Dallas Texas Consultant Agreement with Sharing of Software Revenues is a legal agreement between a consultant and a client based in Dallas, Texas, outlining the terms and conditions under which the consultant will provide services related to software development, maintenance, or implementation, and how the revenue generated from the software will be shared between the parties. This agreement ensures a mutually beneficial relationship and establishes a clear understanding of responsibilities, compensation, and intellectual property rights. Key elements typically addressed in a Dallas Texas Consultant Agreement with Sharing of Software Revenues include: 1. Scope of Services: The agreement will outline the specific services the consultant will provide, whether it is software development, testing, consulting, project management, or any other related task. 2. Revenue Sharing: The agreement will establish the percentage or method by which the consultant will receive a share of the software's revenue. This can be done through royalties, profit-sharing, or other agreed-upon mechanisms. 3. Intellectual Property: The agreement will define who owns the intellectual property rights to the software developed during the engagement. It will typically include provisions for the consultant assigning the rights to the client or granting them a license to use the software for commercial purposes. 4. Term and Termination: The agreement will specify the duration of the engagement and the conditions under which either party can terminate the agreement. This may include for cause termination, notice periods, or agreed-upon exit clauses. 5. Confidentiality: There will be clauses addressing the protection of proprietary information and trade secrets shared between the parties during the engagement. 6. Payment and Expenses: The consultant's compensation and reimbursement for reasonable expenses incurred during the project will be clearly stated in the agreement. It may include provisions for invoicing, due dates, and methods of payment. 7. Indemnification: There will be provisions to protect each party from liability arising from their respective actions or omissions during the engagement. Types of Dallas Texas Consultant Agreements with Sharing of Software Revenues may include: 1. Fee-for-Service Agreement: In this type of agreement, the consultant charges a fixed fee or hourly rate for their services, while also negotiating a revenue-sharing arrangement based on the success or profitability of the software. 2. Project-Specific Revenue Sharing Agreement: This type of agreement is used when the consultant is engaged for a specific software development project, and the revenue sharing is based solely on the success of that project. 3. Non-Exclusive Revenue Sharing Agreement: This agreement allows the consultant to work with multiple clients simultaneously, sharing software revenue with each client based on their respective contributions or involvement. Dallas Texas Consultant Agreements with Sharing of Software Revenues provide a structured framework for collaborations between consultants and clients, ensuring fair compensation and fostering a successful software development or implementation project.

Dallas Texas Consultant Agreement with Sharing of Software Revenues

Description

How to fill out Dallas Texas Consultant Agreement With Sharing Of Software Revenues?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Dallas Consultant Agreement with Sharing of Software Revenues without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Dallas Consultant Agreement with Sharing of Software Revenues by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Dallas Consultant Agreement with Sharing of Software Revenues:

