The Clark Nevada Cash Receipts Control Log is a comprehensive tool that aids businesses in effectively monitoring and managing their cash inflows. This control log document acts as a central repository for recording, tracking, and verifying all cash receipts received by an organization. It plays a crucial role in maintaining the accuracy and integrity of financial transactions, ensuring transparency and accountability within the company's cash handling procedures. The primary purpose of the Clark Nevada Cash Receipts Control Log is to provide a detailed overview of all incoming cash transactions. Each entry typically includes essential information such as the date and time of receipt, the source or payer of the funds, the amount received, and a brief description of the purpose of the payment. This log serves as a primary reference point for reconciliations and audits, helping businesses identify discrepancies or inconsistencies and enabling timely corrective actions. By implementing the Clark Nevada Cash Receipts Control Log, organizations establish an efficient process for recording various forms of cash receipts. This may include payments received in cash, checks, money orders, credit card transactions, or any other legal tender. An important aspect of this control log is the requirement for multiple individuals to participate in the cash handling process, ensuring segregation of duties and minimizing the risk of fraud or misappropriation. Additionally, the Clark Nevada Cash Receipts Control Log should also categorize different types of cash receipts to enhance tracking and analysis. Some common categories might involve sales revenue, customer payments, rental income, service fees, donations, or any other relevant classification applicable to the specific business. Maintaining a well-organized Cash Receipts Control Log is crucial to the financial operations of any organization. It promotes effective cash management by serving as a reference for accurate financial reporting, facilitates timely and accurate cash reconciliations, assists in identifying any irregularities or suspicious activities, and helps businesses comply with regulatory requirements. To summarize, the Clark Nevada Cash Receipts Control Log is a comprehensive and efficient tool that enables businesses to record, monitor, and manage their cash inflows effectively. It ensures financial accuracy, transparency, and accountability while reducing the risk of errors or fraudulent activities. By categorizing different types of cash receipts, this control log provides a clear overview of a company's cash flow, simplifying financial reporting and analysis.

Clark Nevada Cash Receipts Control Log

Description

How to fill out Clark Nevada Cash Receipts Control Log?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Clark Cash Receipts Control Log suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Clark Cash Receipts Control Log, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Clark Cash Receipts Control Log:

