Contra Costa California Aging of Accounts Payable refers to the process of tracking and monitoring outstanding payments owed by a company in Contra Costa County, California. It measures the time it takes for invoices to be paid by the company's customers or clients and categorizes them based on their respective due dates. By examining the aging of accounts payable, businesses can gain insights into their cash flow management, identify potential issues in their payment collection, and prioritize payments accordingly. There are primarily two types of Contra Costa California Aging of Accounts Payable commonly used: 1. Time-Based Aging: This method categorizes payables based on the number of days they are overdue. Typically, invoices are divided into buckets such as 0-30 days, 30-60 days, 60-90 days, and 90+ days. Analyzing the aging of accounts payable through time-based aging provides a clear picture of the company's outstanding payments and helps identify potential risks of bad debts or delayed payments. 2. Vendor-Based Aging: In this approach, payables are categorized based on individual vendors or suppliers. This allows businesses to evaluate the payment behavior of each vendor separately. By tracking the aging of accounts payable vendor-wise, companies can identify suppliers who consistently delay payments or those with a high percentage of overdue invoices. It helps in effectively managing vendor relationships and negotiating favorable payment terms to maintain a smooth accounts payable process. The Contra Costa California Aging of Accounts Payable is a crucial financial management tool that helps businesses in addressing cash flow issues, managing working capital, and maintaining healthy relationships with both customers and vendors. By monitoring and analyzing the aging of accounts payable, companies can take proactive measures to ensure timely payments, optimize cash flow, and maintain financial stability.

