The Franklin Ohio Cash Disbursements Journal is a financial record used by businesses in Franklin, Ohio to track and document all outgoing cash transactions. It serves as a vital tool for the accounting department to maintain accurate and organized records of all payments made by the company. Keywords: Franklin Ohio, cash disbursements journal, financial record, outgoing cash transactions, accounting department, accurate records, payments In Franklin, Ohio, the Cash Disbursements Journal is typically used by businesses to record all cash payments made for various expenses such as vendor bills, employee wages, rent, utilities, office supplies, and other disbursements. This journal plays a crucial role in monitoring the company's cash flow and ensuring that all expenditures are properly accounted for. The Franklin Ohio Cash Disbursements Journal captures essential information for each transaction, including the date of payment, payee name, check number, payment description, and the amount disbursed. This comprehensive documentation eliminates any confusion or discrepancies that may arise regarding payment details in the future. Moreover, the Cash Disbursements Journal in Franklin, Ohio assists in maintaining accurate financial statements by providing a clear and itemized record of all cash outflows. This includes both cash payments made via checks and any other forms of cash disbursements such as credit card payments, electronic fund transfers, or petty cash transactions. Different types of Cash Disbursements Journals may exist for various industries or businesses in Franklin, Ohio. For example, a retail store may have a separate journal to record cash disbursements related to inventory purchases, sales commissions, or shipping expenses. Similarly, a manufacturing company might maintain a distinct journal to track disbursements for raw material procurement, equipment maintenance, or employee benefits. Overall, the Franklin Ohio Cash Disbursements Journal serves as a vital record-keeping tool for businesses in Franklin, Ohio, enabling them to maintain accurate and transparent financial records while ensuring effective cash management. By diligently recording all outgoing cash transactions, businesses can effectively monitor their expenses, identify potential areas of improvement, and make informed financial decisions.

Franklin Ohio Cash Disbursements Journal

Description

How to fill out Franklin Ohio Cash Disbursements Journal?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Cash Disbursements Journal, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the current version of the Franklin Cash Disbursements Journal, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Franklin Cash Disbursements Journal:

- Look through the page and verify there is a sample for your area.

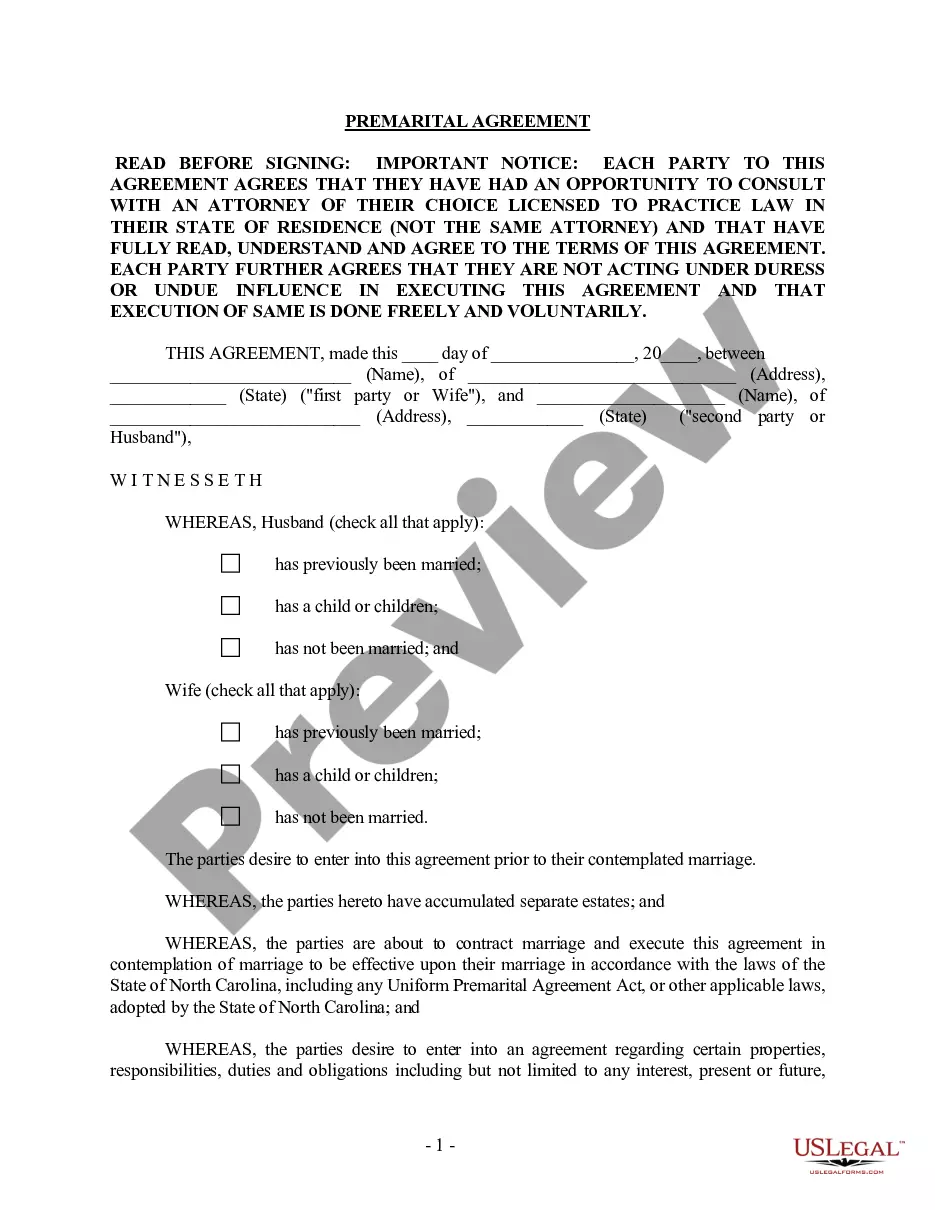

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Franklin Cash Disbursements Journal and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!