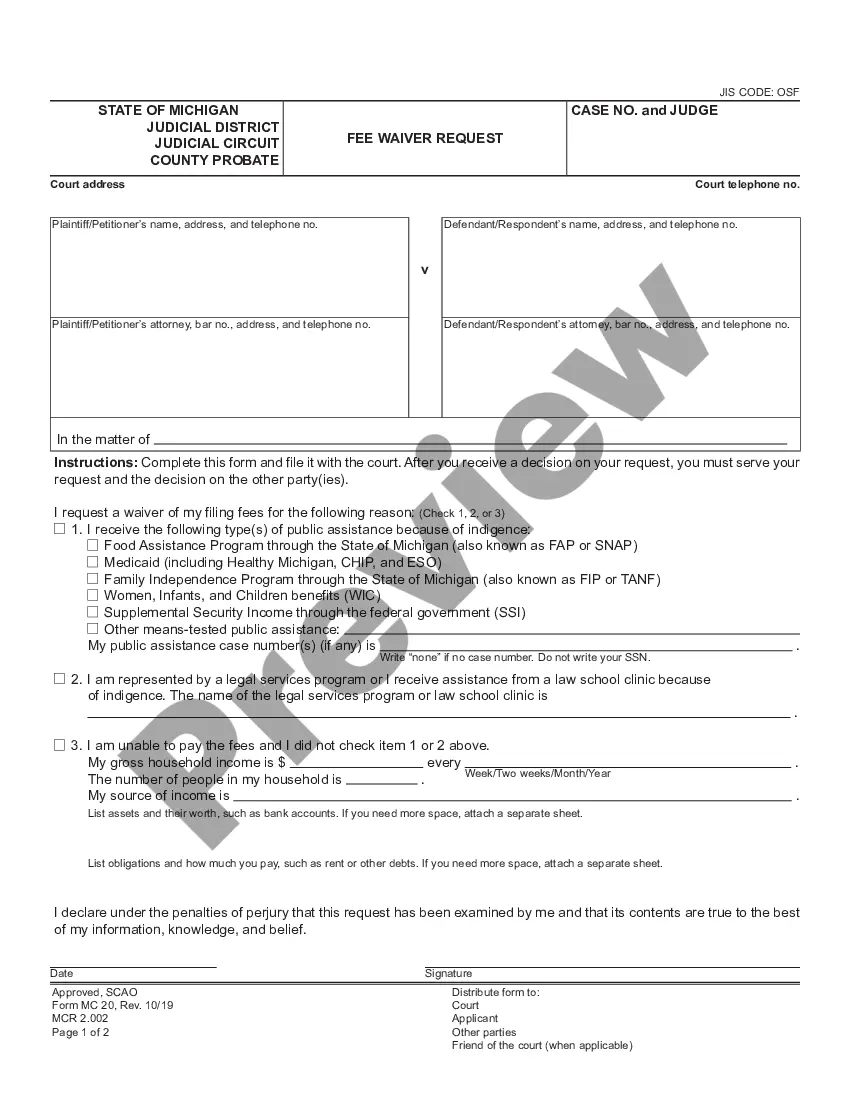

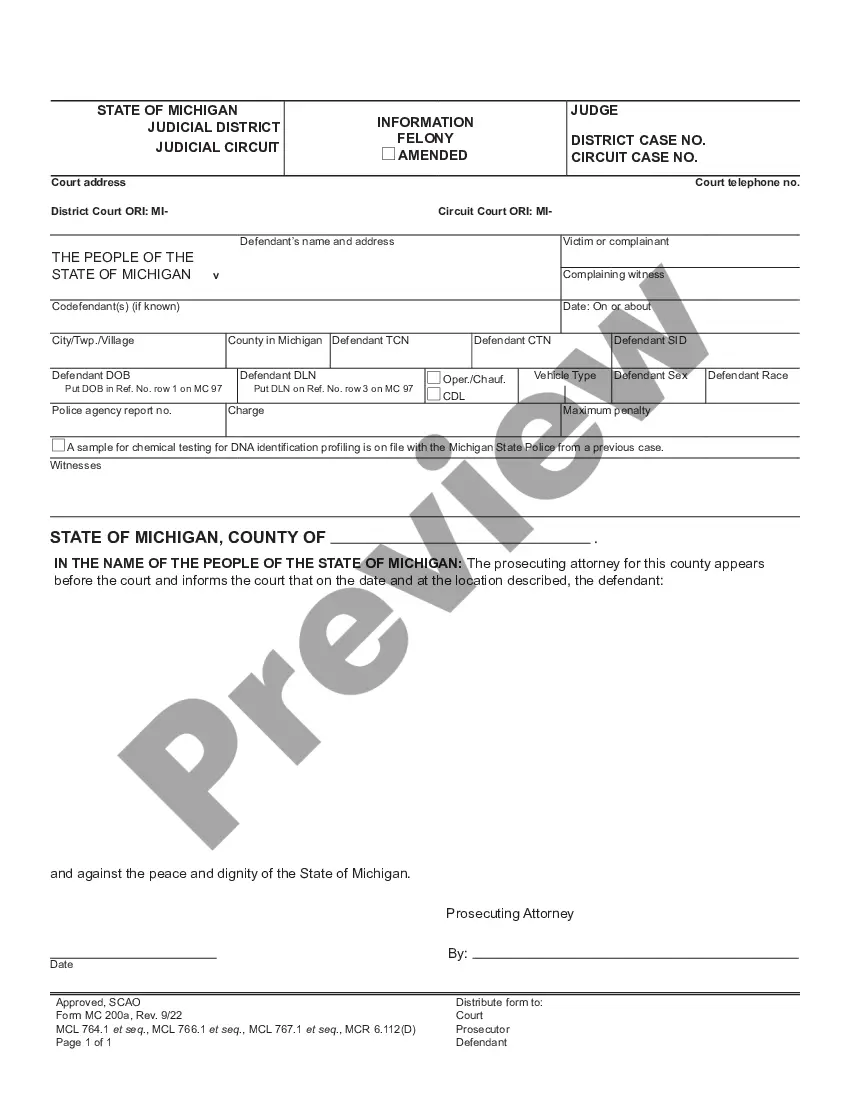

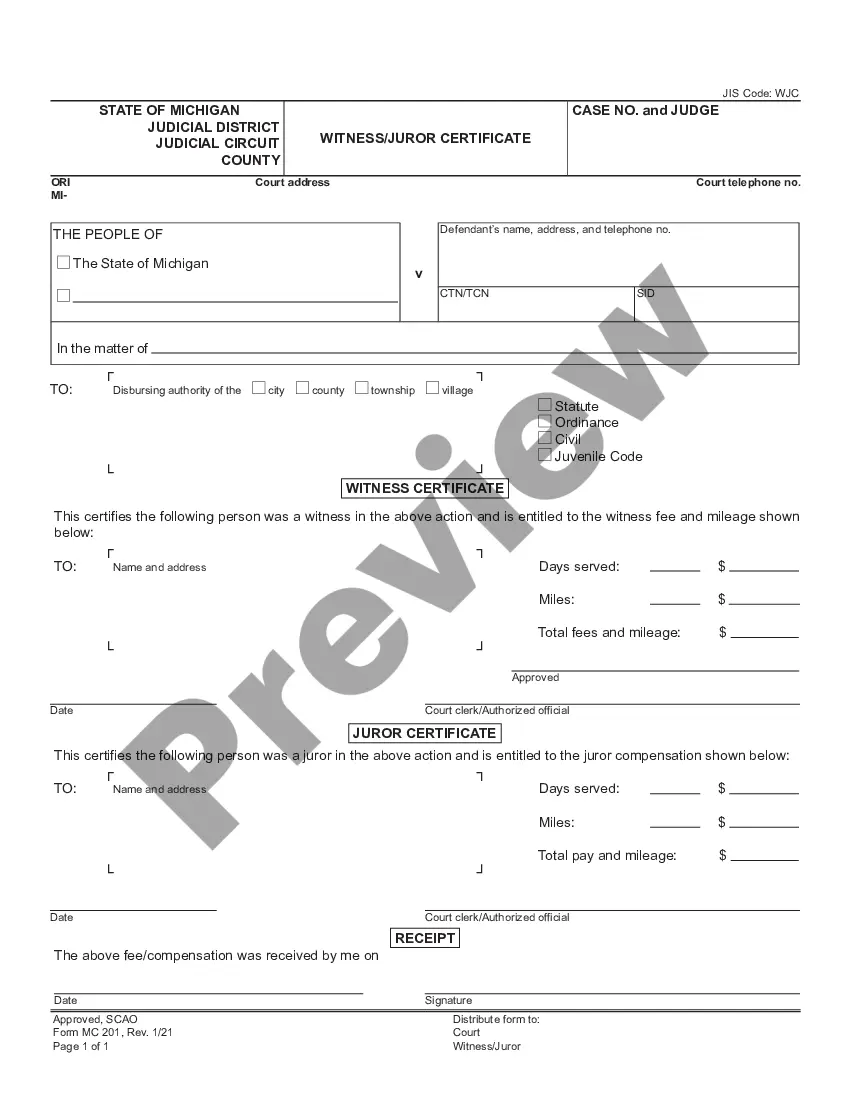

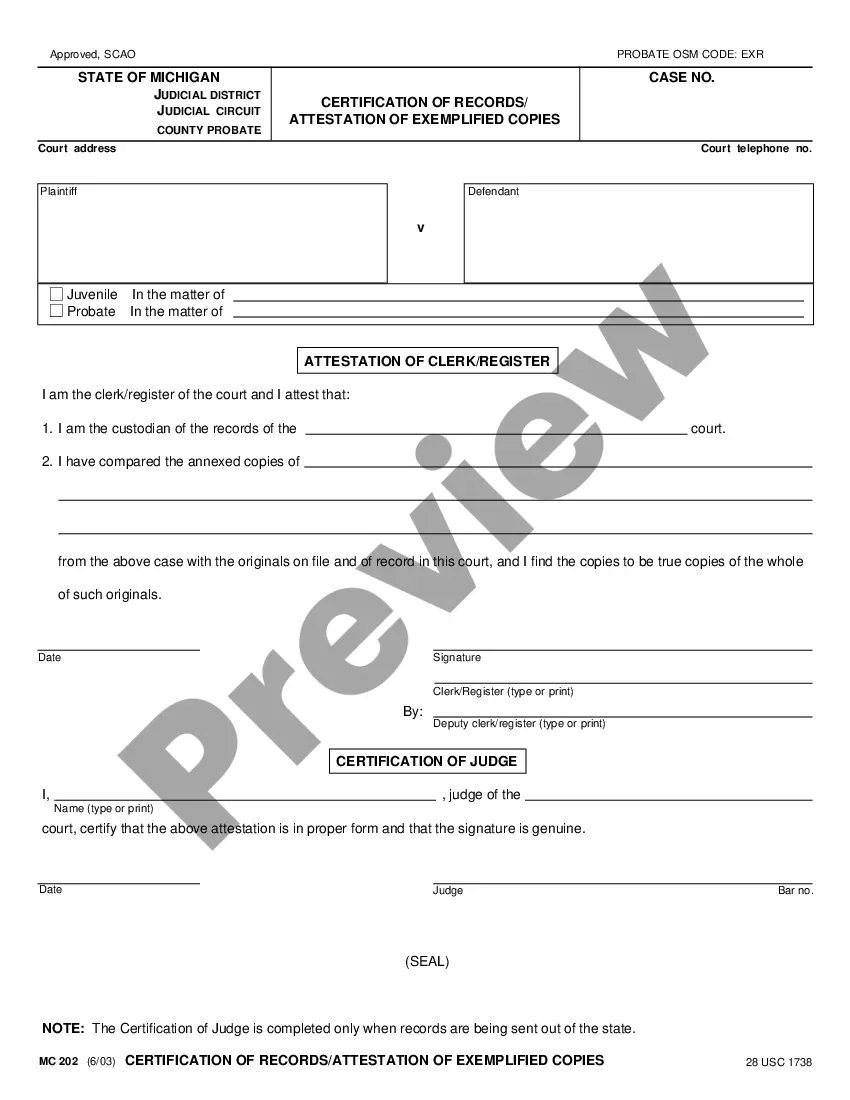

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Cash Receipts Control Log.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!