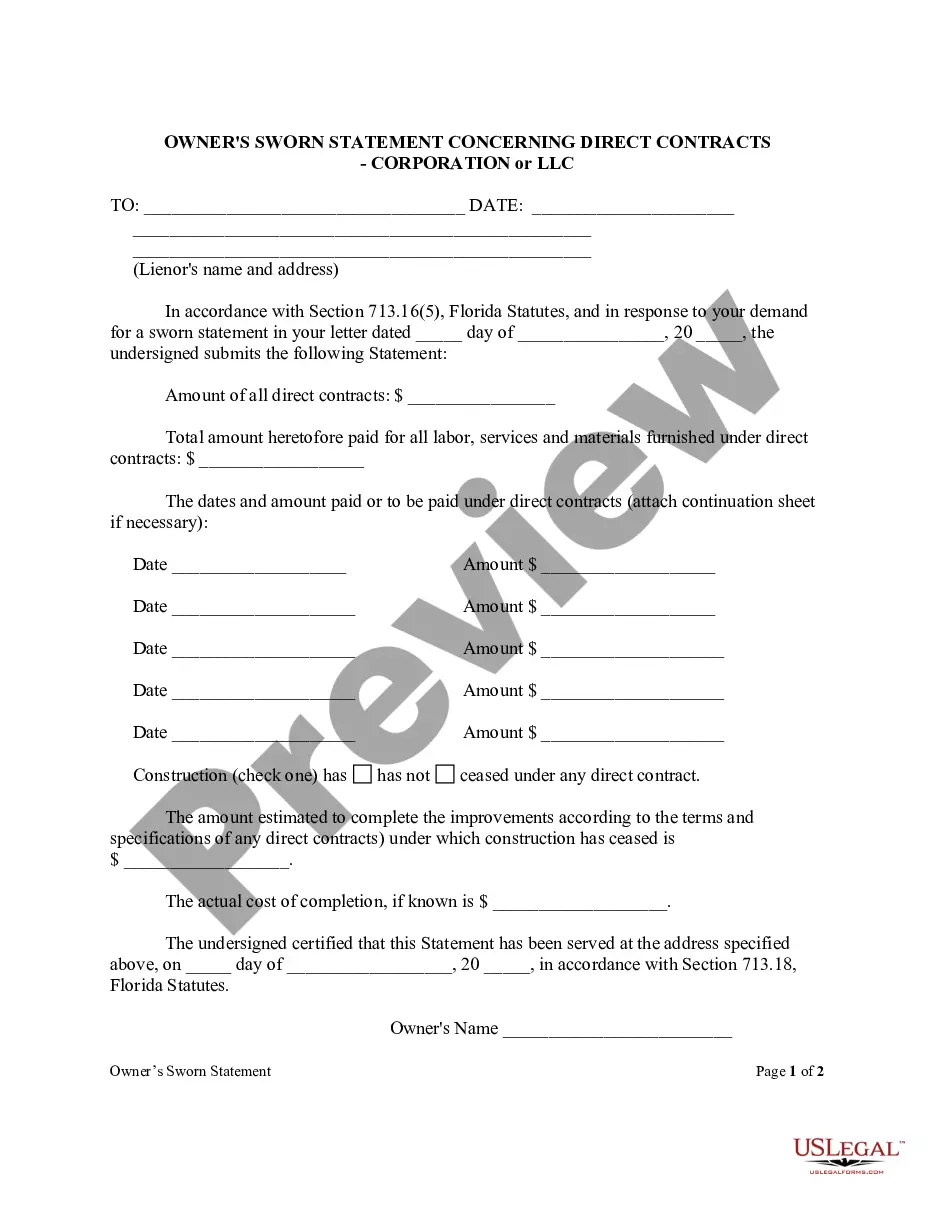

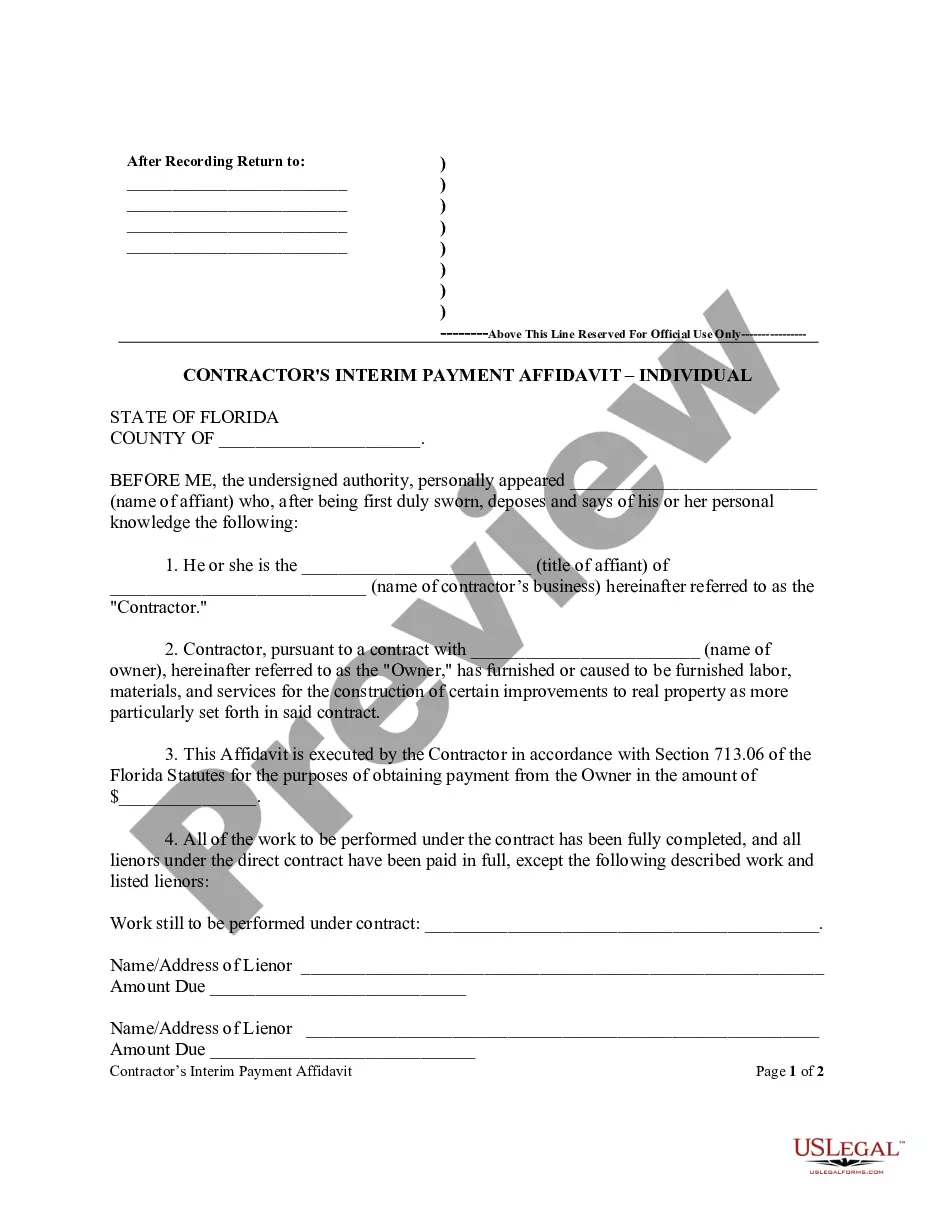

