Suffolk New York Aging of Accounts Receivable refers to the process of categorizing and tracking the outstanding invoices and payments owed to a business in Suffolk County, New York. This financial management tool helps businesses analyze and manage their cash flows, identify potential collection issues, and make informed decisions regarding credit control and debt collection. Keywords: Suffolk New York, Aging of Accounts Receivable, invoices, payments, financial management, cash flows, collection issues, credit control, debt collection. Types of Suffolk New York Aging of Accounts Receivable: 1. Standard Aging: This is the most common method of categorizing outstanding invoices based on the number of days they have been overdue. The typical age categories include 0-30 days, 31-60 days, 61-90 days, and 91+ days. 2. Industry-specific Aging: Some businesses in Suffolk County, New York may use industry-specific aging categories based on the average payment cycles in their respective sectors. For example, a construction company may have aging categories such as 0-45 days, 46-90 days, 91-120 days, and 121+ days. 3. Customer-specific Aging: In certain cases, businesses may track accounts receivable aging based on specific customer agreements or contracts. This approach allows businesses to tailor their credit control measures to individual customer payment patterns and adjust collection strategies accordingly. 4. Fine-tuned Aging: Advanced businesses may employ more sophisticated Aging of Accounts Receivable methods. They may consider variables such as customer creditworthiness, historical payment behavior, and the probability of collection when categorizing overdue invoices. From a financial standpoint, Suffolk New York Aging of Accounts Receivable enables businesses to assess their cash flow positions accurately and plan for the collection of overdue payments more effectively. This process assists in identifying potential payment issues at an early stage and taking appropriate measures to minimize bad debt. Implementing Suffolk New York Aging of Accounts Receivable helps businesses to streamline their debt collection efforts, maintain healthy cash flows, establish efficient credit control procedures, and ultimately improve their overall financial stability and sustainability.

