The San Diego California General Journal serves as a comprehensive record of financial transactions and other important events relevant to the city of San Diego, California. It is an essential tool used by the city's administration to maintain accurate and organized financial documentation, ensuring transparency and accountability. The San Diego California General Journal covers a wide range of transactions, including revenues, expenses, assets, liabilities, and equity. It captures information related to government expenditures, budgetary allocations, payroll, taxes, grants, contracts, and various municipal activities. This journal enables the city authorities to track financial data efficiently and make informed decisions based on the recorded information. Different types of San Diego California General Journals may exist to cater to specific financial aspects within the city administration. These could include: 1. Revenue Journal: This journal records all sources of income for the city, such as taxes, fees, fines, and revenue from services provided. It helps in tracking the various revenue streams and evaluating their impact on the city's financial well-being. 2. Expenditure Journal: This journal contains detailed records of the city's expenses, including payments for personnel salaries, maintenance costs, utilities, supplies, and other day-to-day expenditures. It assists in monitoring and analyzing spending patterns to optimize resource allocation. 3. Payroll Journal: Focusing specifically on employee remuneration, this journal records wages, salaries, taxes, and benefits offered to city employees. It ensures accurate and timely payment while maintaining compliance with legal and regulatory requirements. 4. Grant Journal: As San Diego receives grants from various organizations and government agencies, this journal records the incoming grants, their usage, and compliance-related information. It helps the city track fund utilization and demonstrate accountability. 5. Budget Journal: This journal tracks the city's budget, including revenue estimates, projected expenses, and budget adjustments. It provides a clear picture of financial planning and execution, aiding decision-making processes. 6. Asset and Liability Journal: This journal keeps track of the city's assets, such as property, infrastructure, and equipment, as well as liabilities like outstanding loans, bonds, and contractual obligations. It ensures effective management and accountability of the city's financial resources. By maintaining these different types of journals, the San Diego California General Journal system offers a comprehensive overview of the city's financial activities, allowing for efficient monitoring, analysis, and reporting. Through the use of these journals, the city administration can ensure prudent financial management, public transparency, and effective decision-making for the overall development and well-being of San Diego.

San Diego California General Journal

Description

How to fill out San Diego California General Journal?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the San Diego General Journal, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the San Diego General Journal from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego General Journal:

