Cuyahoga Ohio Aging of Accounts Receivable is a method used by businesses in Cuyahoga County, Ohio, to monitor and manage their outstanding customer invoices. This process involves categorizing invoices based on their due dates and tracking the time it takes for customers to pay their dues. By implementing this system, businesses can gain insights into their financial health, identify potential cash flow issues, and formulate appropriate collection strategies. The main purpose of Cuyahoga Ohio Aging of Accounts Receivable is to provide a visual representation of the outstanding invoices categorized by the length of time they have been unpaid. This aging analysis is typically divided into different time periods or aging buckets, such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. Each bucket represents the number of days elapsed from the invoice due date and helps identify the aging pattern of outstanding invoices. By utilizing Cuyahoga Ohio Aging of Accounts Receivable, businesses can determine the average number of days it takes for customers to pay their invoices. This insight is vital in assessing payment trends and identifying potential late-paying customers. Additionally, it allows businesses to establish appropriate credit terms for future sales and adjust collection efforts accordingly. There are various types of Cuyahoga Ohio Aging of Accounts Receivable, depending on the specific needs and preferences of a business. Some variations include: 1. Summary Aging Report: This report provides an overview of the total outstanding balance in each aging bucket without disclosing specific customer details. It allows businesses to get a quick snapshot of their overall receivables and assess the overall health of their accounts receivable portfolio. 2. Detailed Aging Report: In contrast to the summary report, the detailed aging report provides a breakdown of outstanding balances by customer. It lists each customer's outstanding invoices, the respective aging bucket they fall into, and the total amount due. This report enables businesses to identify specific customers with overdue balances and prioritize collection efforts accordingly. 3. Aging by Customer Category: Businesses may choose to segment their customer base into different categories, such as VIP customers, regular clients, and new customers. The aging analysis can then be performed separately for each category to evaluate the payment behavior of different customer groups. 4. Aging by Product or Service: In some cases, businesses may want to assess the aging of accounts receivable based on the products or services provided to their customers. By categorizing outstanding balances by product or service, businesses can identify potential issues specific to certain offerings and take necessary actions, such as adjusting pricing or addressing quality concerns. In conclusion, Cuyahoga Ohio Aging of Accounts Receivable is a crucial tool for businesses operating in Cuyahoga County, Ohio, to manage their outstanding customer invoices effectively. Through various types of aging reports, businesses can gain valuable insights into their financial position, identify payment trends, and devise strategies to improve cash flow and overall financial health.

Cuyahoga Ohio Aging of Accounts Receivable

Description

How to fill out Cuyahoga Ohio Aging Of Accounts Receivable?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Cuyahoga Aging of Accounts Receivable is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Cuyahoga Aging of Accounts Receivable. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

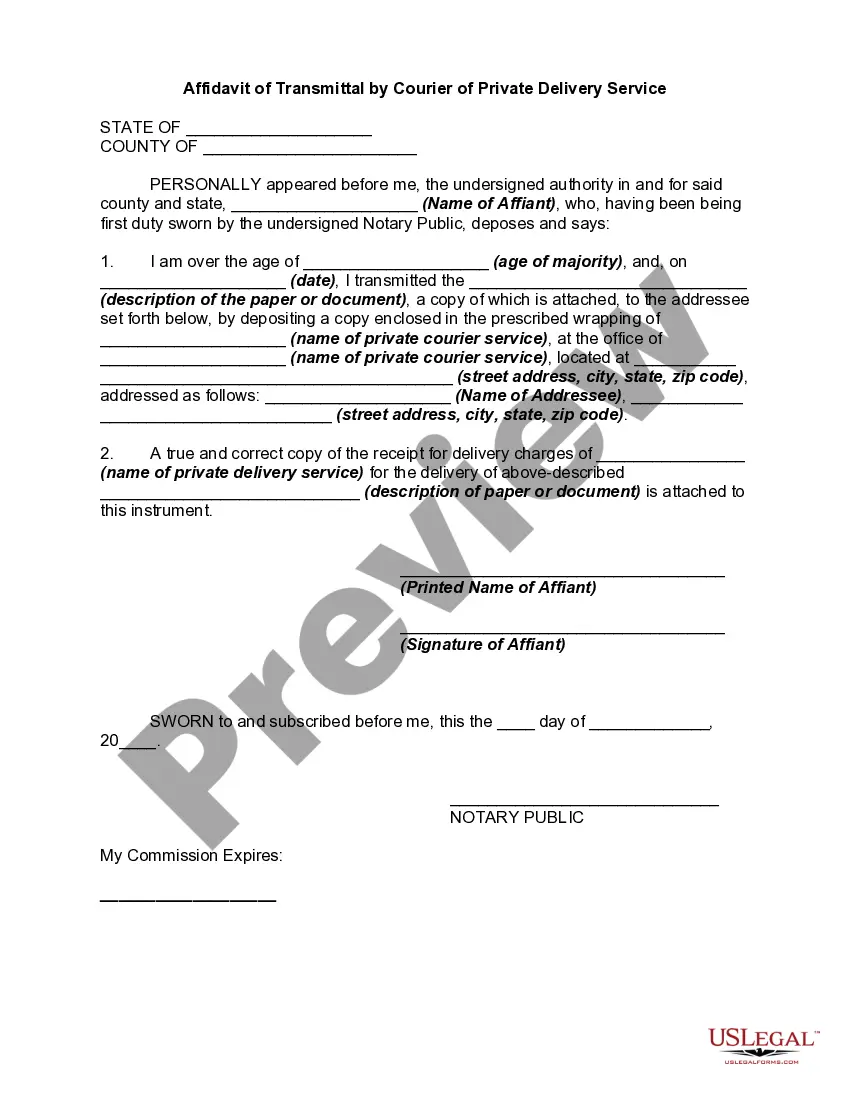

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Aging of Accounts Receivable in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!