Contra Costa California Aging of Accounts Payable

Description

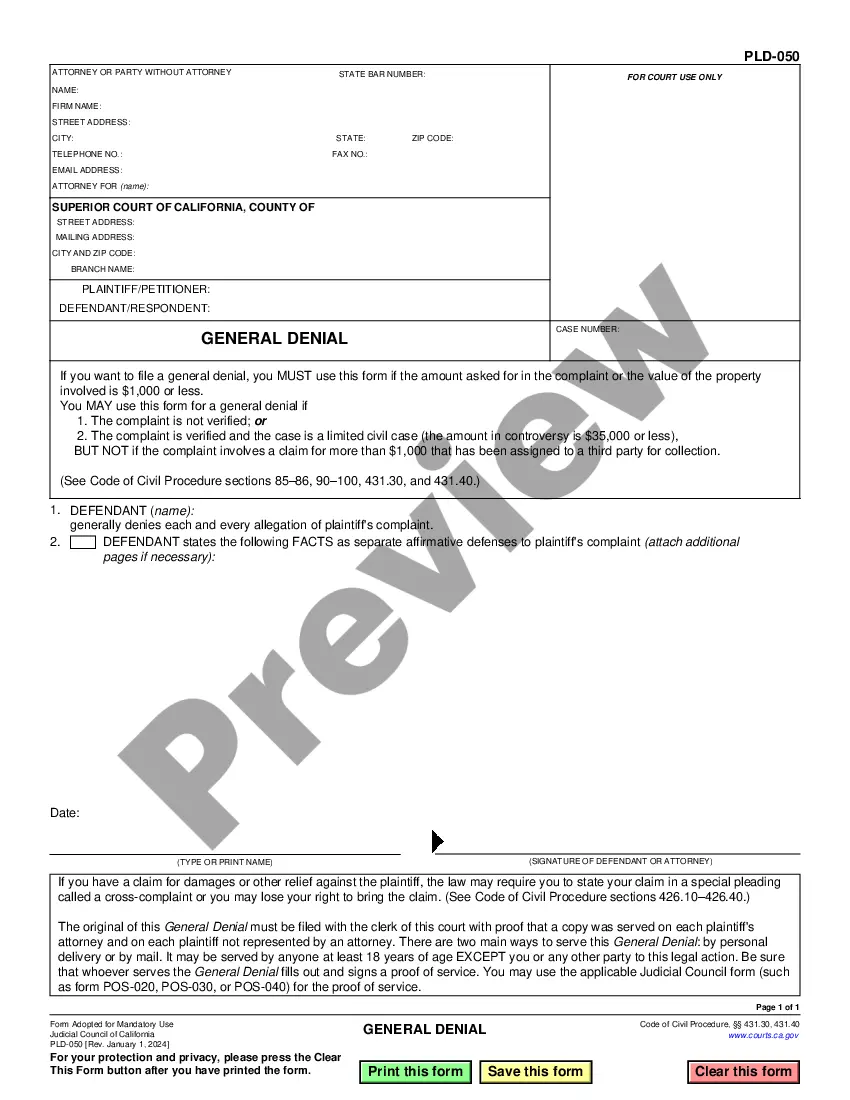

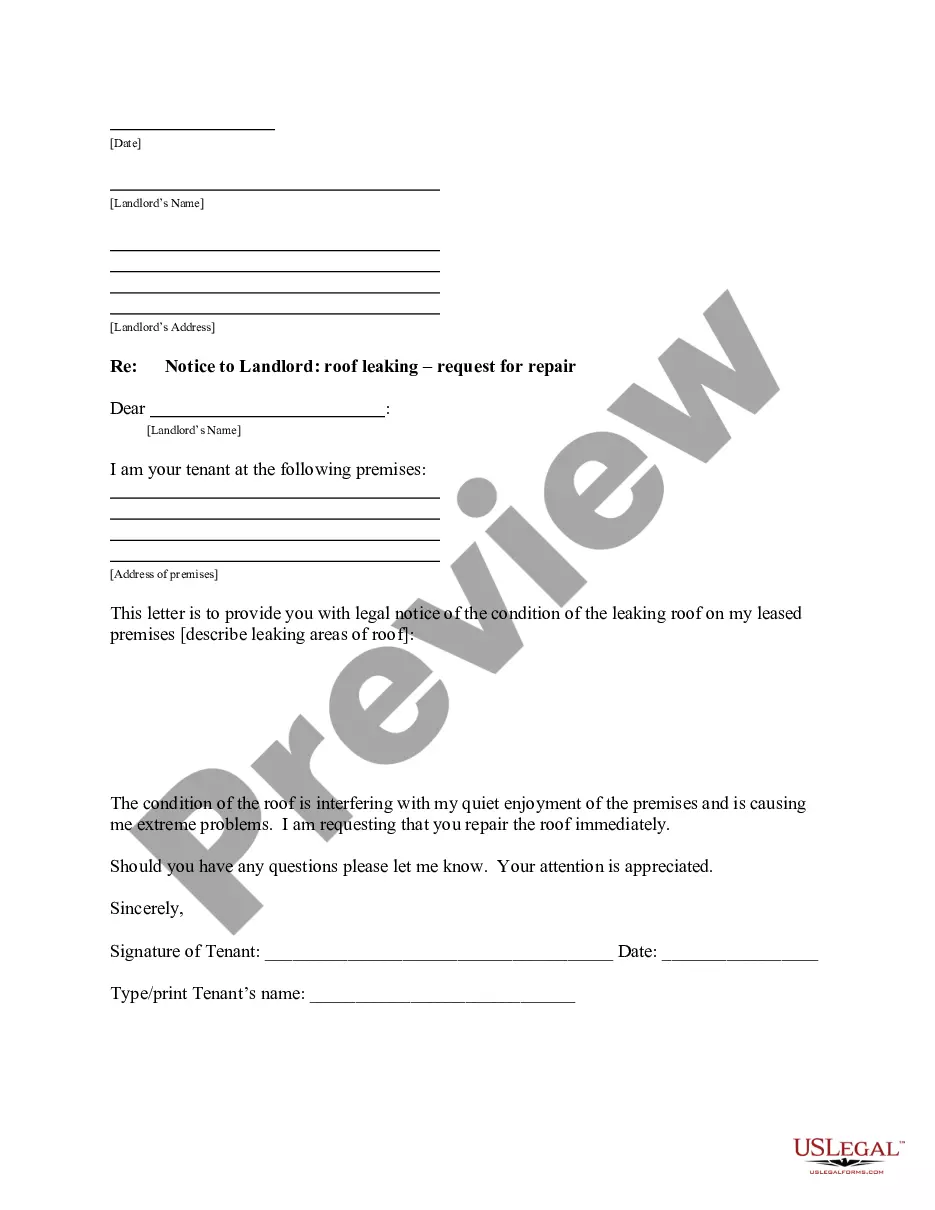

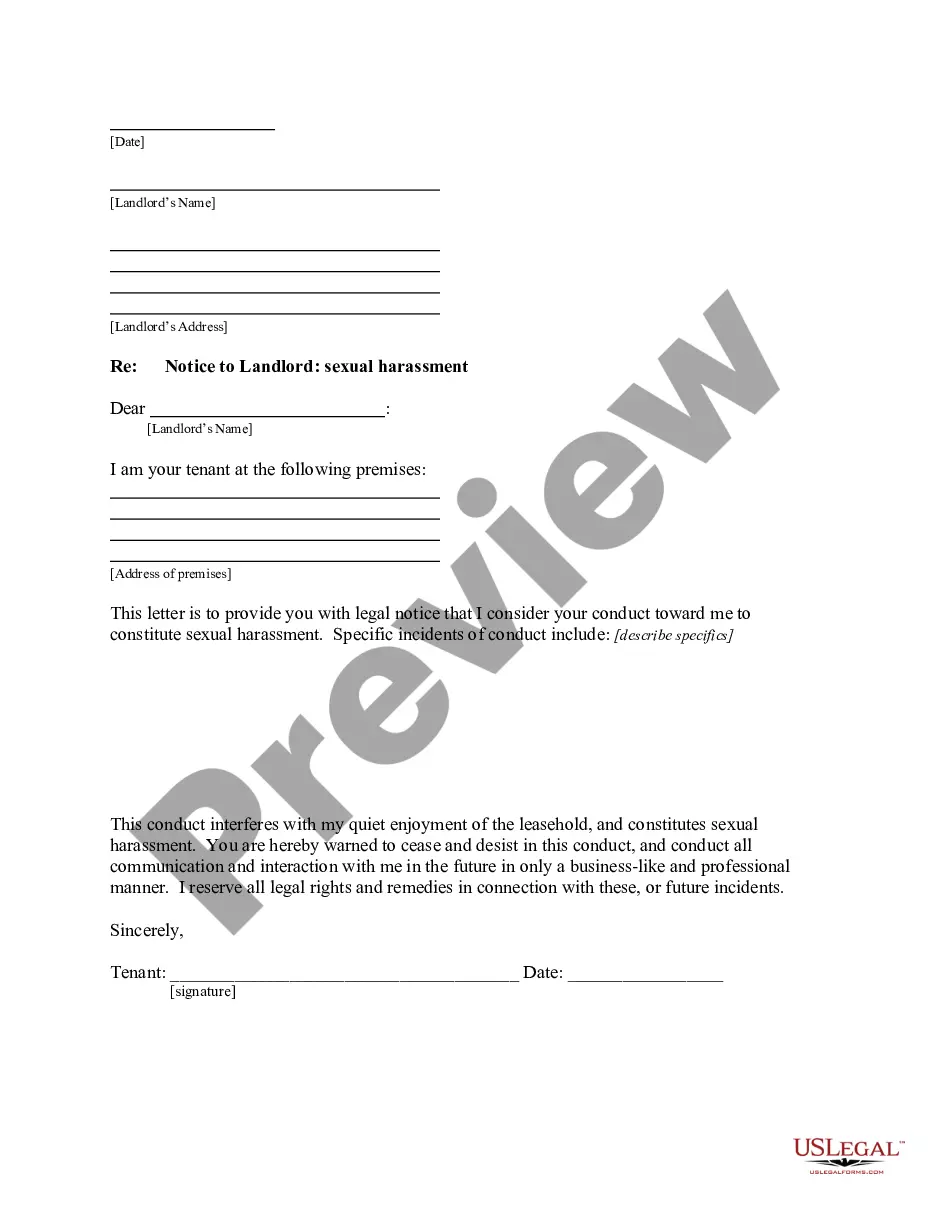

How to fill out Contra Costa California Aging Of Accounts Payable?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Contra Costa Aging of Accounts Payable suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Contra Costa Aging of Accounts Payable, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Contra Costa Aging of Accounts Payable:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Contra Costa Aging of Accounts Payable.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

How to create an accounts receivable aging report Step 1: Review open invoices. Step 2: Categorize open invoices according to the aging schedule. Step 3: List the names of customers whose accounts are past due. Step 4: Organize customers based on the number of days outstanding and the total amount due.

An aged accounts payable report, sometimes called an accounts payable aging report, outlines how many payments you have that are coming due. An ideal report shows you the due dates of numerous invoices.

An aged accounts payable report allows your business to identify deficiencies or inefficiencies in your invoicing or collections system. The report can give you ideas for potential improvement regarding cash flow and dealing with delinquent customers.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

The accounts payable aging report shows all current unpaid invoices. Balances are typically dated in 30-day increments. So you will show each vendor with its current balance owed separated out to the amount that is current, 30 days past due, 60 days past due, and 90 days past due.

To prepare an accounts receivable aging report, you need to have the customer's name, outstanding balance amount, and aging schedules.

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

AP Aging Reports Go to Reports on the top menu. Choose Vendors and Payables. Select A/P Aging Detail. Tick the Customize Report tab. In the Dates field choose Custom. Enter the date for April in the From and To field. Tap OK.

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.