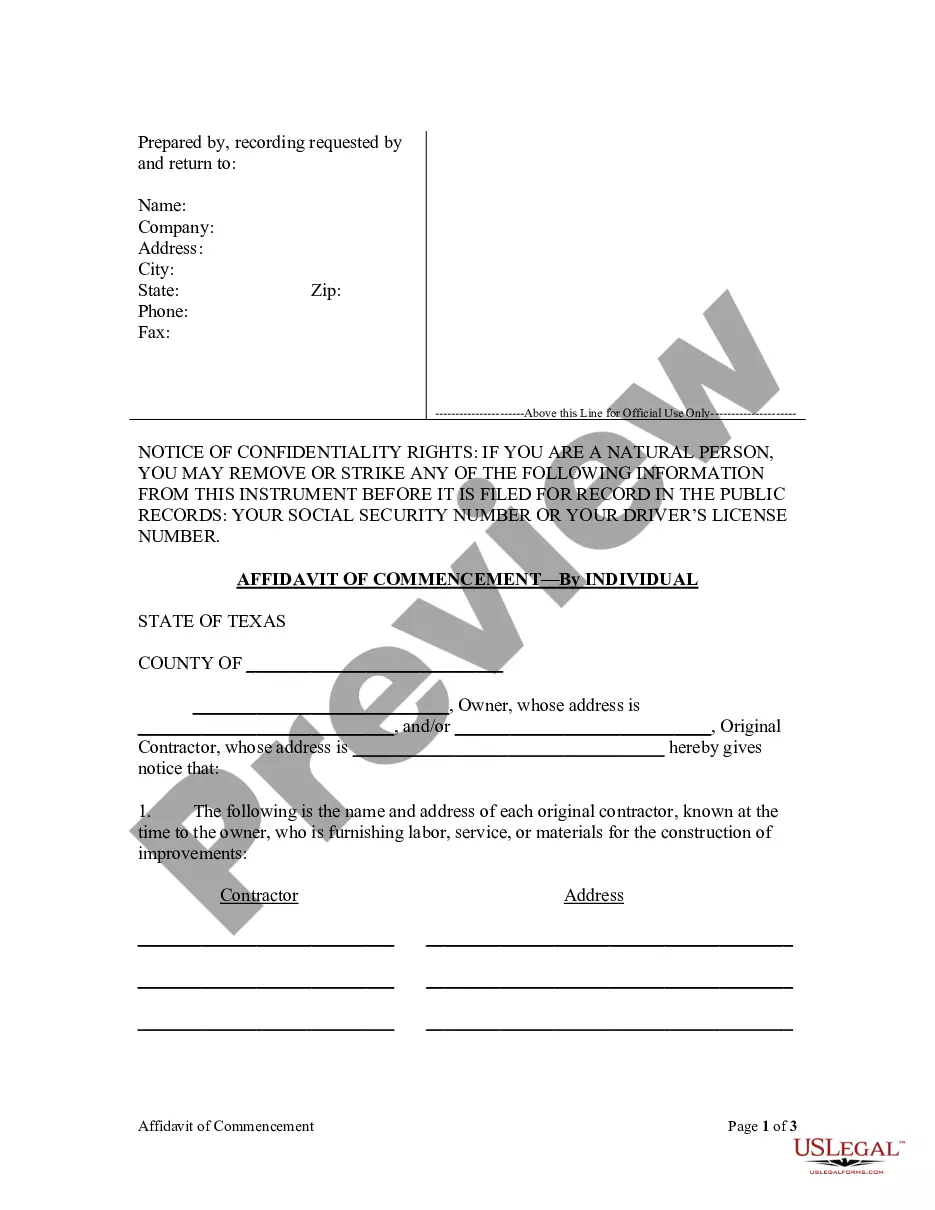

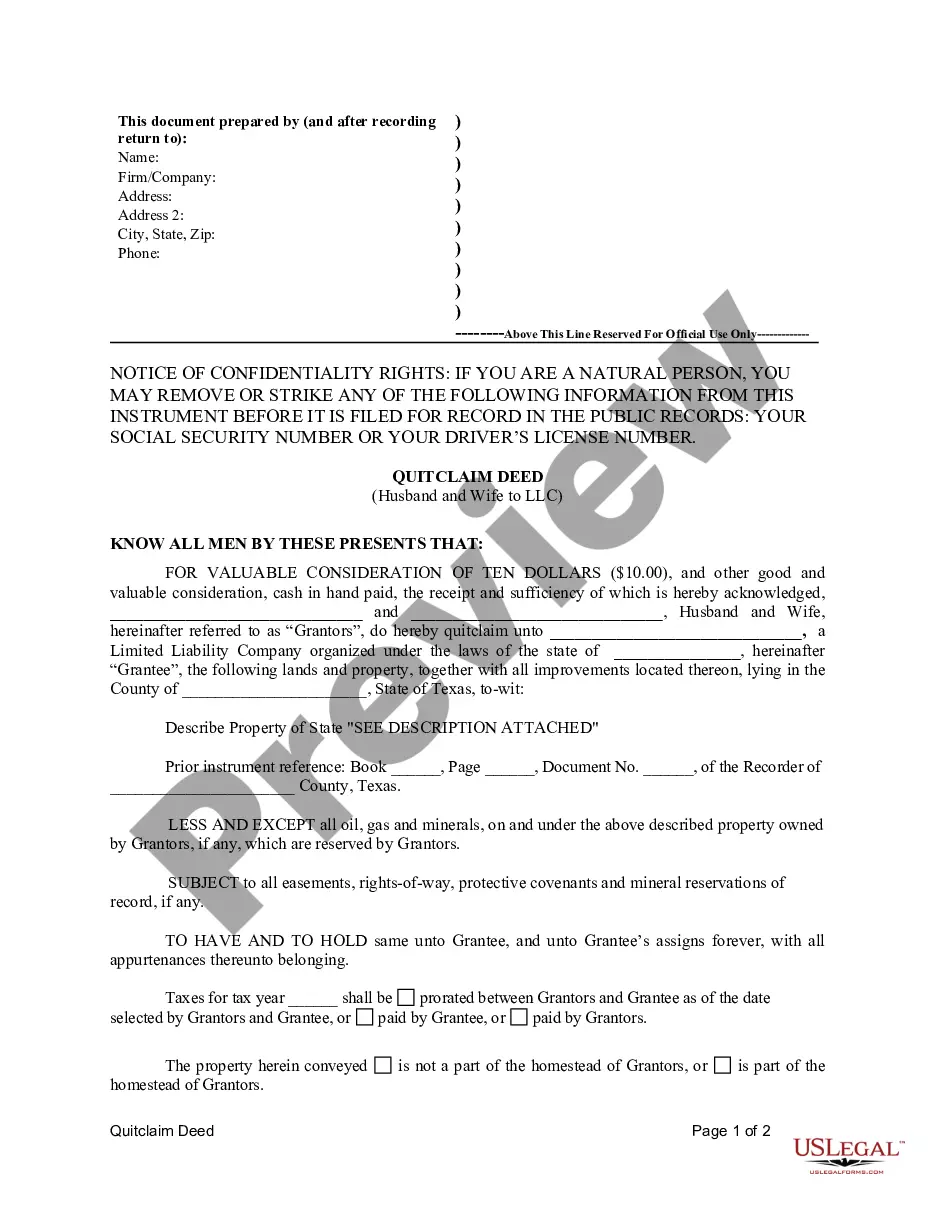

