Maricopa Arizona Cash Receipts Control Log is an invaluable document used by organizations and businesses to track and manage their cash transactions effectively. It plays a crucial role in maintaining financial accountability, ensuring accurate record-keeping, and safeguarding against potential fraud or errors. The Maricopa Arizona Cash Receipts Control Log serves as a comprehensive record-keeping tool that encompasses various types of cash receipts. These may include cash payments received from customers, donations, fees, sales transactions, and any other forms of cash inflows specific to the organization or industry. Organizations that deal with diversified cash transactions often utilize different types of Maricopa Arizona Cash Receipts Control Logs, each tailored to their specific needs. These may include: 1. Retail Cash Receipts Control Log: Commonly used by retail businesses, this log is designed to monitor cash sales, credit card transactions, and any other form of payment received at the point of sale. It may include details like the date of the transaction, customer name or number, payment method, and the amount received. 2. Donation Cash Receipts Control Log: Non-profit organizations typically maintain this log to record and acknowledge cash donations received. It helps in tracking donor information, donation amounts, relevant dates, and other essential details required for issuing tax receipts or acknowledgments. 3. Service or Consultation Cash Receipts Control Log: Professionals, such as consultants, therapists, or freelancers, often use this log to track cash payments received for their services. It aids in maintaining and cross-referencing client details, service dates, payment amounts, and any additional notes. 4. Event Cash Receipts Control Log: Event management companies or organizations hosting events may utilize this log to record cash proceeds from ticket sales, merchandise sales, or other event-related transactions. It helps in reconciling the total cash received with the number of tickets or products sold. Regardless of the specific type, a typical Maricopa Arizona Cash Receipts Control Log includes crucial information such as transaction dates, payer information, payment methods used, amounts received, and signatures for authentication. The log also serves as a reference tool for balancing cash registers, reconciling bank statements, and providing an audit trail for internal or external financial audits. Adhering to Maricopa Arizona's regulations and guidelines, maintaining an accurate and up-to-date Cash Receipts Control Log ensures financial transparency, mitigates risks, and promotes efficient cash management practices, benefiting both organizations and their stakeholders.

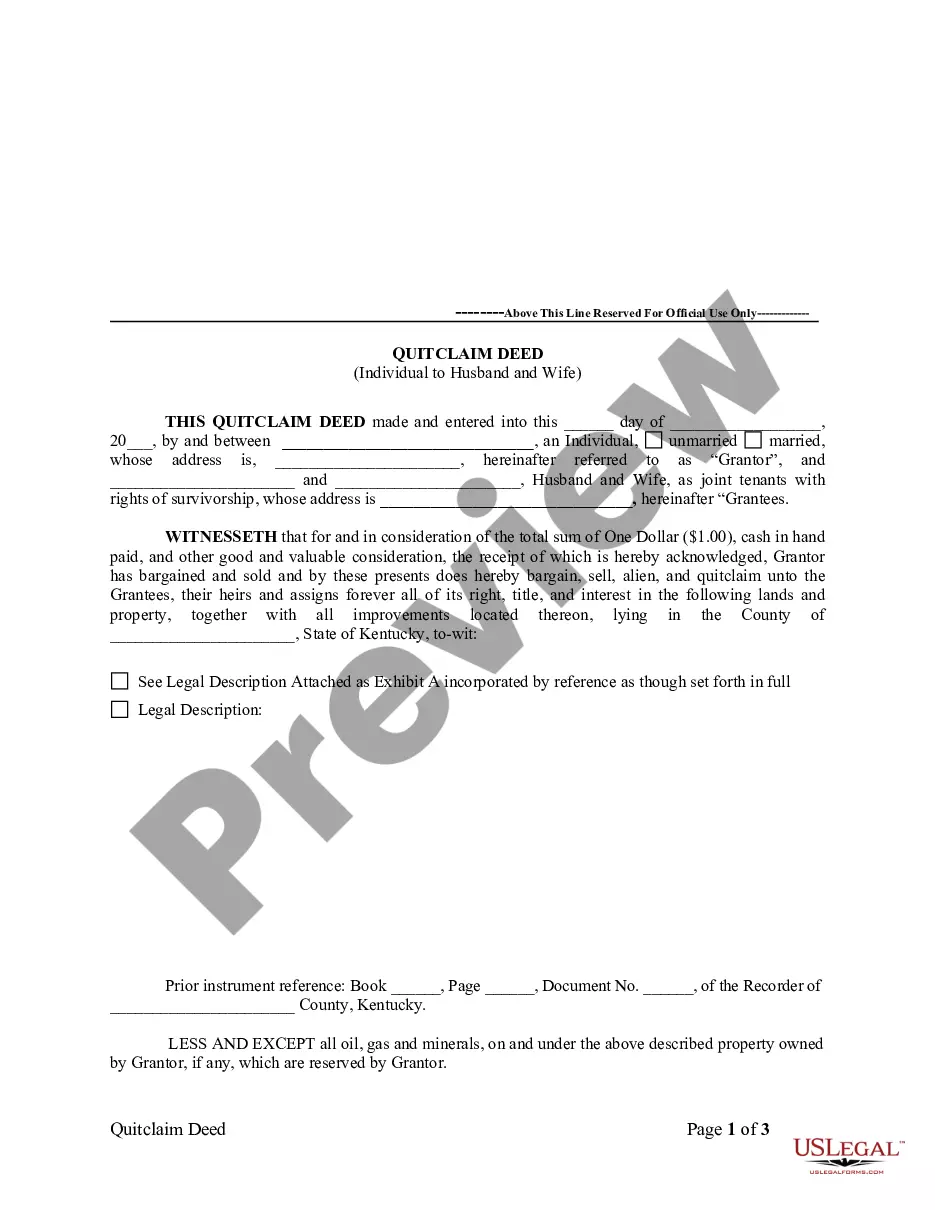

Maricopa Arizona Cash Receipts Control Log

Description

How to fill out Maricopa Arizona Cash Receipts Control Log?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Maricopa Cash Receipts Control Log.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Maricopa Cash Receipts Control Log will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Maricopa Cash Receipts Control Log:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Maricopa Cash Receipts Control Log on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!