A consultant is someone who gives expert or professional advice. Consultants are ordinarily hired on an independent contractor basis, therefore, the hiring party is not liable to others for the acts or omissions of the consultant. As distinguished from an employee, a consultant pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

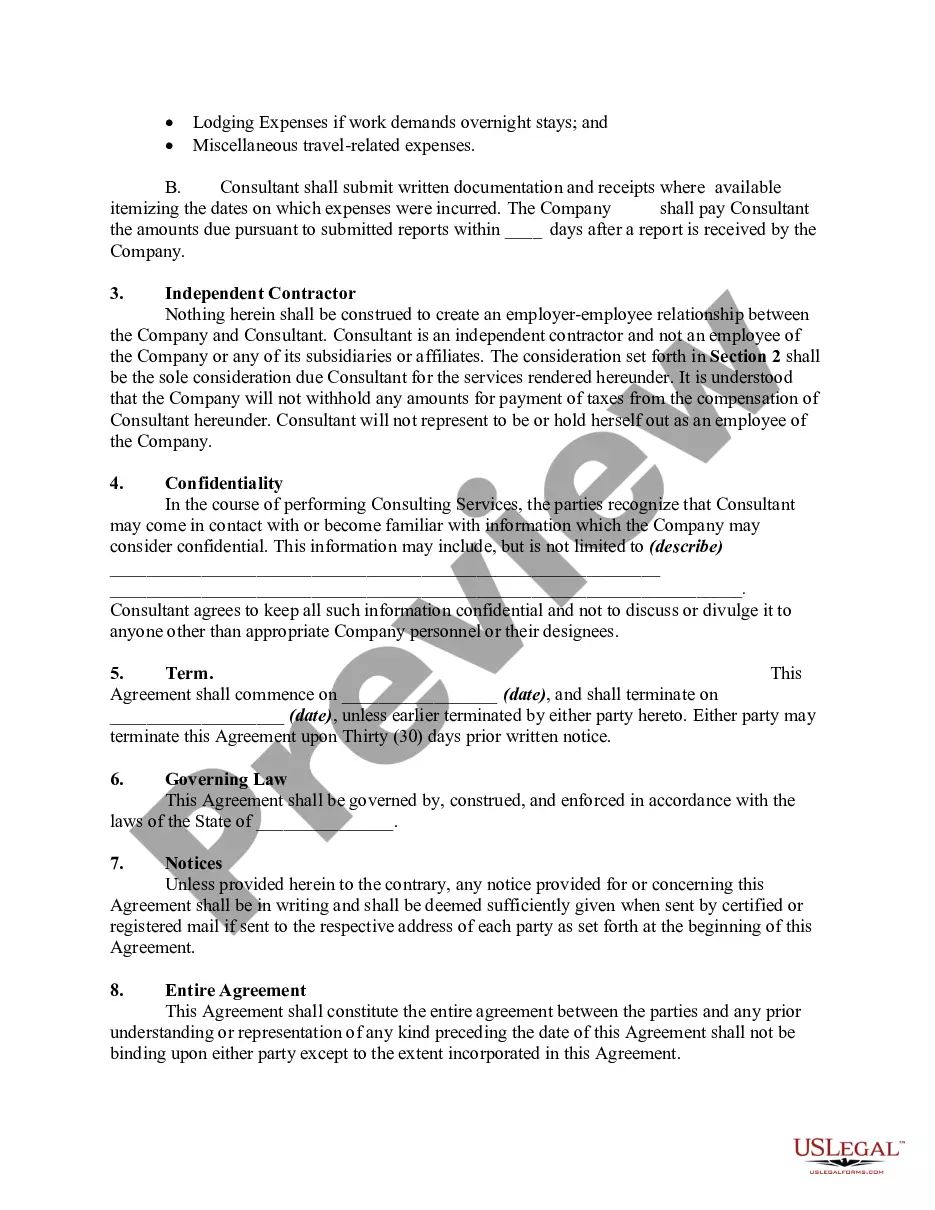

A Harris Texas Consulting Agreement — Short is a legal document that outlines the terms and conditions agreed upon between a consultant and a client in the state of Texas. This agreement sets the foundation for a professional relationship and ensures both parties understand their roles, responsibilities, and obligations. The key components of a Harris Texas Consulting Agreement — Short typically include: 1. Parties: This section identifies the consultant, referred to as the "Provider," and the client, referred to as the "Client." It includes their legal names, addresses, and contact information. 2. Scope of Work: This outlines the specific services the consultant will provide to the client. It defines the goals, objectives, and deliverables of the consulting engagement, ensuring clarity and alignment between both parties. 3. Payment Terms: This section details the compensation structure, including the rate or fee the client will pay for the consulting services. It may also include information about the payment schedule, method, and any additional expenses that may be reimbursed. 4. Confidentiality: Confidentiality provisions safeguard the client's proprietary information, trade secrets, and other sensitive data. The consultant agrees to maintain strict confidentiality and not disclose any confidential information without the client's consent. 5. Term and Termination: This section specifies the duration of the consulting agreement, whether it is a fixed-term or ongoing engagement. It may also outline the circumstances under which either party can terminate the agreement, such as breach of contract or non-performance. 6. Intellectual Property Rights: This addresses ownership and rights to any intellectual property developed during the consulting engagement. It clarifies whether the consultant or the client will retain ownership or have the right to use such intellectual property. 7. Limitation of Liability: This clause limits the liability of both parties. It outlines the extent to which either party will be responsible for any damages or losses arising from the consulting services provided. Different types of Harris Texas Consulting Agreement — Short can include: 1. IT Consulting Agreement: This agreement specifically caters to consultants providing information technology-related services. It may include clauses regarding software development, system implementation, or network security. 2. Financial Consulting Agreement: This type of consulting agreement caters to consultants offering financial advisory, accounting, or investment-related services. Specific considerations may include regulatory compliance, risk management, or financial planning. 3. Human Resources Consulting Agreement: This agreement focuses on consultants providing HR-related services, such as talent acquisition, training and development, or HR policy implementation. It may address employee relations, compensation, or workplace compliance. 