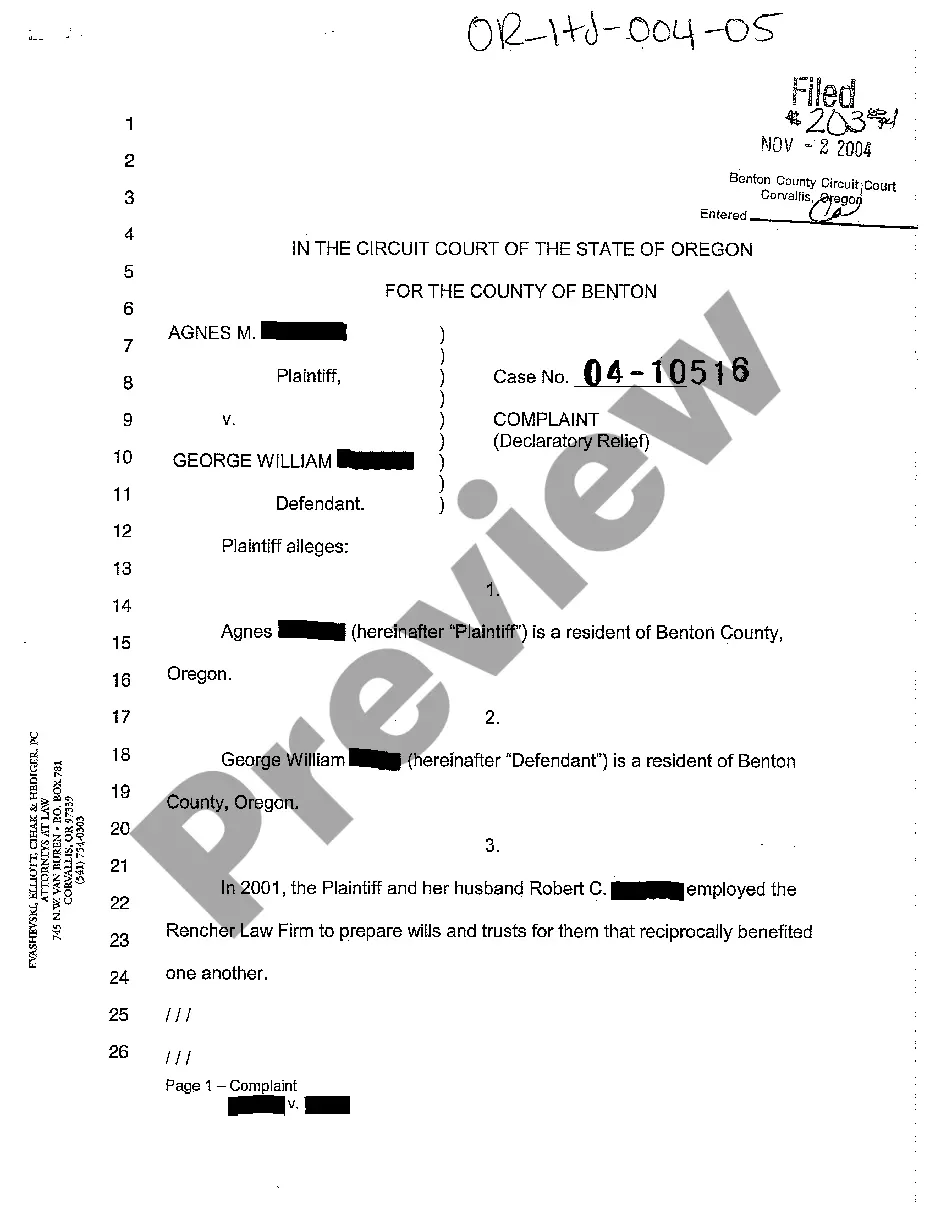

Orange California Cash Receipts Control Log is a record-keeping document used by businesses in Orange, California to effectively track and manage their cash receipts. This log serves as an integral part of the internal control system, ensuring accuracy and transparency in financial transactions. It aims to prevent errors, theft, and fraud related to cash receipts, providing businesses with a reliable record of all incoming cash. The Orange California Cash Receipts Control Log typically includes relevant information such as the date, source, amount, purpose, and responsible individual involved in each cash transaction. Each entry is carefully recorded in chronological order, enabling businesses to maintain an accurate audit trail and quickly reconcile their cash accounts. This log is especially crucial for establishments dealing with a high volume of cash transactions, such as retail stores, restaurants, hotels, and other service-based businesses where cash is frequently exchanged. Having a cash receipts control log ensures proper cash handling procedures, reduces the risk of discrepancies, and increases accountability among staff members. Different types of Orange California Cash Receipts Control Logs may exist, tailored to specific industries or business needs. For example: 1. Retail Cash Receipts Control Log: Designed specifically for retail businesses, this log may include additional fields such as customer name, item purchased, and payment method. 2. Restaurant Cash Receipts Control Log: Catering to the unique requirements of the food service industry, this log might incorporate sections for table numbers, server names, and tips received. 3. Hospitality Cash Receipts Control Log: Adapted for hotels, motels, and other lodging establishments, this log might include details such as room number, guest name, and folio number. Regardless of the specific type, all Orange California Cash Receipts Control Logs share the common purpose of maintaining financial integrity, preventing cash mishandling, and facilitating accurate reconciliation. By implementing a robust control system like this, businesses in Orange, California can effectively monitor their cash flow, improve financial transparency, and safeguard their assets.

Orange California Cash Receipts Control Log

Description

How to fill out Orange California Cash Receipts Control Log?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Orange Cash Receipts Control Log, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Orange Cash Receipts Control Log from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Orange Cash Receipts Control Log:

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Internal control encompasses the policies and procedures that an organization establishes to ensure that it operates in accordance with management's intentions and that accountability is maintained for all transactions.

Reconciliation Verify the deposit by agreeing Cash Operations deposit slip to the general ledger on a monthly basis. Cash registers and credit card machines should be balanced daily. Over/short amounts should be monitored. A dated and signed record of the reconciliation should be maintained.

Internal control mechanisms the auditor should check for include documents that establish accountability for the reception of cash and completion of bank deposits, an accurate daily cash summary and deposit slip, requiring daily journal entries that post the amount received to customer accounts and appropriate

No individual is to have complete control in the handling of cash. Specifically, no one individual's duties should include the actual handling of money, recording receipt of money, and the reconciliation of bank accounts or with the state treasurer. Incoming cash must be made a matter of record as soon as possible.

In vouching the cash sales, cash register should be fully checked with carbon copies of cash memos. Then, the auditor should verify the daily deposits of cash received in the bank. Dates of cash memos and date on which the receipts are recorded in cash book must be same.

Auditing cash tends to be straightforward....Substantive Procedures for Cash Confirm cash balances. Vouch reconciling items to the subsequent month's bank statement. Ask if all bank accounts are included on the general ledger. Inspect final deposits and disbursements for proper cutoff.

A receipt or proof of purchase may be printed from a cash register, hand written or a tax invoice. Any receipt or proof of purchase you give your customers must include: your business name and Australian business number (ABN) or Australian company number (ACN) the date of supply.

Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. They protect both the University and the employees handling the cash.

Safekeeping of cash-All cash and cash equivalents must be kept in a locked box in a safe or cabinet. Petty cash floats must also be stored in a safe or cabinet overnight. An office receipt must be issued, these must be pre-numbered, and the receipt books must be kept under lock and key.