Dallas Texas Daily Cash Report is a financial document that provides a comprehensive summary of the daily cash transactions conducted by a business or organization in the city of Dallas, Texas. This report assists businesses in tracking their cash flow, identifying trends, and ensuring financial accuracy. The Dallas Texas Daily Cash Report is crucial for monitoring cash handling activities, minimizing discrepancies, and maintaining effective financial controls. Keywords: Dallas Texas, daily cash report, financial document, cash transactions, business, organization, cash flow, tracking, trends, financial accuracy, cash handling activities, discrepancies, financial controls. Different Types of Dallas Texas Daily Cash Reports: 1. Sales Daily Cash Report: This type of daily cash report specifically focuses on recording and analyzing the cash inflow from sales transactions. It outlines the total sales revenue, individual transaction amounts, and any discounts or refunds provided. 2. Expenses Daily Cash Report: The expenses daily cash report keeps a record of all the cash outflows for various expenses incurred by the business on a daily basis. It includes categories such as payroll, rent, utilities, inventory purchases, and other related expenses. 3. Petty Cash Daily Report: For businesses maintaining a petty cash fund, this report tracks all the daily expenses covered by the petty cash. It outlines the amounts disbursed, the purpose of the expense, and any remaining balance. 4. Cash Register Daily Report: This report focuses on capturing the cash inflows and outflows specifically associated with the cash register transactions. It includes information about the opening and closing cash register balances, cash deposits made, cash withdrawals, and any discrepancies found. 5. Bank Deposit Daily Report: This type of daily cash report summarizes the cash and checks deposited into the business's bank account on a particular day. It includes details such as the total deposit amount, individual deposit sources, and any associated fees or charges. 6. Cash Reconciliation Daily Report: This report compares and reconciles the cash balance recorded in the previous day's report with the cash balance on the current day. It highlights any discrepancies or variances found, ensuring accurate financial reporting and prevention of cash mishandling. Keywords: sales daily cash report, expenses daily cash report, petty cash daily report, cash register daily report, bank deposit daily report, cash reconciliation daily report, cash inflow, cash outflow, cash balance, transactions, recording, analyzing, petty cash fund, expenses, payroll, sales revenue, deposits, discrepancies, financial reporting.

Dallas Texas Daily Cash Report

Description

How to fill out Dallas Texas Daily Cash Report?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Dallas Daily Cash Report, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Dallas Daily Cash Report from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Dallas Daily Cash Report:

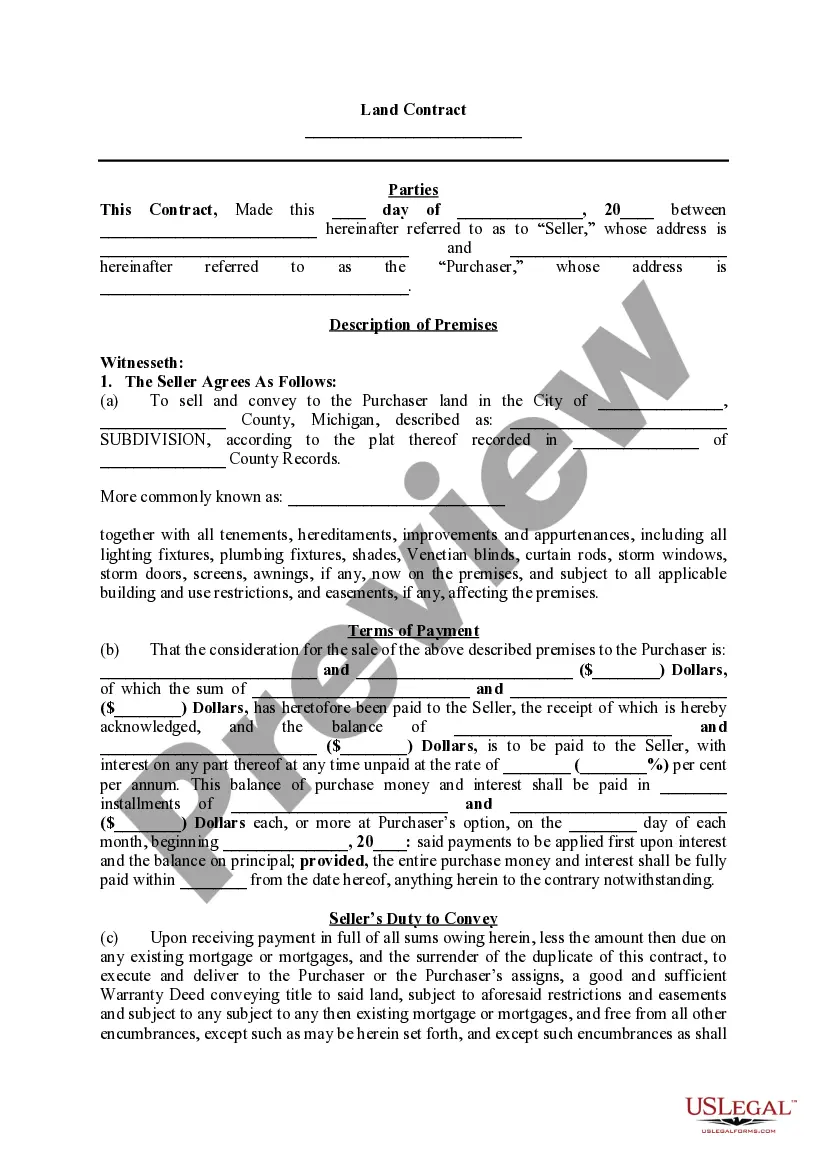

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!