4. Management Consulting Agreement: This type of agreement is designed for consultants offering organizational or strategic management guidance. It may cover areas like process improvement, project management, or business strategy. In conclusion, a Harris Texas Consulting Agreement — Short is a document that outlines the terms and conditions of a consulting engagement between a consultant and client in Texas. It ensures clarity, protects both parties' interests, and sets the framework for a successful consulting relationship.A Harris Texas Consulting Agreement — Short is a legal document that outlines the terms and conditions agreed upon between a consultant and a client in the state of Texas. This agreement sets the foundation for a professional relationship and ensures both parties understand their roles, responsibilities, and obligations. The key components of a Harris Texas Consulting Agreement — Short typically include: 1. Parties: This section identifies the consultant, referred to as the "Provider," and the client, referred to as the "Client." It includes their legal names, addresses, and contact information. 2. Scope of Work: This outlines the specific services the consultant will provide to the client. It defines the goals, objectives, and deliverables of the consulting engagement, ensuring clarity and alignment between both parties. 3. Payment Terms: This section details the compensation structure, including the rate or fee the client will pay for the consulting services. It may also include information about the payment schedule, method, and any additional expenses that may be reimbursed. 4. Confidentiality: Confidentiality provisions safeguard the client's proprietary information, trade secrets, and other sensitive data. The consultant agrees to maintain strict confidentiality and not disclose any confidential information without the client's consent. 5. Term and Termination: This section specifies the duration of the consulting agreement, whether it is a fixed-term or ongoing engagement. It may also outline the circumstances under which either party can terminate the agreement, such as breach of contract or non-performance. 6. Intellectual Property Rights: This addresses ownership and rights to any intellectual property developed during the consulting engagement. It clarifies whether the consultant or the client will retain ownership or have the right to use such intellectual property. 7. Limitation of Liability: This clause limits the liability of both parties. It outlines the extent to which either party will be responsible for any damages or losses arising from the consulting services provided. Different types of Harris Texas Consulting Agreement — Short can include: 1. IT Consulting Agreement: This agreement specifically caters to consultants providing information technology-related services. It may include clauses regarding software development, system implementation, or network security. 2. Financial Consulting Agreement: This type of consulting agreement caters to consultants offering financial advisory, accounting, or investment-related services. Specific considerations may include regulatory compliance, risk management, or financial planning. 3. Human Resources Consulting Agreement: This agreement focuses on consultants providing HR-related services, such as talent acquisition, training and development, or HR policy implementation. It may address employee relations, compensation, or workplace compliance. 4. Management Consulting Agreement: This type of agreement is designed for consultants offering organizational or strategic management guidance. It may cover areas like process improvement, project management, or business strategy. In conclusion, a Harris Texas Consulting Agreement — Short is a document that outlines the terms and conditions of a consulting engagement between a consultant and client in Texas. It ensures clarity, protects both parties' interests, and sets the framework for a successful consulting relationship.