Suffolk New York Aging of Accounts Receivable

Description

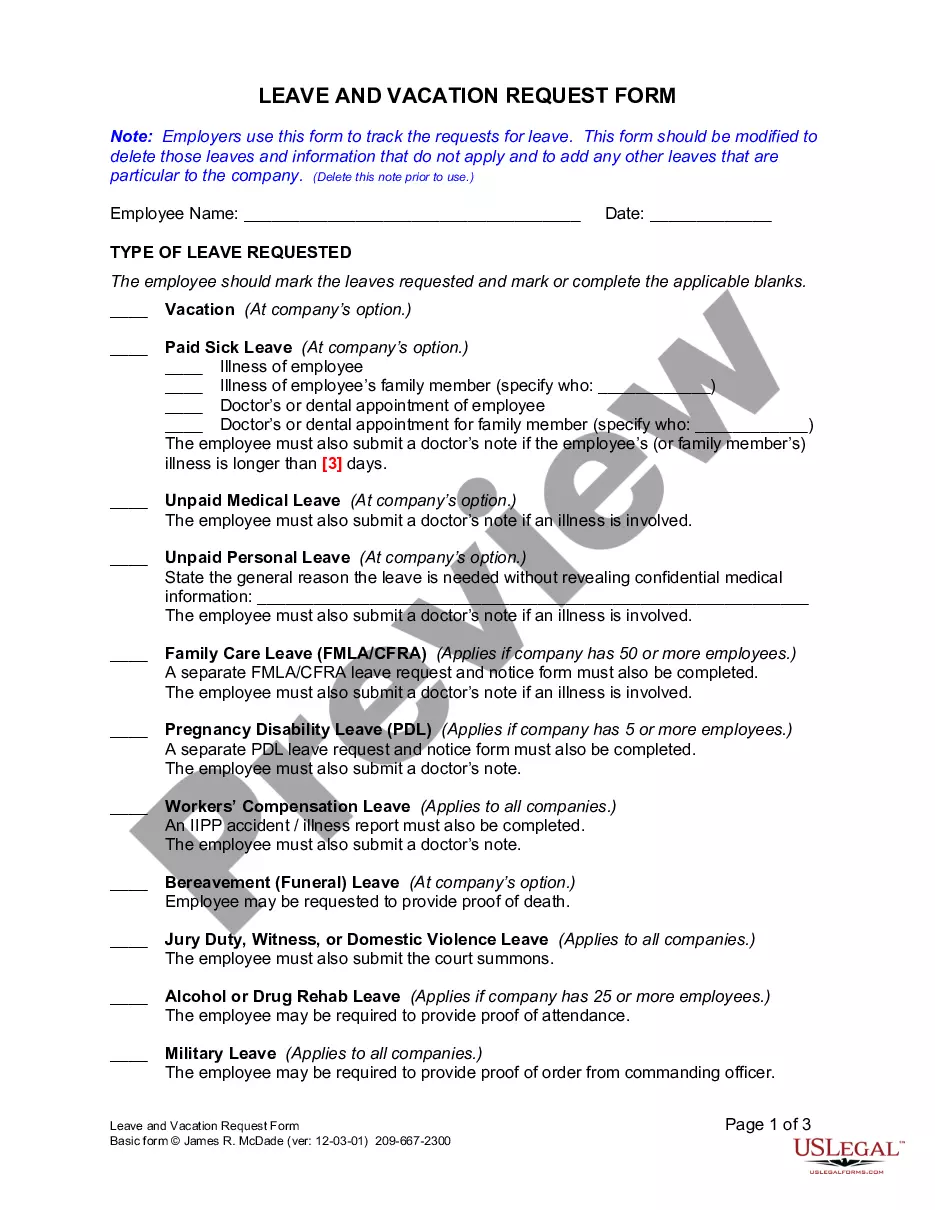

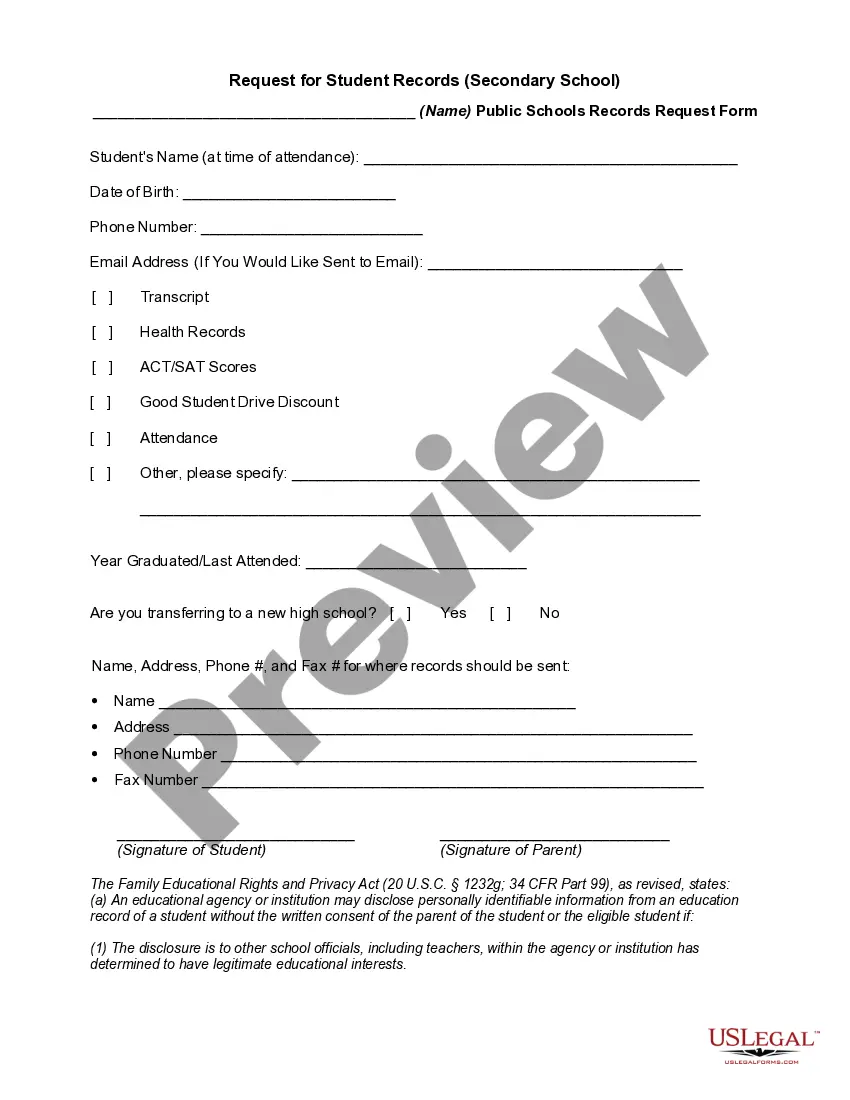

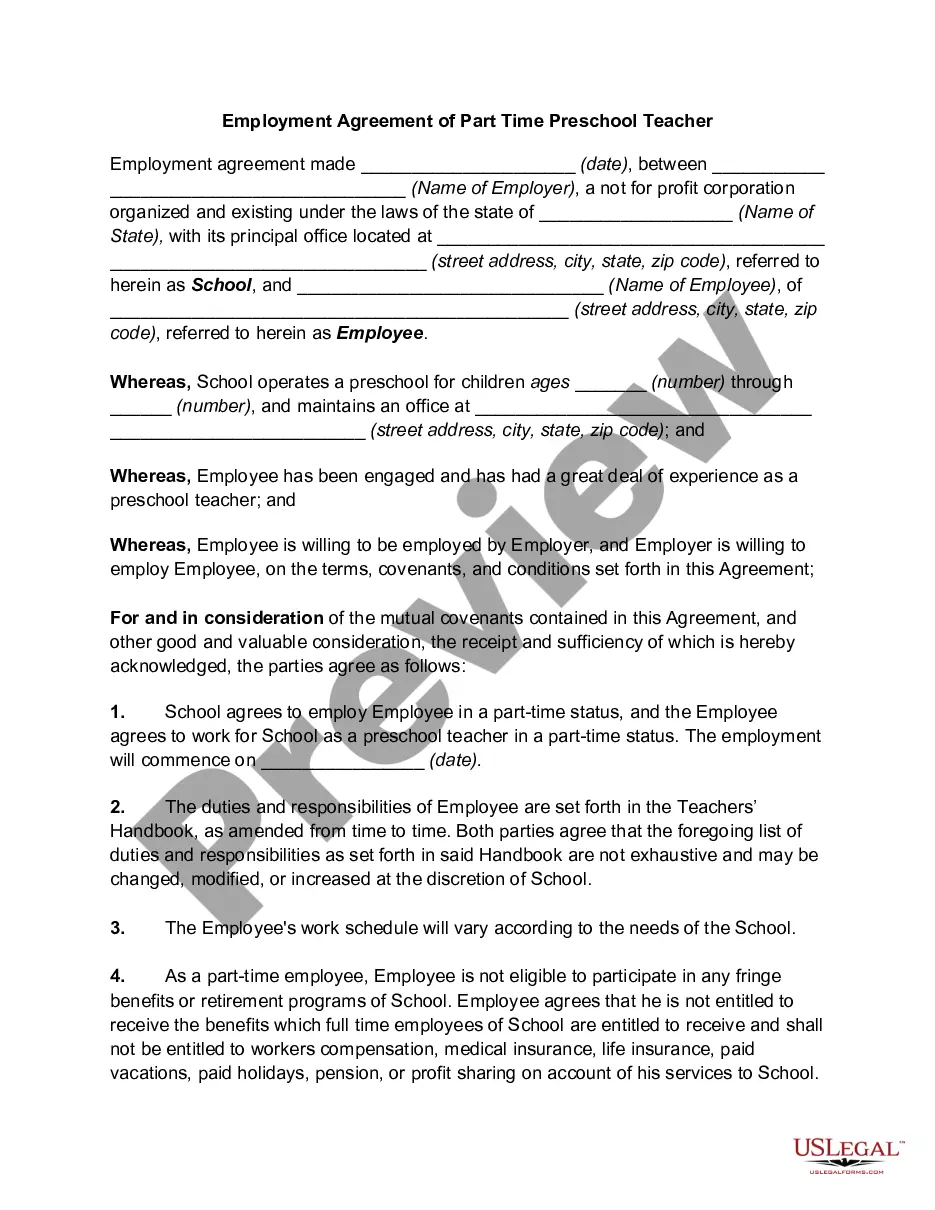

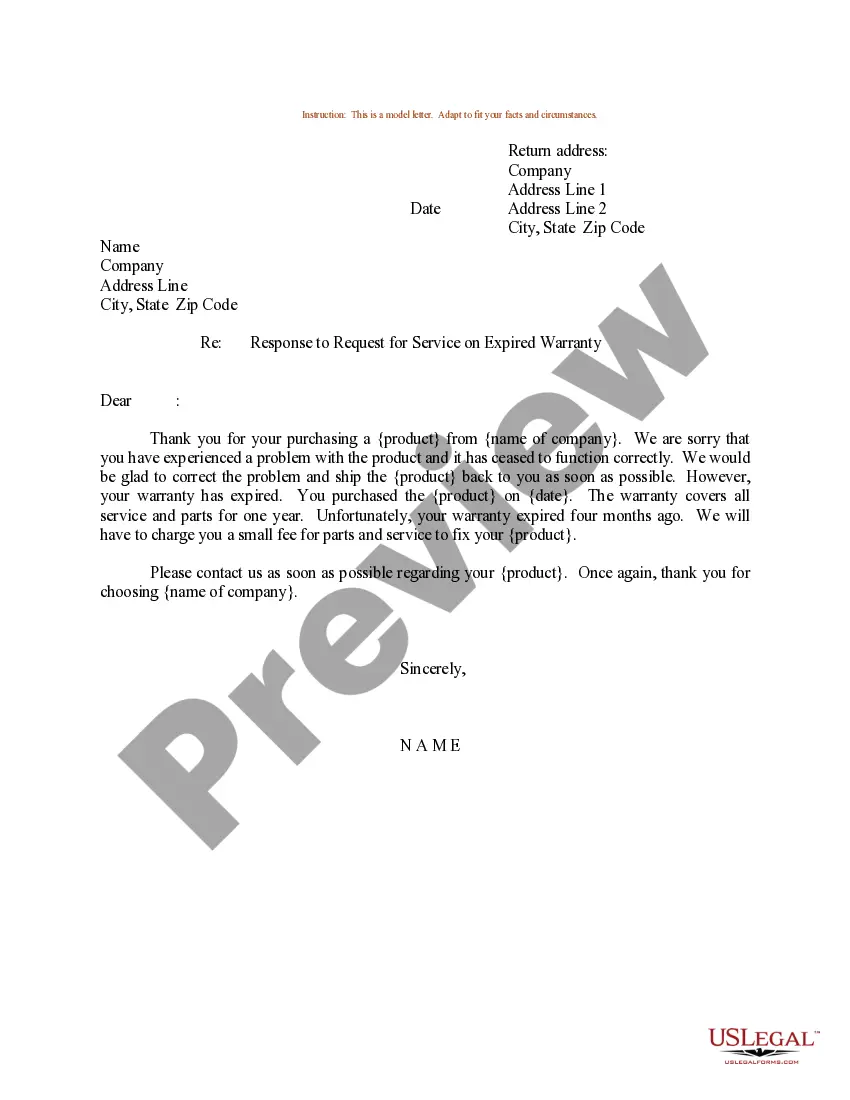

How to fill out Suffolk New York Aging Of Accounts Receivable?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Suffolk Aging of Accounts Receivable, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the recent version of the Suffolk Aging of Accounts Receivable, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Aging of Accounts Receivable:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Suffolk Aging of Accounts Receivable and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!