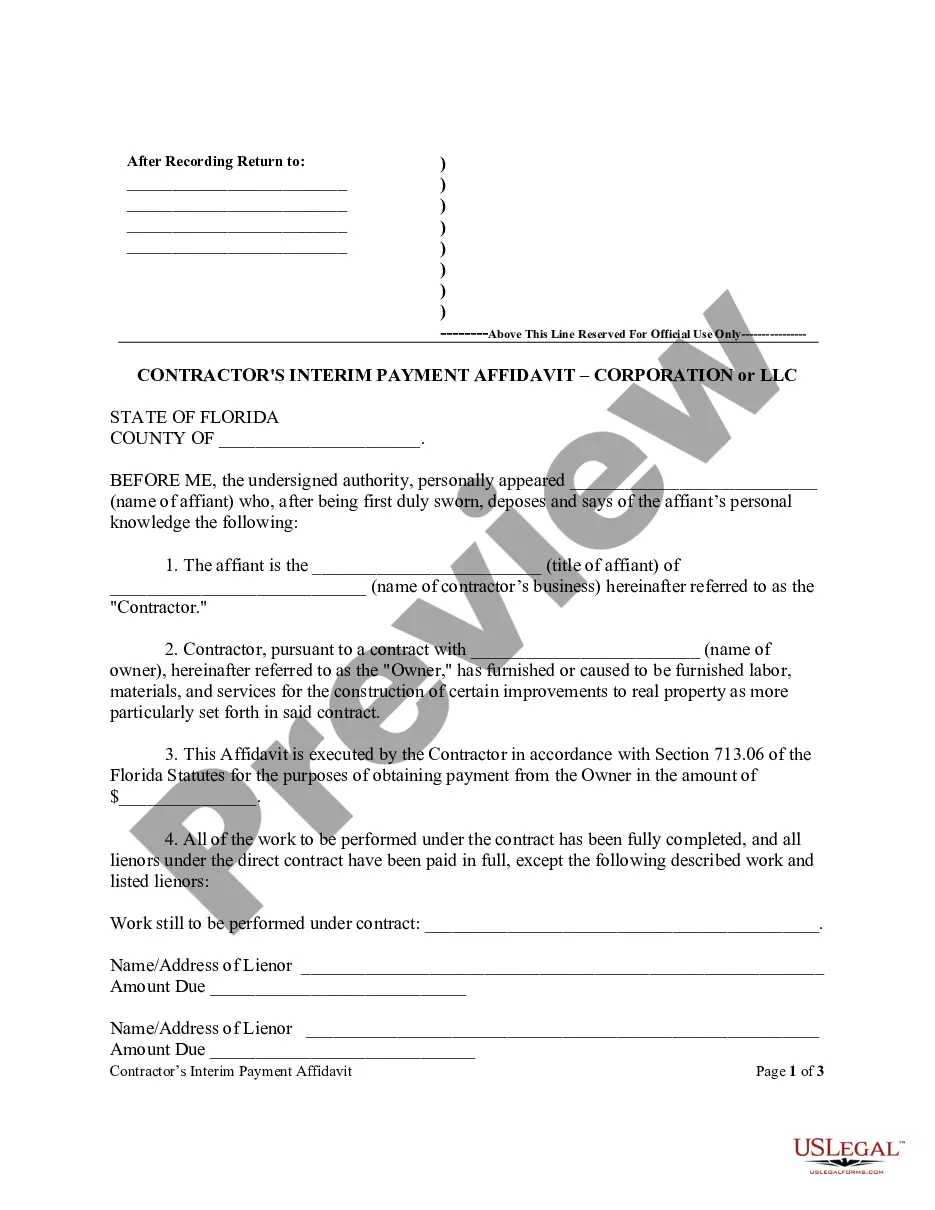

