Montgomery County, Maryland is a suburban area located just outside of Washington, D.C. It is known for its diverse community, vibrant economy, and excellent quality of life. In the world of finance and accounting, the term "Aging of Accounts Payable" refers to the method used to track and manage outstanding payments owed by a company to its vendors or suppliers. The aging of accounts payable process in Montgomery Maryland involves categorizing unpaid invoices based on the length of time they have been outstanding. This categorization helps businesses assess their cash flow and make informed decisions about payment priorities. By breaking down the accounts payable into different age brackets, companies gain a better understanding of their financial obligations and can take action accordingly. In Montgomery Maryland, there are two common types of aging of accounts payable used by businesses: 1. Standard Aging of Accounts Payable: This method organizes unpaid invoices based on predefined time brackets, usually 30, 60, 90, and 120+ days past due. Each invoice is assigned to the relevant bracket based on the date it was originally due. This aging report enables businesses in Montgomery Maryland to identify which invoices are becoming delinquent and need immediate attention. 2. Weighted Aging of Accounts Payable: Some companies in Montgomery Maryland may employ a weighted aging approach to prioritize outstanding invoices based on their dollar value. In this method, instead of treating all outstanding invoices equally, the report places more weight on larger amounts. This allows businesses to address higher-value invoices that may have a more significant impact on cash flow. Effective management of aging accounts payable is crucial for businesses in Montgomery Maryland. It ensures timely payments to vendors, strengthens relationships, avoids late payment penalties, and maintains a positive credit standing. By continuously monitoring the aging of accounts payable, businesses can proactively address potential financial challenges and maintain a healthy financial ecosystem. Keywords: Montgomery Maryland, Aging of Accounts Payable, finance, accounting, unpaid invoices, vendors, suppliers, outstanding payments, cash flow, financial obligations, delinquent invoices, standard aging, weighted aging, payment priorities, cash flow management, credit standing.

Montgomery Maryland Aging of Accounts Payable

Description

How to fill out Montgomery Maryland Aging Of Accounts Payable?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Montgomery Aging of Accounts Payable is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Montgomery Aging of Accounts Payable. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

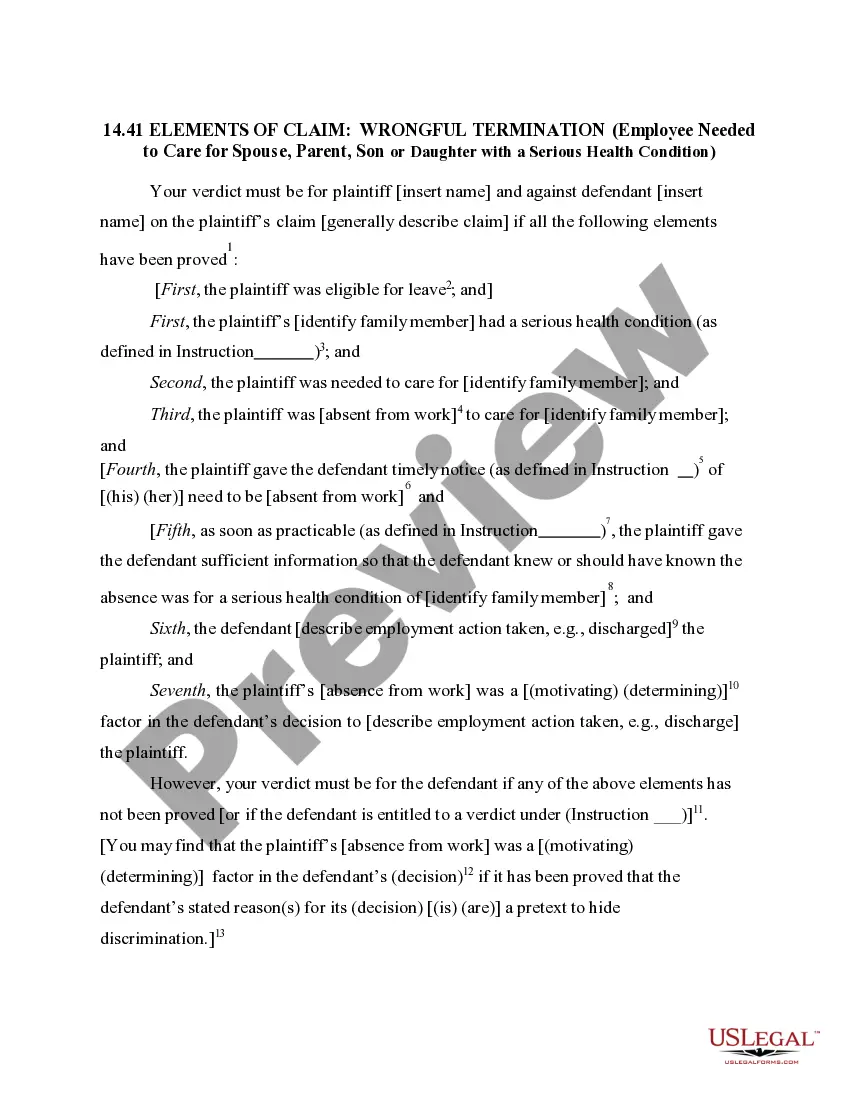

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Aging of Accounts Payable in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!