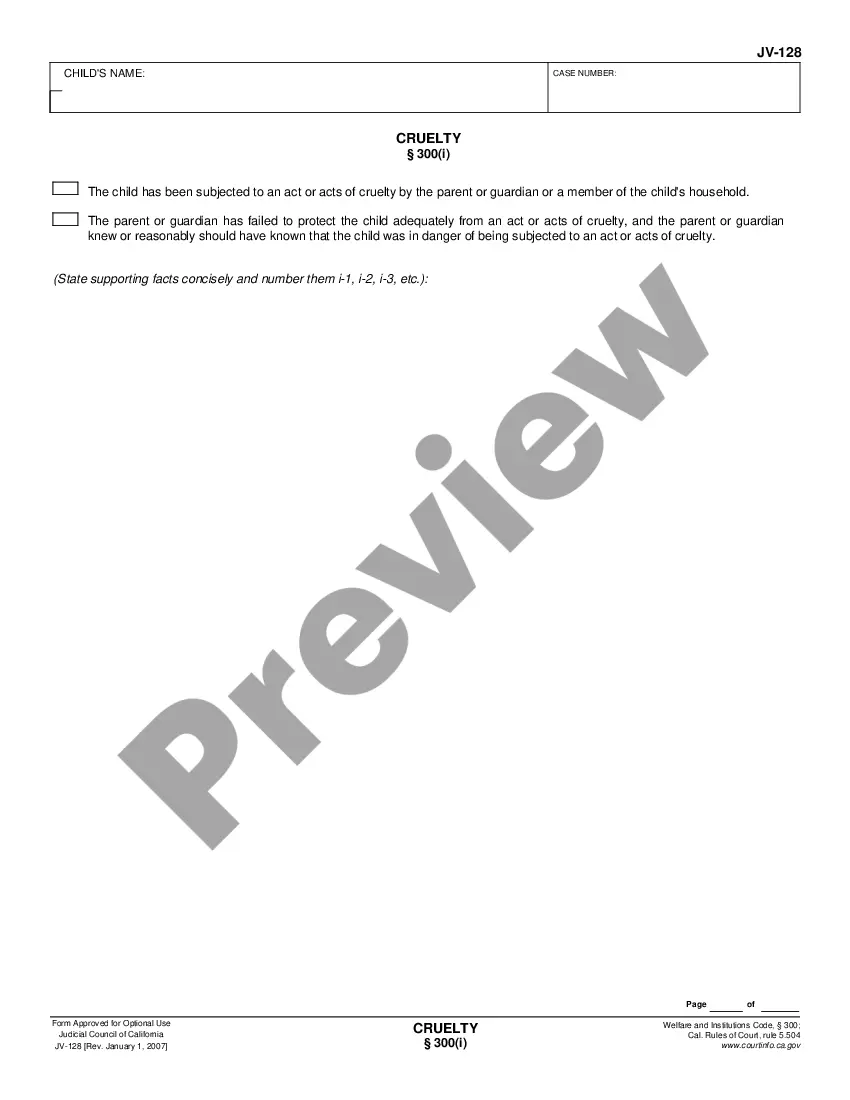

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!