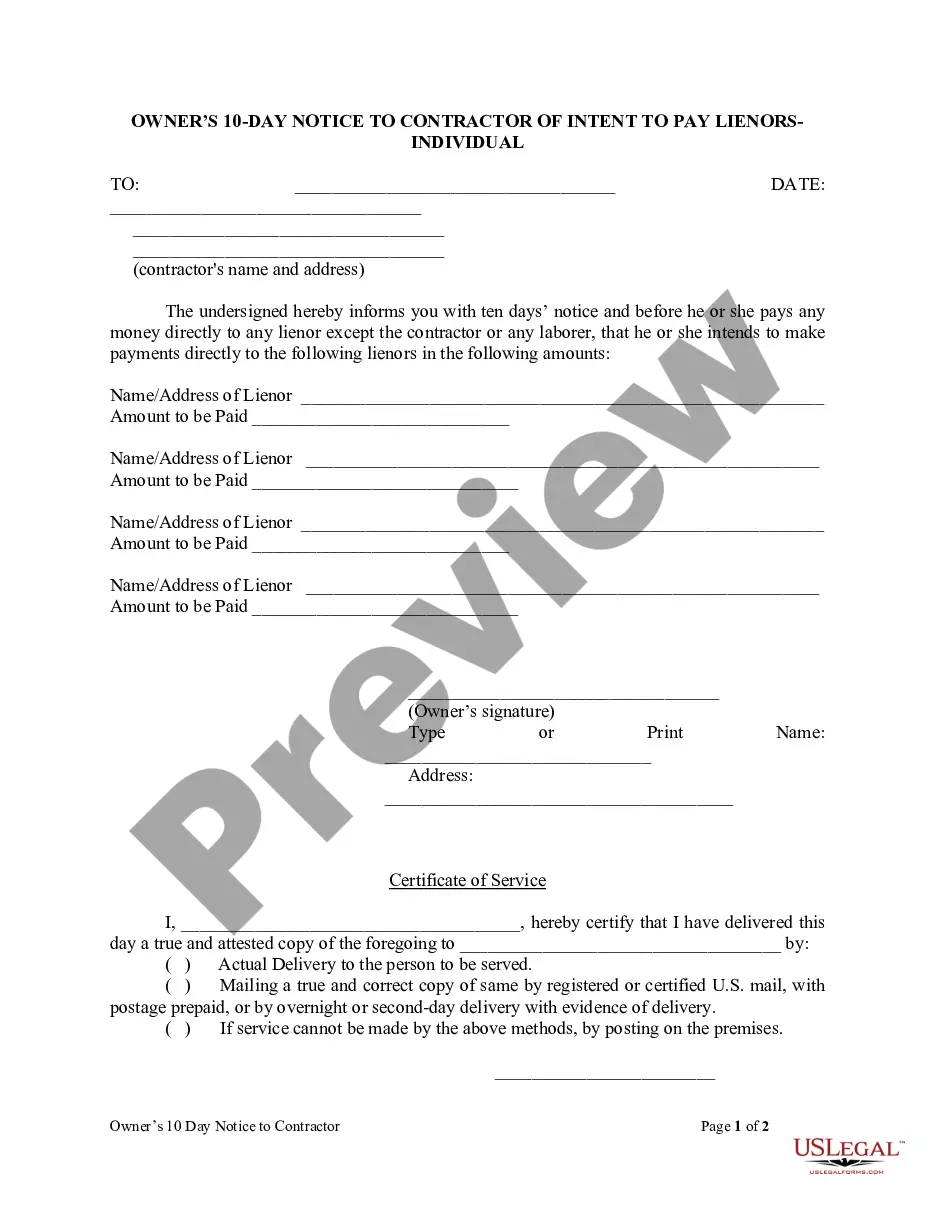

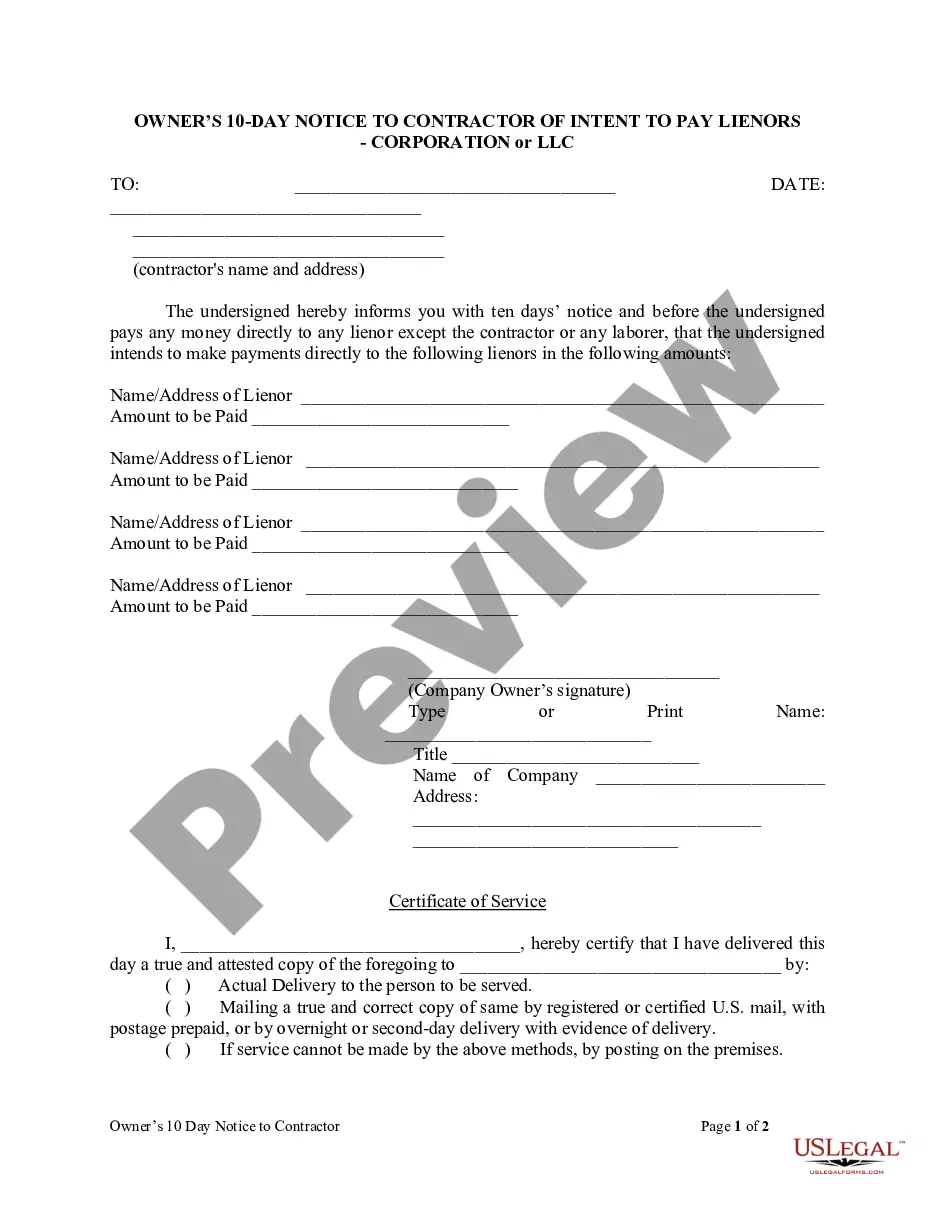

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!