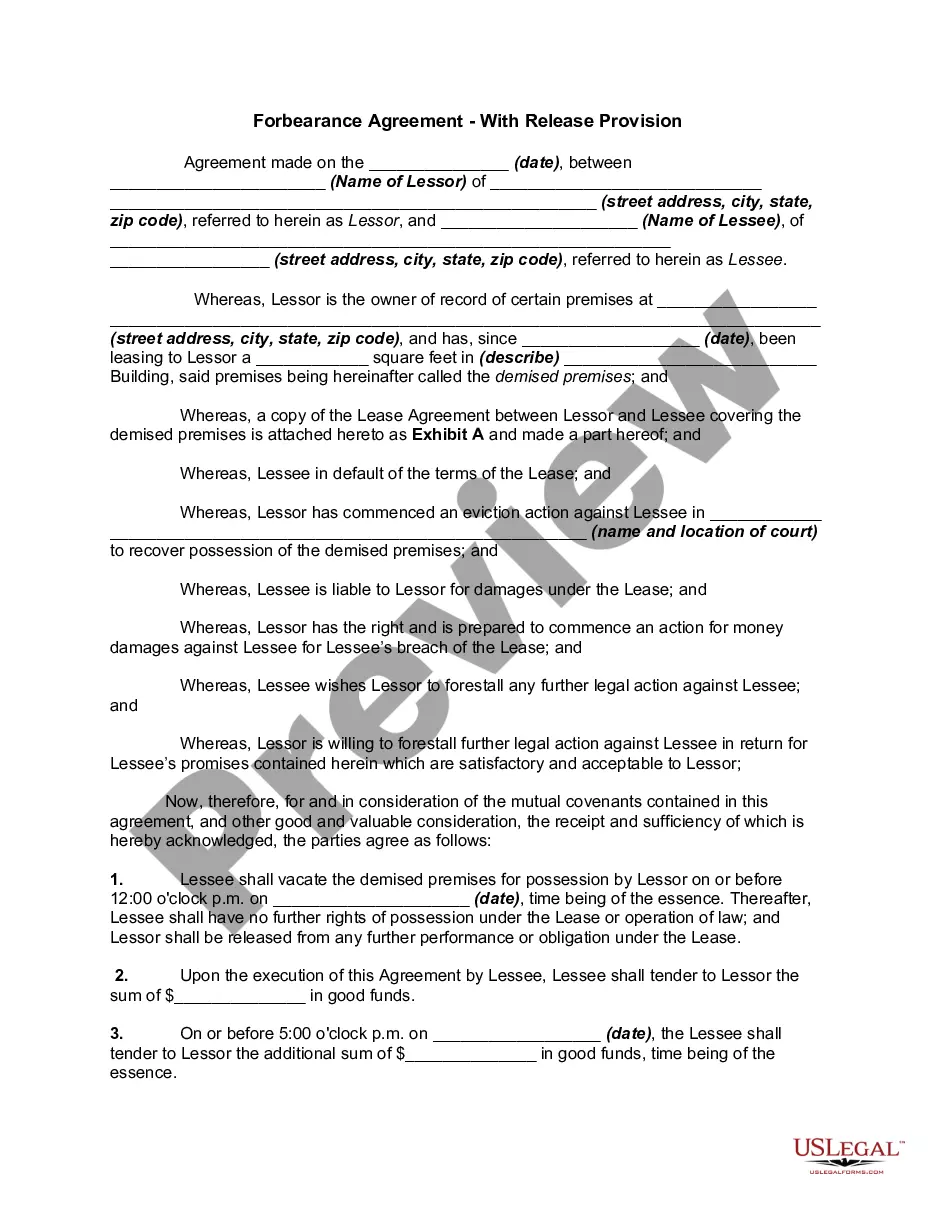

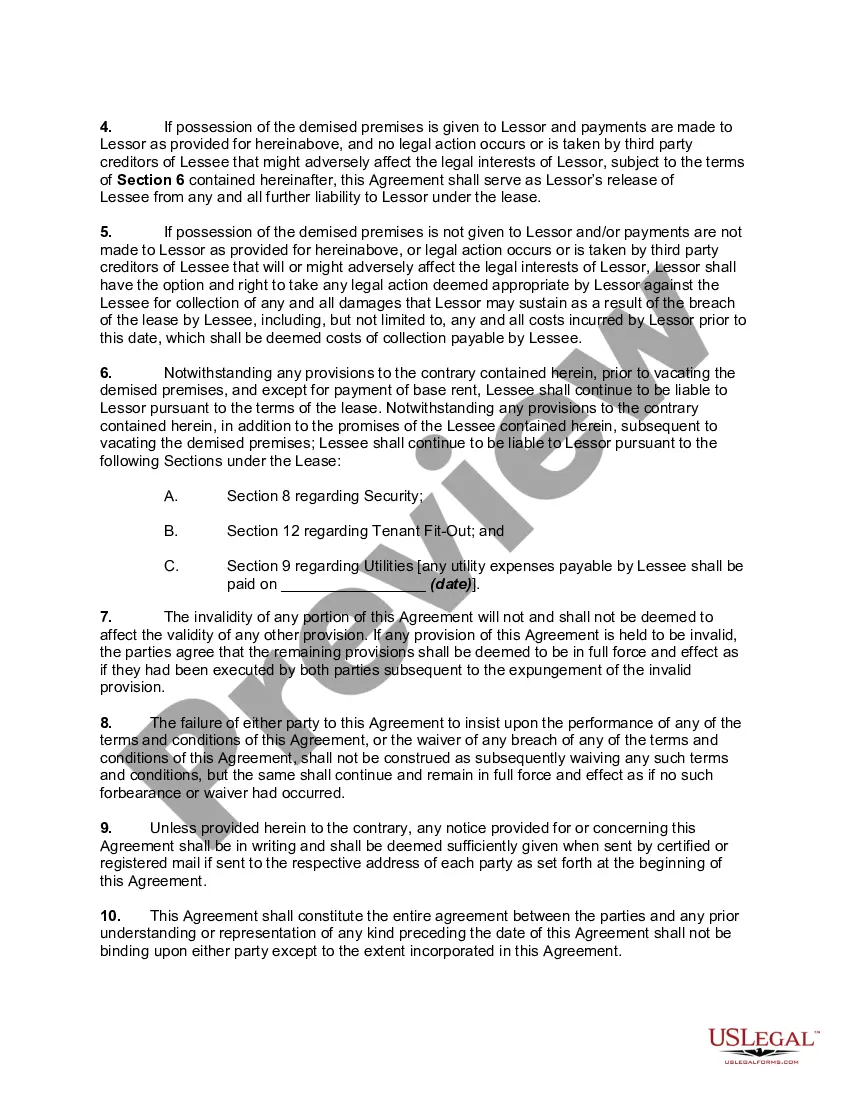

In this form, the lessee is in default and lessor has brought an eviction action against lessee. Pursuant to two cash payments, lessor agrees to release lessee (with some exceptions) from the lease, covenants not to sue for monetary damages, and drop the eviction action.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Fulton Georgia Forbearance Agreement with Release Provision is a legal document that outlines an agreement between a lender and a borrower in Fulton, Georgia, in which the lender agrees to temporarily suspend or reduce the borrower's mortgage payments due to financial hardship. This agreement is commonly utilized when a borrower is facing foreclosure or is unable to meet their regular mortgage obligations. The Forbearance Agreement serves as a modification to the original loan terms and provides a temporary solution to help the borrower stay in their home while they regain their financial stability. It allows the borrower to make reduced payments or no payments at all for a specified period, typically ranging from a few months to a year. The Forbearance Agreement also includes a Release Provision, which outlines the conditions under which the lender will release the borrower from any further obligations once the agreed-upon forbearance period ends. This provision may involve forgiving a portion of the outstanding debt, waiving any late fees or penalties, or reevaluating the loan terms entirely. There are different types of Fulton Georgia Forbearance Agreements — With Release Provision that can be offered, depending on the situation and the lender's policies: 1. Short-Term Forbearance Agreement: This type of agreement provides a temporary respite for the borrower by allowing them to make reduced or no payments for a short duration, typically around three to six months. At the end of the forbearance period, the borrower is expected to resume regular payments or negotiate a longer-term solution. 