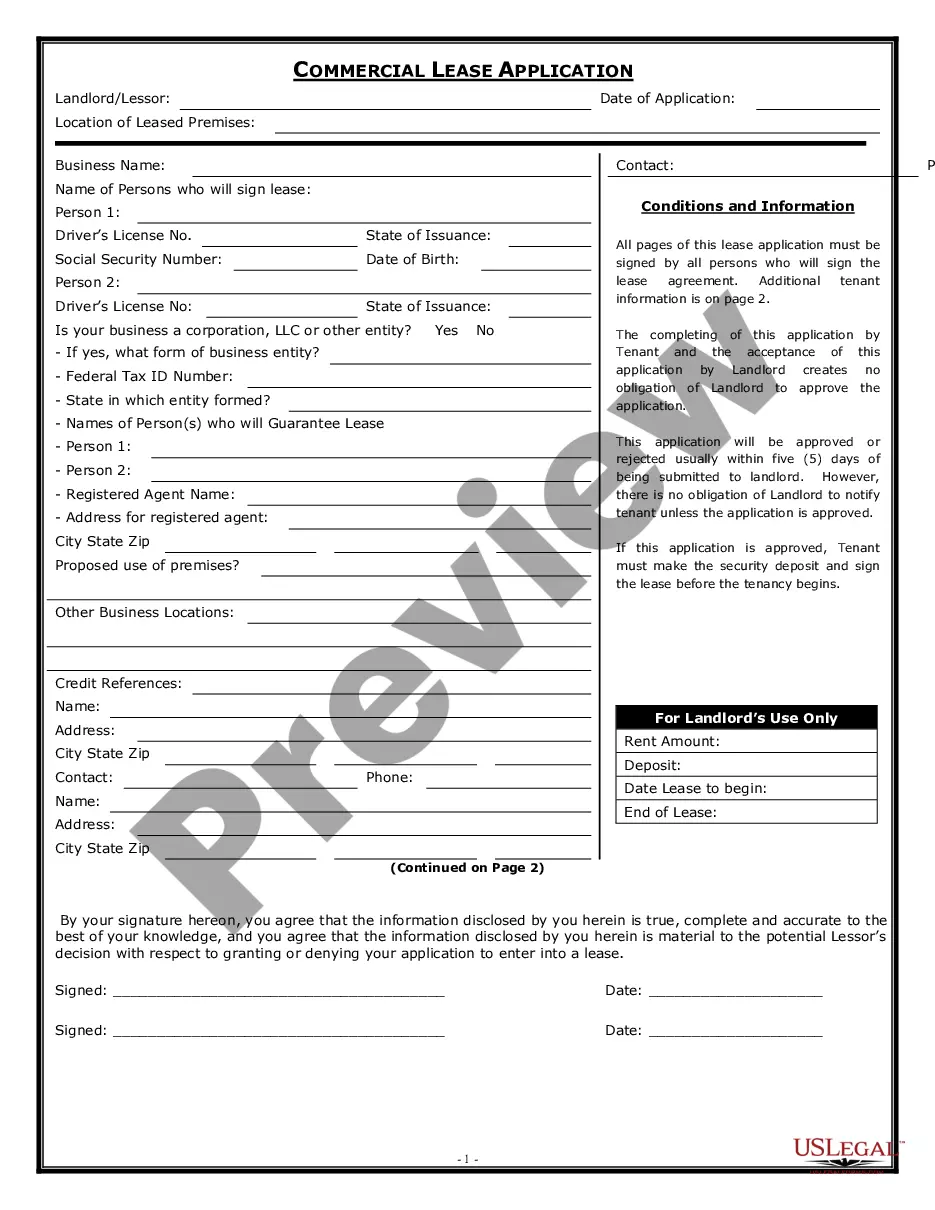

Chicago Illinois Consumer Credit Application is a formal document that individuals residing in Chicago, Illinois, can use to apply for consumer credit. This application is often required by various financial institutions, lenders, or credit providers in the area to gather crucial information from prospective borrowers. It allows lenders to assess an applicant's creditworthiness before granting them credit. The Chicago Illinois Consumer Credit Application typically includes several sections and requires applicants to provide detailed personal and financial information. The application form may vary slightly depending on the lender or credit provider; however, some common sections found in most applications include: 1. Personal Information: This section gathers essential personal details such as full name, residential address, contact information, social security number, date of birth, and marital status. These details help establish the applicant's identity and residence. 2. Employment Information: In this section, applicants are required to provide details about their current and past employment, including the employer's name, address, and contact information. It may also include information about the applicant's job title, length of employment, and income. 3. Financial Information: This section aims to understand the applicant's financial standing and includes details like monthly income, other sources of income, monthly expenses, outstanding debts, and existing credit lines. It may also request information about assets such as property, vehicles, or investments. 4. Credit History: Lenders often request information about an applicant's credit history, including details about current and previous credit accounts, outstanding loans, payment history, bankruptcies, foreclosures, or any other financial-related legal issues. 5. References: Some applications require applicants to provide references, such as friends, family members, or colleagues who can confirm their character and financial stability. These references may be contacted to validate the applicant's credibility. Different types of Consumer Credit Applications that may be available in Chicago, Illinois, include: 1. Mortgage Loan Application: Specifically for individuals applying for a mortgage to purchase or refinance a property in Chicago. 2. Auto Loan Application: Designed for individuals seeking financing for purchasing a vehicle in Chicago. 3. Personal Loan Application: Used by individuals who require personal credit for purposes such as debt consolidation, education, home improvements, or unexpected expenses. 4. Credit Card Application: Used to apply for a credit card offered by various financial institutions or credit card providers operating in Chicago. By completing the Chicago Illinois Consumer Credit Application accurately and thoroughly, applicants increase their chances of securing the desired credit. It is crucial to read and understand the terms and conditions associated with each specific credit application, as they may vary depending on the lender or credit provider.

Chicago Illinois Consumer Credit Application

Description

How to fill out Chicago Illinois Consumer Credit Application?

Do you need to quickly draft a legally-binding Chicago Consumer Credit Application or probably any other document to manage your own or business affairs? You can go with two options: hire a professional to write a legal document for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant document templates, including Chicago Consumer Credit Application and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Chicago Consumer Credit Application is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Chicago Consumer Credit Application template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!