Miami-Dade Florida Auto Expense Travel Report is a comprehensive document that outlines all the expenses incurred during a business or official travel within Miami-Dade County, Florida. This report is crucial for maintaining accurate records and seeking reimbursement for the incurred travel costs. It provides a detailed breakdown of various expenses associated with transportation within the county, giving organizations a clear overview of their travel-related expenditures. The primary purpose of the Miami-Dade Florida Auto Expense Travel Report is to provide a systematic record of all auto-related expenses, particularly those incurred during official travel. This report includes various types of travel expenses, such as fuel costs, toll charges, parking fees, and maintenance expenses for the vehicle used during the travel period. Keywords: Miami-Dade Florida, auto expense, travel report, transportation, reimbursement, expenses, official travel, records, fuel costs, toll charges, parking fees, maintenance expenses. There can be different types of Miami-Dade Florida Auto Expense Travel Reports, based on the specific aspects organizations wish to emphasize or the format they prefer. Some of these variations include: 1. Basic Auto Expense Travel Report: This type of report covers the essential auto-related expenses incurred during travel within Miami-Dade County. It provides a summary of costs without going into much detail. 2. Detailed Auto Expense Travel Report: This report offers a comprehensive breakdown of all auto-related expenses, including individual receipts for fuel purchases, toll charges, parking fees, and maintenance costs. It provides a more accurate representation of the total expenses incurred. 3. Mileage-based Auto Expense Travel Report: This type of report focuses on recording the distance traveled during the official travel. It calculates the mileage and applies a standard reimbursement rate per mile to determine the total expense. 4. Time-based Auto Expense Travel Report: Instead of focusing on mileage, this report tracks the duration of travel. It considers the time spent on the road and applies an hourly rate to calculate the auto-related expenses. 5. Per Diem Auto Expense Travel Report: This report is based on a fixed per diem rate for transportation expenses. It provides a consistent reimbursement amount without considering the actual expenses incurred. By using these various types of Miami-Dade Florida Auto Expense Travel Reports, organizations can choose the format that suits their requirements and present a detailed breakdown or summary of auto-related expenses during official travel.

Miami-Dade Florida Auto Expense Travel Report

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02876BG

Format:

Word;