2. COVID-19 Forbearance Agreement: Amidst the ongoing global pandemic, specialized forbearance agreements have been introduced to provide financial relief to borrowers who have been directly impacted by COVID-19. These agreements often incorporate additional provisions and protections specific to pandemic-related challenges. 3. Long-Term Forbearance Agreement: In cases where the borrower's financial hardship is expected to last longer, or they are struggling with ongoing issues, a long-term forbearance agreement may be established. This allows for an extended suspension or reduction of monthly mortgage payments, spanning over several years. 4. Partial Payment Forbearance Agreement: Sometimes, borrowers in Fulton, Georgia, can negotiate a partial payment forbearance agreement, where they make reduced payments that are still greater than zero throughout the forbearance period. This option helps borrowers gradually catch up on their outstanding payments while the lender demonstrates flexibility. It is crucial to note that each Fulton Georgia Forbearance Agreement — With Release Provision may have unique terms and conditions depending on the lender and the borrower's specific circumstances. Seeking legal advice and carefully reviewing the agreement before signing is highly recommended ensuring it aligns with the borrower's financial goals and needs.A Fulton Georgia Forbearance Agreement with Release Provision is a legal document that outlines an agreement between a lender and a borrower in Fulton, Georgia, in which the lender agrees to temporarily suspend or reduce the borrower's mortgage payments due to financial hardship. This agreement is commonly utilized when a borrower is facing foreclosure or is unable to meet their regular mortgage obligations. The Forbearance Agreement serves as a modification to the original loan terms and provides a temporary solution to help the borrower stay in their home while they regain their financial stability. It allows the borrower to make reduced payments or no payments at all for a specified period, typically ranging from a few months to a year. The Forbearance Agreement also includes a Release Provision, which outlines the conditions under which the lender