The Suffolk New York Daily Cash Report is a comprehensive financial document that provides a detailed overview of daily monetary transactions in the Suffolk County area of New York. This report plays a vital role in monitoring and managing fiscal activities for various businesses, government organizations, and institutions. Keywords: Suffolk New York, Daily Cash Report, financial document, monetary transactions, Suffolk County, monitoring, managing, fiscal activities, businesses, government organizations, institutions. 1. General Description: The Suffolk New York Daily Cash Report serves as an essential tool for tracking and recording financial transactions conducted within Suffolk County, New York, on a daily basis. This report ensures transparency, accountability, and effective financial management. 2. Purpose and Importance: The primary purpose of the Suffolk New York Daily Cash Report is to provide a comprehensive summary of daily monetary activities, including cash inflows and outflows, sales revenue, expenses, deposits, withdrawals, and various other financial transactions. This report is crucial for organizations to maintain accurate financial records, reconcile accounts, identify any discrepancies, and make informed decisions based on real-time financial data. 3. Components and Format: The Suffolk New York Daily Cash Report typically comprises several key sections to present financial information effectively. These sections may include: — Cash inflows: Details of cash received from various sources, such as sales, services, loans, investments, and other revenue-generating activities. — Cash outflows: Breakdown of cash payments made for expenses, payroll, supplies, utilities, loan repayments, and other expenditures. — Deposits: Records any cash deposited into bank accounts, specifying the amounts, date, and purpose. — Withdrawals: Documentation of cash withdrawn from bank accounts for any required purposes. — Bank reconciliation: The process of matching the report's cash balances with bank statements to identify and rectify any discrepancies. — Additional notes: Any relevant remarks, explanations, or comments regarding specific transactions or financial activities. 4. Types of Suffolk New York Daily Cash Reports: While the content and format may vary, depending on the organization's specific requirements, there are a few common types of Suffolk New York Daily Cash Reports: — Retail Cash Report: Focused on cash transactions at retail establishments, including sales revenue, cash refunds, and petty cash expenditures. — Restaurant Cash Report: Documenting cash inflows from dining sales, tips, delivery orders, and cash outflows for food purchases, salaries, and other restaurant-related expenses. — Government Cash Report: Provides a detailed overview of cash inflows and outflows for government organizations, including tax collections, fines, grants, and various expenditures. — Non-profit Cash Report: Specifically designed for non-profit organizations, showcasing donations, grants, program expenses, and fundraising event revenues. In conclusion, the Suffolk New York Daily Cash Report is an essential financial document that aids in monitoring, managing, and accounting for daily monetary transactions. By utilizing this report, businesses, government organizations, and institutions can maintain accurate financial records, identify issues promptly, and make informed decisions to ensure financial stability and growth.

Suffolk New York Daily Cash Report

Description

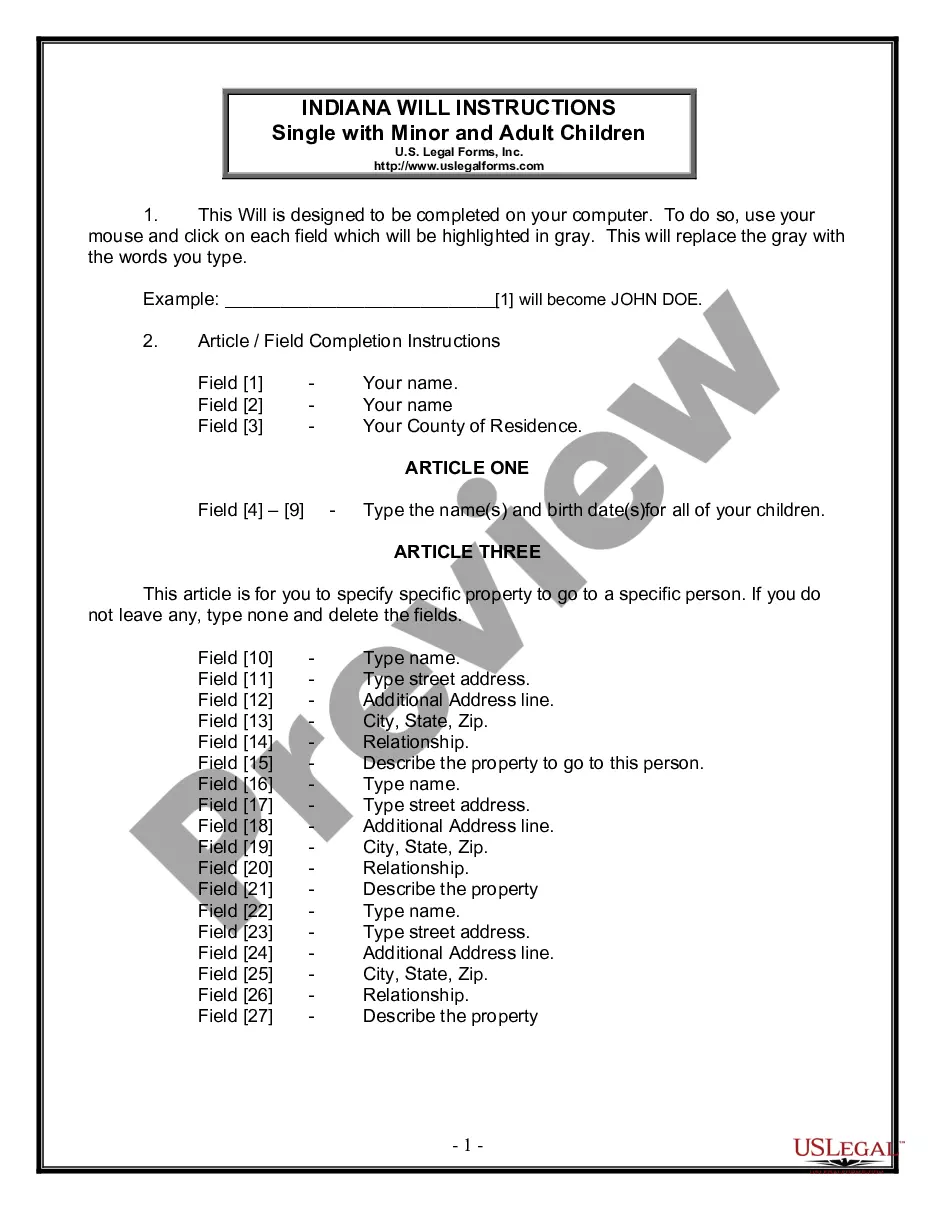

How to fill out Suffolk New York Daily Cash Report?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Suffolk Daily Cash Report, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how to purchase and download Suffolk Daily Cash Report.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Examine the related forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Suffolk Daily Cash Report.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Suffolk Daily Cash Report, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to cope with an extremely complicated situation, we recommend using the services of a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!