Oakland Michigan Expense Report

Description

How to fill out Expense Report?

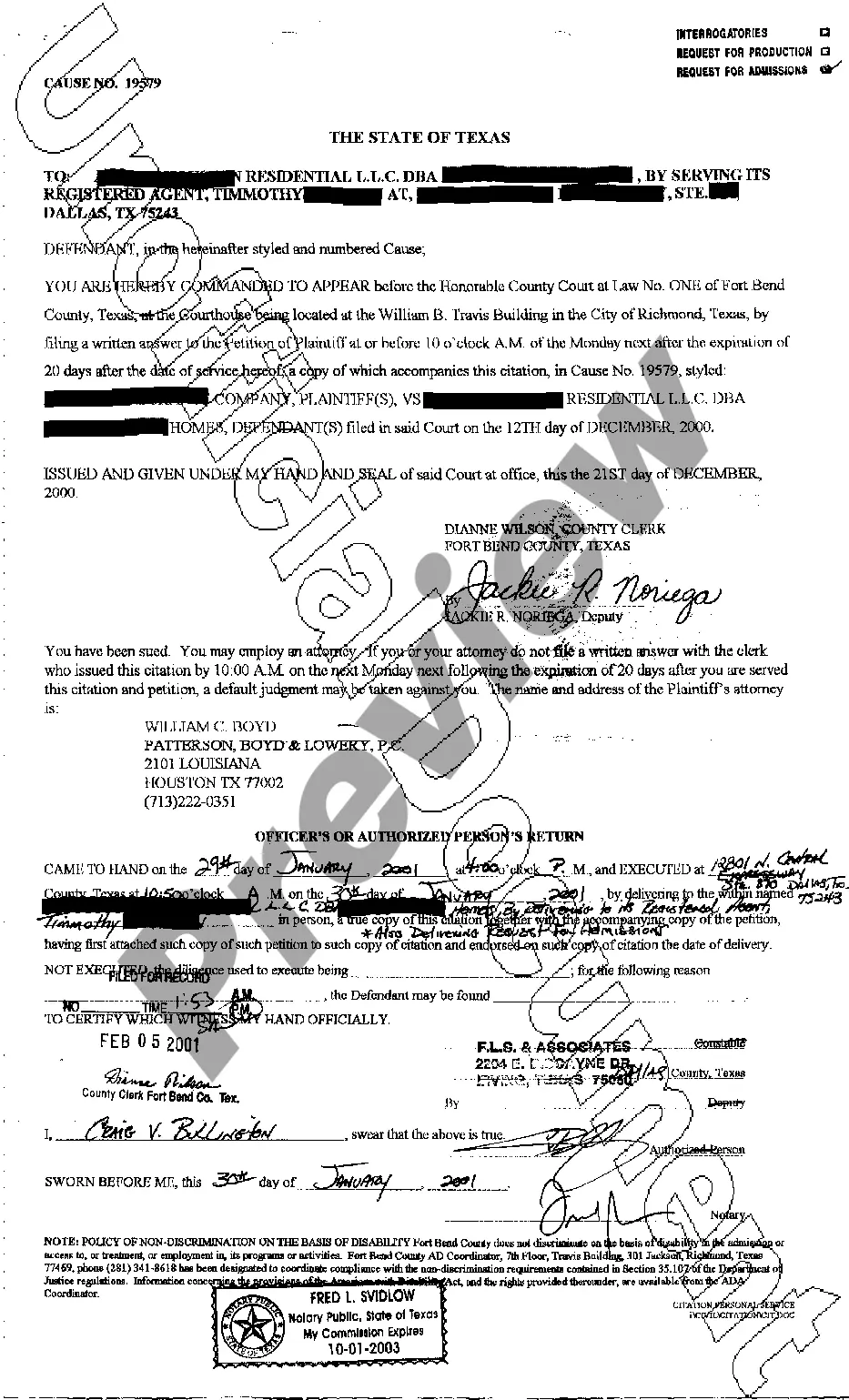

A document process always accompanies any legal endeavor you undertake.

Launching a business, applying for or accepting a job offer, transferring ownership, and numerous other life situations require you to prepare official documentation that differs across the country.

This is why having everything organized in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal templates. On this platform, you can effortlessly find and obtain a document for any personal or business purpose relevant in your area, including the Oakland Expense Report.

This is the simplest and most dependable method to acquire legal paperwork. All the samples offered by our library are professionally crafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Finding templates on the platform is remarkably straightforward.

- If you currently have a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Oakland Expense Report will be accessible for further use in the My documents tab of your profile.

- If you are accessing US Legal Forms for the first time, follow this brief guide to obtain the Oakland Expense Report.

- Ensure you have arrived at the correct page with your localized form.

- Utilize the Preview mode (if available) and review the template.

- Examine the description (if any) to confirm the form suits your requirements.

- Search for another document using the search feature if the sample does not meet your needs.

Form popularity

FAQ

You can report blight, housing or zoning violations online or with the OAK311 app. File a Complaint. Report Property Complaint Online. (510) 238-3381. Property Complaint Hotline. Visit OAK 311 or Download the App. OAK 311 to Report Code Violations.

For every dollar you pay in property tax, the City receives less than 26 cents; the rest goes to other local government agencies and to the state to fund public education.

In Oakland's current business tax structure, tax rates vary from 60 cents to $13.95 per $1,000 in gross receipts. Retail, restaurants and other businesses pay $1.20 per $1,000 in gross receipts, and business and personal services firms and contractors pay $1.80 per $1,000 in gross receipts.

Where Do I Direct a Request for Police Information? By U.S. mail: Public Records Request Coordinator, OPD Records Section, 455 7th Street, Room 306 Oakland, CA 94607.

A taxpayer may be an individual or business entity that is obligated to pay taxes to a federal, state, or local government. Taxes from both individuals and businesses are a primary source of revenue for governments. Individuals and businesses have different annual income tax obligations.

The 10.25% sales tax rate in Oakland consists of 6% California state sales tax, 0.25% Alameda County sales tax and 4% Special tax. There is no applicable city tax. You can print a 10.25% sales tax table here.

OAK 311 is here to help you with requests for routine maintenance and urgent infrastructure issues. For urgent issues, call 311 or (510) 615-5566.

The City of Oakland has a standard claim form that can be used for your convenience. You can file the form electronically at claims@oaklandcityattorney.org, or you can send the form by mail to: Oakland City Attorney's Office, 1 Frank H. Ogawa Plaza, 6th Floor, Oakland, CA 94612.

The Michigan Business Tax (MBT), which was signed into law by Governor Jennifer M. Granholm July 12, 2007, imposes a 4.95% business income tax and a modified gross receipts tax at the rate of 0.8%.

A. Yes, all property owners in Oakland who wish to rent out their property must file and pay the initial $99.00 Registration Fee to obtain a business tax certificate. The tax is based on annual gross rental income at a rate of $13.95 per $1,000 of gross rental income.