Rich Text

Instant download

Description

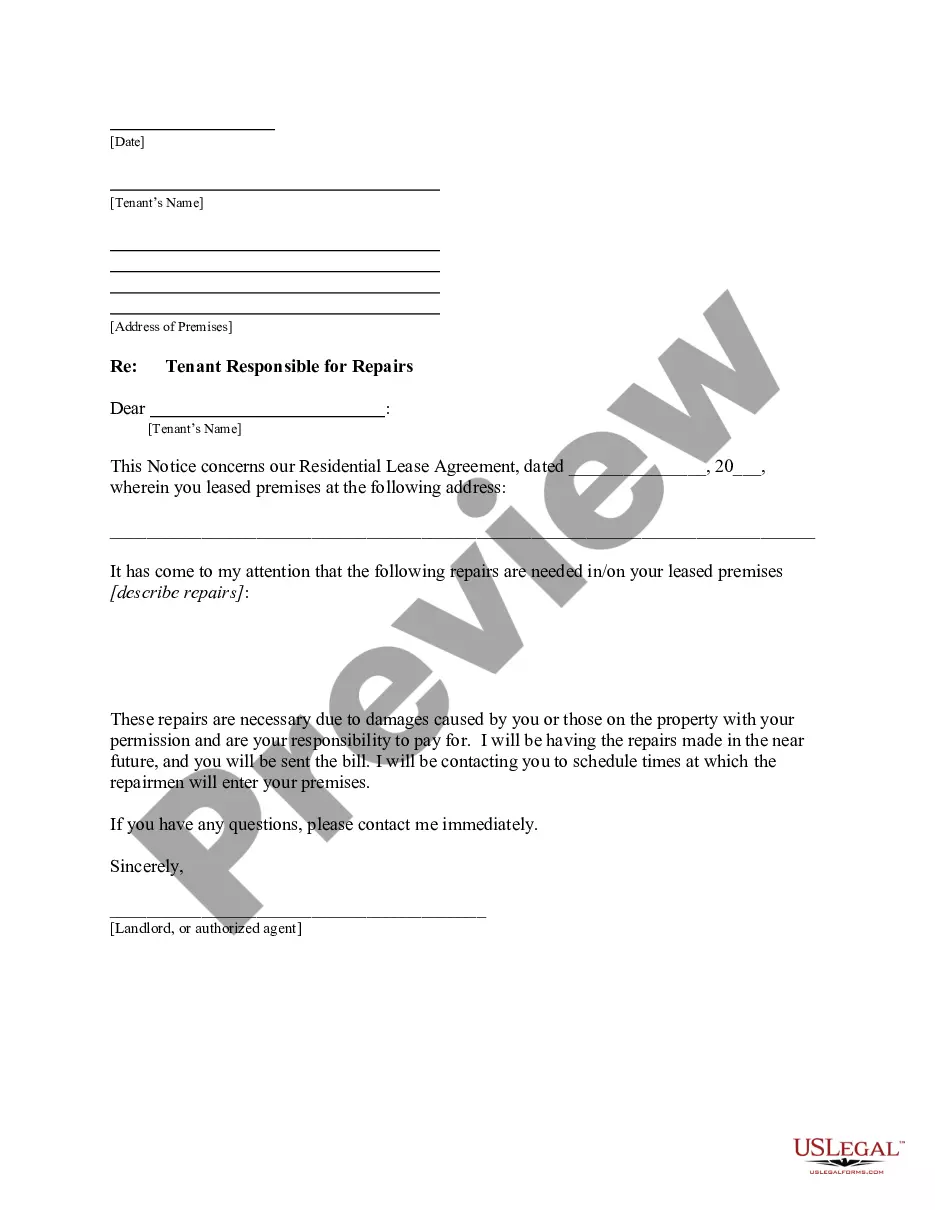

This expense report may be used to record an employee's automobile travel mileage and reimbursement expenses.

Miami-Dade Florida Auto Expense Travel Report is a comprehensive document that outlines all the expenses incurred during a business or official travel within Miami-Dade County, Florida. This report is crucial for maintaining accurate records and seeking reimbursement for the incurred travel costs. It provides a detailed breakdown of various expenses associated with transportation within the county, giving organizations a clear overview of their travel-related expenditures. The primary purpose of the Miami-Dade Florida Auto Expense Travel Report is to provide a systematic record of all auto-related expenses, particularly those incurred during official travel. This report includes various types of travel expenses, such as fuel costs, toll charges, parking fees, and maintenance expenses for the vehicle used during the travel period. Keywords: Miami-Dade Florida, auto expense, travel report, transportation, reimbursement, expenses, official travel, records, fuel costs, toll charges, parking fees, maintenance expenses. There can be different types of Miami-Dade Florida Auto Expense Travel Reports, based on the specific aspects organizations wish to emphasize or the format they prefer. Some of these variations include: 1. Basic Auto Expense Travel Report: This type of report covers the essential auto-related expenses incurred during travel within Miami-Dade County. It provides a summary of costs without going into much detail. 2. Detailed Auto Expense Travel Report: This report offers a comprehensive breakdown of all auto-related expenses, including individual receipts for fuel purchases, toll charges, parking fees, and maintenance costs. It provides a more accurate representation of the total expenses incurred. 3. Mileage-based Auto Expense Travel Report: This type of report focuses on recording the distance traveled during the official travel. It calculates the mileage and applies a standard reimbursement rate per mile to determine the total expense. 4. Time-based Auto Expense Travel Report: Instead of focusing on mileage, this report tracks the duration of travel. It considers the time spent on the road and applies an hourly rate to calculate the auto-related expenses. 5. Per Diem Auto Expense Travel Report: This report is based on a fixed per diem rate for transportation expenses. It provides a consistent reimbursement amount without considering the actual expenses incurred. By using these various types of Miami-Dade Florida Auto Expense Travel Reports, organizations can choose the format that suits their requirements and present a detailed breakdown or summary of auto-related expenses during official travel.

Free preview