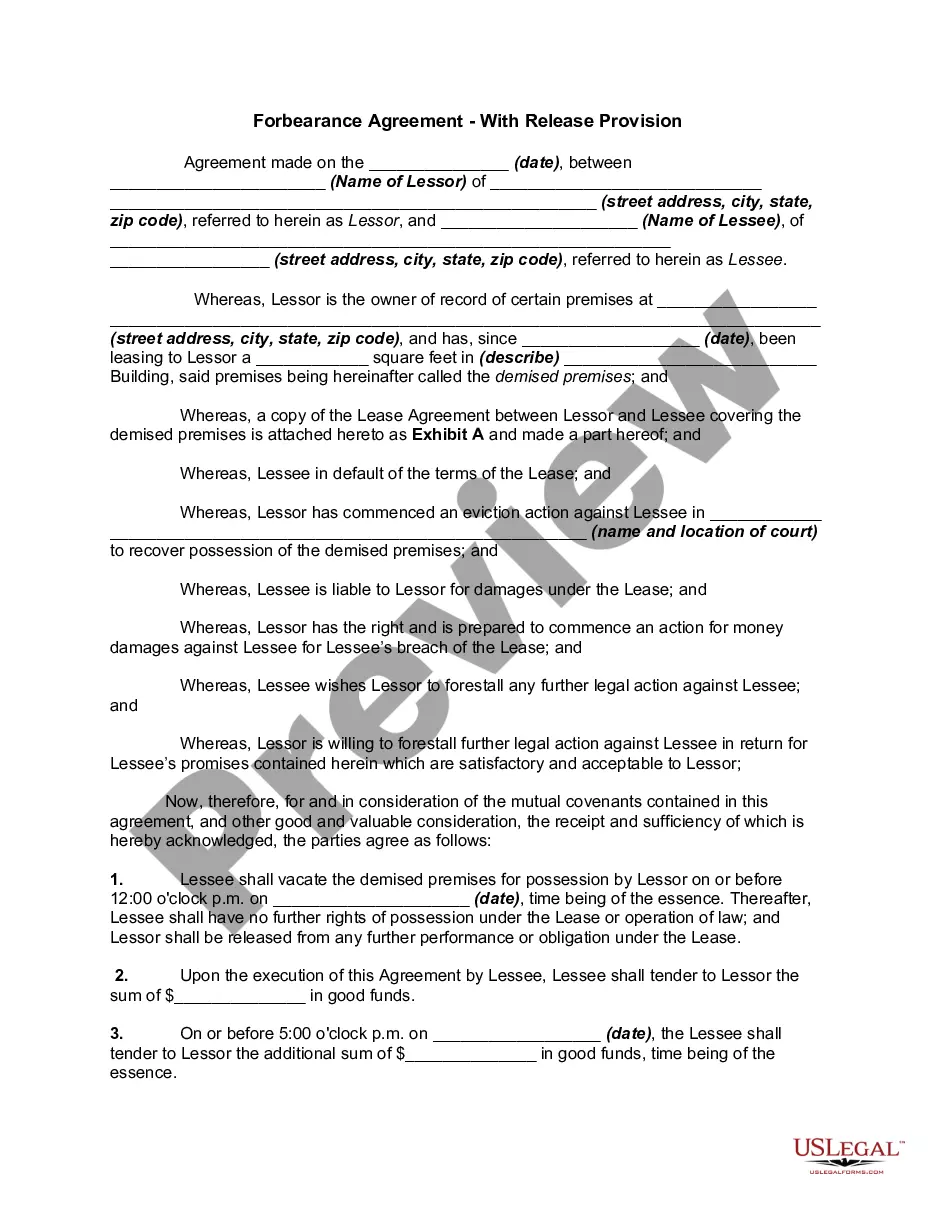

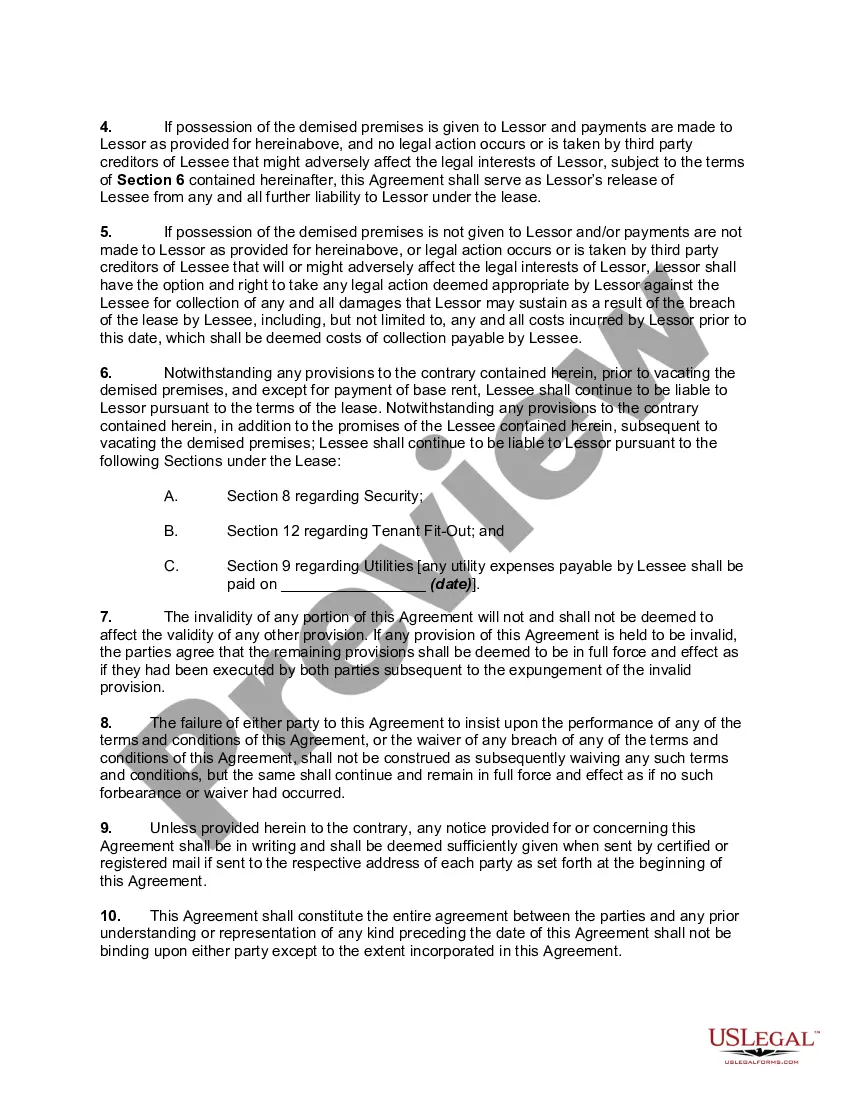

In this form, the lessee is in default and lessor has brought an eviction action against lessee. Pursuant to two cash payments, lessor agrees to release lessee (with some exceptions) from the lease, covenants not to sue for monetary damages, and drop the eviction action.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the San Antonio Texas Forbearance Agreement — With Release Provision: Types and Detailed Description Introduction: The San Antonio Texas Forbearance Agreement — With Release Provision is a legal document designed to provide temporary relief for parties involved in loan defaults or financial hardships. This agreement allows for debtors and creditors to reach an understanding, ensuring a manageable repayment plan while simultaneously releasing specific obligations among parties. Let's delve into the details and different types of this agreement. Types of San Antonio Texas Forbearance Agreement — With Release Provision: 1. Mortgage Forbearance Agreement: This type of forbearance agreement is commonly used by homeowners facing mortgage payment challenges. It allows borrowers to suspend or reduce mortgage payments temporarily, providing a breathing space to stabilize their financial situation. 2. Student Loan Forbearance Agreement: Specifically addressing student loans, this type of agreement grants individuals temporary relief from making regular monthly payments. It offers flexibility during financial hardships, ensuring borrowers do not default on their education-related debt obligations. Detailed Description: A San Antonio Texas Forbearance Agreement — With Release Provision typically includes the following key components: 1. Parties involved: Clearly specifies the identities and roles of the borrower and lender involved in the agreement. 2. Loan details and amount: Provides a comprehensive overview of the loan, including the principal amount, interest rate, and the repayment terms originally agreed upon. 3. Default circumstances: Outlines the reasons or circumstances leading to the borrower's inability to fulfill their loan obligations, such as loss of employment, medical emergencies, or other valid hardships. 4. Temporary suspension of payments: Describes the agreed-upon period during which the borrower is allowed to temporarily halt or reduce repayments. The parties determine a specific timeline for this forbearance. 