Oakland Michigan Aging of Accounts Receivable refers to the process of analyzing and monitoring the outstanding accounts receivable of businesses or organizations located in Oakland, Michigan. It provides insights into the effectiveness of credit and collection policies, as well as the financial health and stability of a company. The aging of accounts receivable helps businesses determine the average time it takes for their customers to pay their invoices, allowing them to identify potential cash flow issues or areas for improvement. It categorizes outstanding invoices based on their due dates, allowing businesses to track payment delinquencies accurately. There are different types of aging of accounts receivable that businesses in Oakland, Michigan can utilize, including: 1. Standard Aging: This method categorizes outstanding invoices into predetermined time frames, such as 30, 60, 90, or 120 days. It gives businesses a clear picture of the number of invoices outstanding in each time frame, highlighting any significant overdue payments or long-standing debts. 2. Weighted-Average Aging: This method assigns weights to outstanding invoices based on their age and calculates the average number of days it takes for customers to pay. It reflects the overall payment behavior of customers, considering both recent and long-standing invoices. 3. Date of Last Activity Aging: This method categorizes outstanding invoices based on the date of the last activity or interaction with customers. It helps identify accounts that require immediate attention or follow-up, ensuring businesses stay proactive in their collections efforts. 4. Customer Category Aging: This method classifies outstanding invoices based on customer categories, such as new customers, returning customers, or VIP customers. It provides insights into the payment patterns of different customer segments, helping businesses tailor their credit and collection strategies accordingly. By utilizing Oakland Michigan Aging of Accounts Receivable, businesses can effectively manage their cash flow, improve collections processes, and establish healthier relationships with their customers. It allows them to identify potential risks, take appropriate actions to minimize bad debts, and make informed decisions to ensure sustainable financial growth.

Oakland Michigan Aging of Accounts Receivable

Description

How to fill out Oakland Michigan Aging Of Accounts Receivable?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Oakland Aging of Accounts Receivable, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the current version of the Oakland Aging of Accounts Receivable, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Oakland Aging of Accounts Receivable:

- Glance through the page and verify there is a sample for your area.

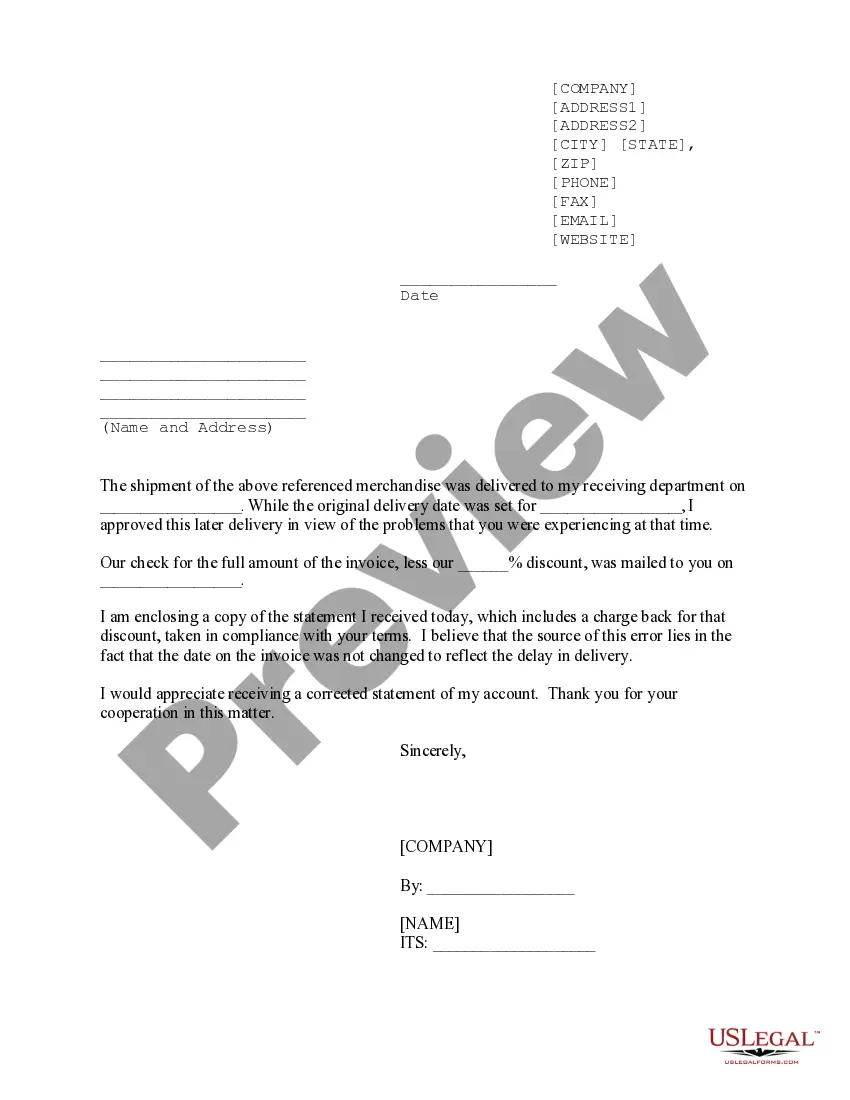

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Oakland Aging of Accounts Receivable and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!