will release the borrower from any further obligations once the agreed-upon forbearance period ends. This provision may involve forgiving a portion of the outstanding debt, waiving any late fees or penalties, or reevaluating the loan terms entirely. There are different types of Fulton Georgia Forbearance Agreements — With Release Provision that can be offered, depending on the situation and the lender's policies: 1. Short-Term Forbearance Agreement: This type of agreement provides a temporary respite for the borrower by allowing them to make reduced or no payments for a short duration, typically around three to six months. At the end of the forbearance period, the borrower is expected to resume regular payments or negotiate a longer-term solution. 2. COVID-19 Forbearance Agreement: Amidst the ongoing global pandemic, specialized forbearance agreements have been introduced to provide financial relief to borrowers who have been directly impacted by COVID-19. These agreements often incorporate additional provisions and protections specific to pandemic-related challenges. 3. Long-Term Forbearance Agreement: In cases where the borrower's financial hardship is expected to last longer, or they are struggling with ongoing issues, a long-term forbearance agreement may be established. This allows for an extended suspension or reduction of monthly mortgage payments, spanning over several years. 4. Partial Payment Forbearance Agreement: Sometimes, borrowers in Fulton, Georgia, can negotiate a partial payment forbearance agreement, where they make reduced payments that are still greater than zero throughout the forbearance period. This option helps borrowers gradually catch up on their outstanding payments while the lender demonstrates flexibility. It is crucial to note that each Fulton Georgia Forbearance Agreement — With Release Provision may have unique terms and conditions depending on the lender and the borrower's specific circumstances. Seeking legal advice and carefully reviewing the agreement before signing is highly recommended ensuring it aligns with the borrower's financial goals and needs.