5. Reinstatement plan: Defines the terms and conditions for loan repayment after the forbearance period ends. This includes details on the resumption of regular payments and any potential modifications to the loan terms to accommodate the borrower's financial situation. 6. Release provision: Highlights the specific obligations that will be released by the lender after the forbearance agreement ends. This provision ensures that upon successful completion of the agreement, the lender waives certain claims against the borrower, providing relief from legal liabilities. 7. Legal implications: Emphasizes that the forbearance agreement is a legally binding contract, with both parties committing to its terms and conditions. 8. Possible consequences: Outlines the potential repercussions if the borrower fails to meet the terms of the forbearance agreement, such as foreclosure, legal action, or further financial penalties. Conclusion: The San Antonio Texas Forbearance Agreement — With Release Provision is an essential legal instrument designed to provide temporary relief for borrowers facing financial difficulties. Whether it's a mortgage or student loan forbearance agreement, this document enables parties to establish a structured repayment plan while releasing specific obligations. Understanding and utilizing these agreements properly can provide significant financial security during challenging times.Title: Understanding the San Antonio Texas Forbearance Agreement — With Release Provision: Types and Detailed Description Introduction: The San Antonio Texas Forbearance Agreement — With Release Provision is a legal document designed to provide temporary relief for parties involved in loan defaults or financial hardships. This agreement allows for debtors and creditors to reach an understanding, ensuring a manageable repayment plan while simultaneously releasing specific obligations among parties. Let's delve into the details and different types of this agreement. Types of San Antonio Texas Forbearance Agreement — With Release Provision: 1. Mortgage Forbearance Agreement: This type of forbearance agreement is commonly used by homeowners facing mortgage payment challenges. It allows borrowers to suspend or reduce mortgage payments temporarily, providing a breathing space to stabilize their financial situation. 