Maricopa Arizona Blind Trust Agreement is a legal document that establishes a trust to manage and protect assets without the knowledge or involvement of the beneficiary. A blind trust serves as a protective measure to avoid conflicts of interest, maintain confidentiality, and prevent the beneficiary from making biased decisions based on personal gain. The Maricopa Arizona Blind Trust Agreement allows an individual or entity, known as the granter, to transfer their assets and control over to a trustee. The trustee, who can be an individual or a trust management company, manages the assets and investments in the best interest of the beneficiary, who remains unaware of the specific details regarding the trust's holdings. This arrangement ensures that the beneficiary, often a public official or elected representative, cannot influence the decisions made by the trustee, maintaining impartiality and public trust. By creating a level of separation between the beneficiary and the trust's assets, this agreement helps avoid conflicts that may arise due to personal interests or political motives. Different types of Maricopa Arizona Blind Trust Agreements may include: 1. Personal Blind Trust: This type of trust is established by individuals who hold public office or have a fiduciary duty, such as politicians, high-ranking government officials, or corporate executives. The trust allows them to maintain privacy and prevent potential conflicts of interest while in their positions. 2. Political Blind Trust: This trust is applied specifically to politicians or elected officials to prevent their knowledge of specific investments or assets that could influence their decision-making power. It aims to maintain integrity, impartiality, and avoid favoritism or biased judgments. 3. Corporate Blind Trust: Corporations, especially those with substantial holdings or influential public figures, can establish a blind trust to separate the management of their assets from the executive or board members' knowledge. This agreement helps safeguard the corporation's interests, prevents internal bias, and ensures transparency when making vital business decisions. 4. Estate Blind Trust: In the context of estate planning, individuals may create a blind trust to transfer their assets to a trustee while protecting the privacy of their beneficiaries. This arrangement safeguards the distribution of wealth and preserves confidentiality, especially in complex or high-value estates. Maricopa Arizona Blind Trust Agreements are designed to maintain transparency, prevent conflicts of interest, and uphold the trustworthiness of public officials or protect the privacy of individuals and corporations. These agreements play a significant role in ensuring fair and ethical decision-making while upholding the integrity of the beneficiaries involved.

Maricopa Arizona Blind Trust Agreement

Description

How to fill out Maricopa Arizona Blind Trust Agreement?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Maricopa Blind Trust Agreement, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the latest version of the Maricopa Blind Trust Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Blind Trust Agreement:

- Look through the page and verify there is a sample for your area.

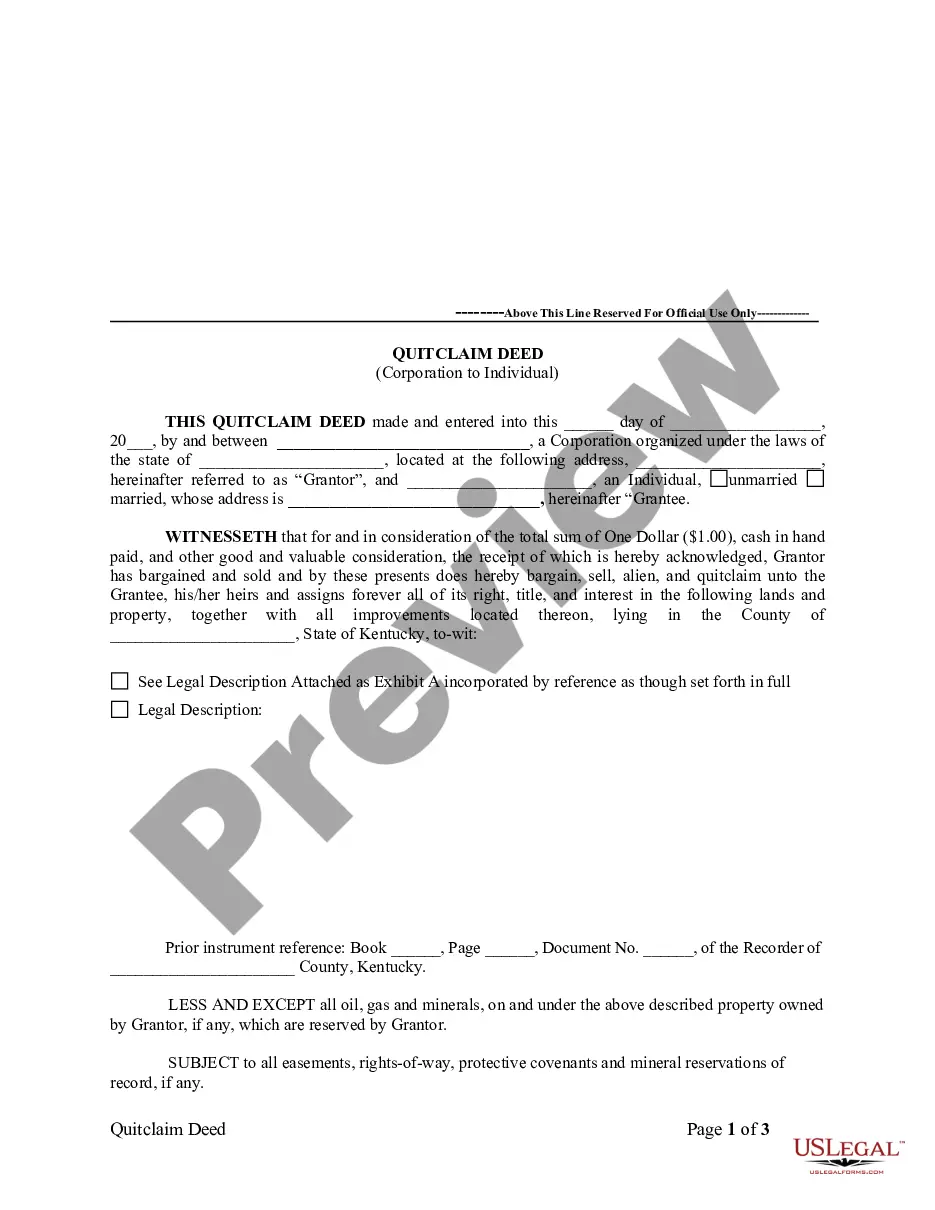

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Maricopa Blind Trust Agreement and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!