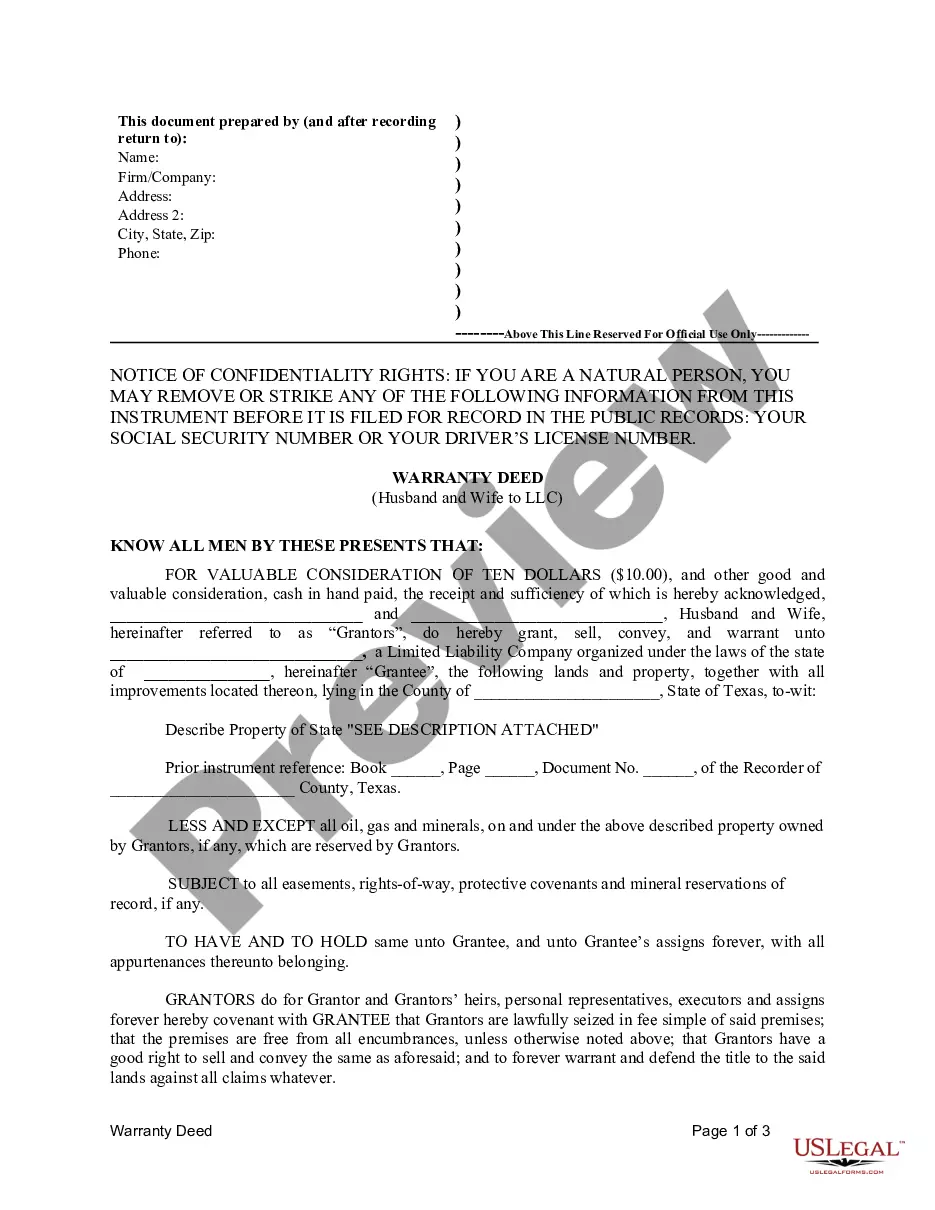

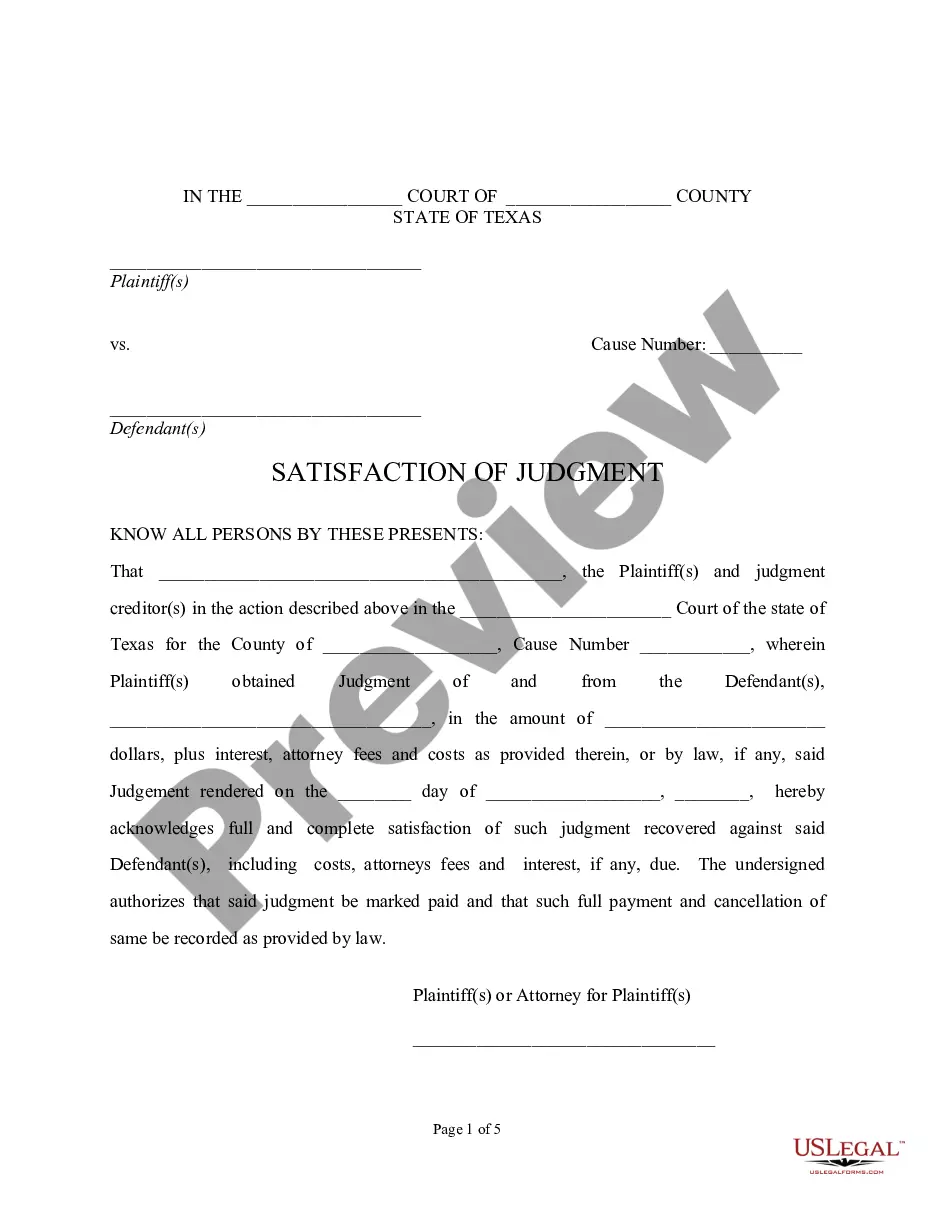

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!