2. Student Loan Forbearance Agreement: Specifically addressing student loans, this type of agreement grants individuals temporary relief from making regular monthly payments. It offers flexibility during financial hardships, ensuring borrowers do not default on their education-related debt obligations. Detailed Description: A San Antonio Texas Forbearance Agreement — With Release Provision typically includes the following key components: 1. Parties involved: Clearly specifies the identities and roles of the borrower and lender involved in the agreement. 2. Loan details and amount: Provides a comprehensive overview of the loan, including the principal amount, interest rate, and the repayment terms originally agreed upon. 3. Default circumstances: Outlines the reasons or circumstances leading to the borrower's inability to fulfill their loan obligations, such as loss of employment, medical emergencies, or other valid hardships. 4. Temporary suspension of payments: Describes the agreed-upon period during which the borrower is allowed to temporarily halt or reduce repayments. The parties determine a specific timeline for this forbearance. 5. Reinstatement plan: Defines the terms and conditions for loan repayment after the forbearance period ends. This includes details on the resumption of regular payments and any potential modifications to the loan terms to accommodate the borrower's financial situation. 6. Release provision: Highlights the specific obligations that will be released by the lender after the forbearance agreement ends. This provision ensures that upon successful completion of the agreement, the lender waives certain claims against the borrower, providing relief from legal liabilities. 7. Legal implications: Emphasizes that the forbearance agreement is a legally binding contract, with both parties committing to its terms and conditions. 8. Possible consequences: Outlines the potential repercussions if the borrower fails to meet the terms of the forbearance agreement, such as foreclosure, legal action, or further financial penalties. Conclusion: The San Antonio Texas Forbearance Agreement — With Release Provision is an essential legal instrument designed to provide temporary relief for borrowers facing financial difficulties. Whether it's a mortgage or student loan forbearance agreement, this document enables parties to establish a structured repayment plan while releasing specific obligations. Understanding and utilizing these agreements properly can provide significant financial security during challenging times.