Cook Illinois Expense Report is a comprehensive document that tracks and records financial expenses incurred by employees and individuals associated with Cook Illinois Corporation. Cook Illinois is a renowned transportation company, specializing in providing safe and reliable services across various locations. Its expense report is designed to maintain transparency and accuracy in financial transactions, ensuring accountability and efficient expense management. The Cook Illinois Expense Report serves as a crucial tool for the company's financial department and plays a vital role in budgeting and financial planning processes. It captures a wide range of expenses, including travel, accommodation, meals, transportation, entertainment, supplies, and other miscellaneous expenditures. By meticulously documenting these expenses, the report allows the company to analyze spending patterns, identify cost-saving opportunities, and make informed financial decisions. Depending on the nature of the expenditures, there can be various types of Cook Illinois Expense Reports. Some of these may include: 1. Travel Expense Report: This type of report focuses specifically on expenses related to business travel. It covers costs associated with airfare, accommodation, meals, rental cars, taxi fares, parking fees, and other travel-related expenses. 2. Meal Expense Report: This report concentrates on meal expenses incurred during business-related activities. It provides details of meals purchased for clients, employees, or other individuals as part of official meetings, conferences, or events. 3. Transportation Expense Report: This report primarily captures expenses related to transportation for business purposes. It includes costs associated with fuel, tolls, public transportation fares, maintenance, and repairs of company vehicles. 4. Entertainment Expense Report: This type of report concentrates on expenses incurred for client entertainment or team-building activities. It encompasses costs related to meals, event tickets, recreational activities, and other entertainment expenses. 5. Supply Expense Report: This report focuses specifically on purchases and expenses related to office supplies, equipment, and other materials necessary for business operations. It includes items like stationery, electronics, software, and maintenance contracts. Cook Illinois Corporation prioritizes accuracy and completeness when it comes to expense reporting. Therefore, all expense reports require supporting documentation such as receipts, invoices, and other relevant proofs of purchase. Employees and individuals associated with the company are responsible for ensuring that all expenses are recorded correctly, and any potential errors or discrepancies are promptly reported. By maintaining detailed and accurate Cook Illinois Expense Reports, the company can effectively monitor and control expenses, ensure compliance with financial policies and regulations, and streamline its overall financial management process.

Cook Illinois Expense Report

Description

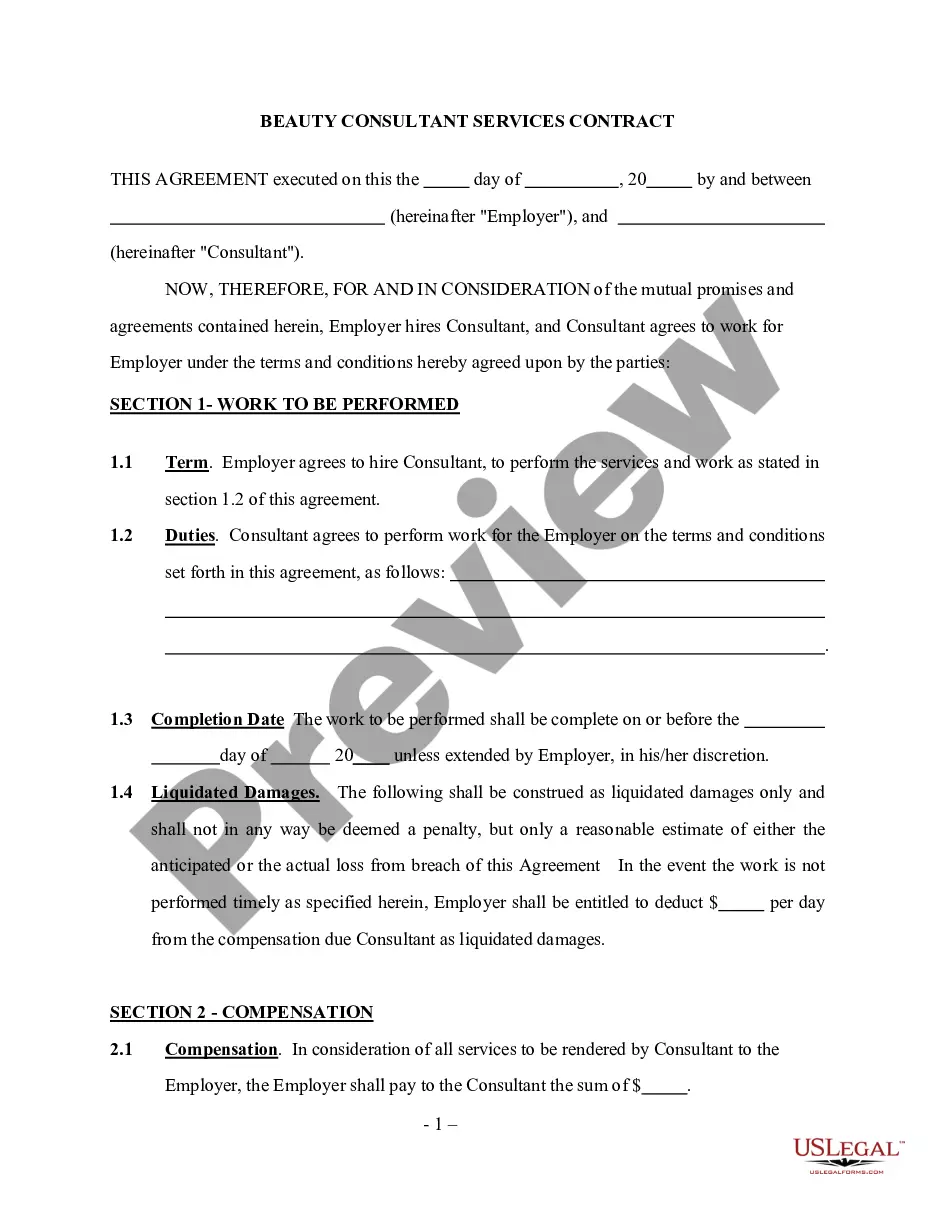

How to fill out Cook Illinois Expense Report?

If you need to find a reliable legal form supplier to find the Cook Expense Report, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to find and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Cook Expense Report, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Cook Expense Report template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Cook Expense Report - all from the comfort of your home.

Sign up for US Legal Forms now!