Kings New York Consumer Credit Application is a comprehensive and user-friendly process designed to help individuals apply for credit in Kings New York. This application serves as a vital tool for those seeking financial assistance, whether it's for personal expenses, education, or even purchasing a new home or car. The Kings New York Consumer Credit Application consists of a series of detailed forms and documents that individuals need to fill out accurately to be considered for credit. It requires applicants to provide their personal information, such as their full name, contact details, social security number, date of birth, and current address. In addition to personal information, the application also requires applicants to disclose their employment details, including their current occupation, monthly income, and the length of employment. This information helps lenders assess an applicant's ability to repay the borrowed amount. Furthermore, the application may require individuals to provide details about their current financial situation, including their monthly expenses, outstanding debts, and assets such as real estate, vehicles, investments, and savings. These details help lenders evaluate an applicant's financial stability and make informed decisions regarding credit approval. Apart from the standard Kings New York Consumer Credit Application, there may be different types or variations available to cater to specific credit needs. These may include: 1. Kings New York Consumer Credit Application for Mortgages: This application specializes in credit specifically for purchasing or refinancing a home. It typically requires additional information such as property details, loan amount, down payment, and existing mortgage details. 2. Kings New York Consumer Credit Application for Auto Loans: This application focuses on credit options for individuals looking to finance the purchase of a vehicle. It may require additional details such as the make, model, year, and mileage of the desired vehicle. 3. Kings New York Consumer Credit Application for Personal Loans: This application is suitable for individuals seeking credit for personal expenses, such as medical bills, home improvements, vacations, or debt consolidation. It may require details about the purpose of the loan and the desired loan amount. It is crucial to mention that the requirements and details mentioned above are just general examples, and the actual Kings New York Consumer Credit Application may include additional or different sections depending on the lender's policies and specific credit products. Overall, the Kings New York Consumer Credit Application aims to streamline the credit approval process while ensuring transparency and accuracy. By providing comprehensive information, applicants increase their chances of securing credit and achieving their financial goals.

Kings New York Consumer Credit Application

Description

How to fill out Kings New York Consumer Credit Application?

Preparing paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Kings Consumer Credit Application without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Kings Consumer Credit Application by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Kings Consumer Credit Application:

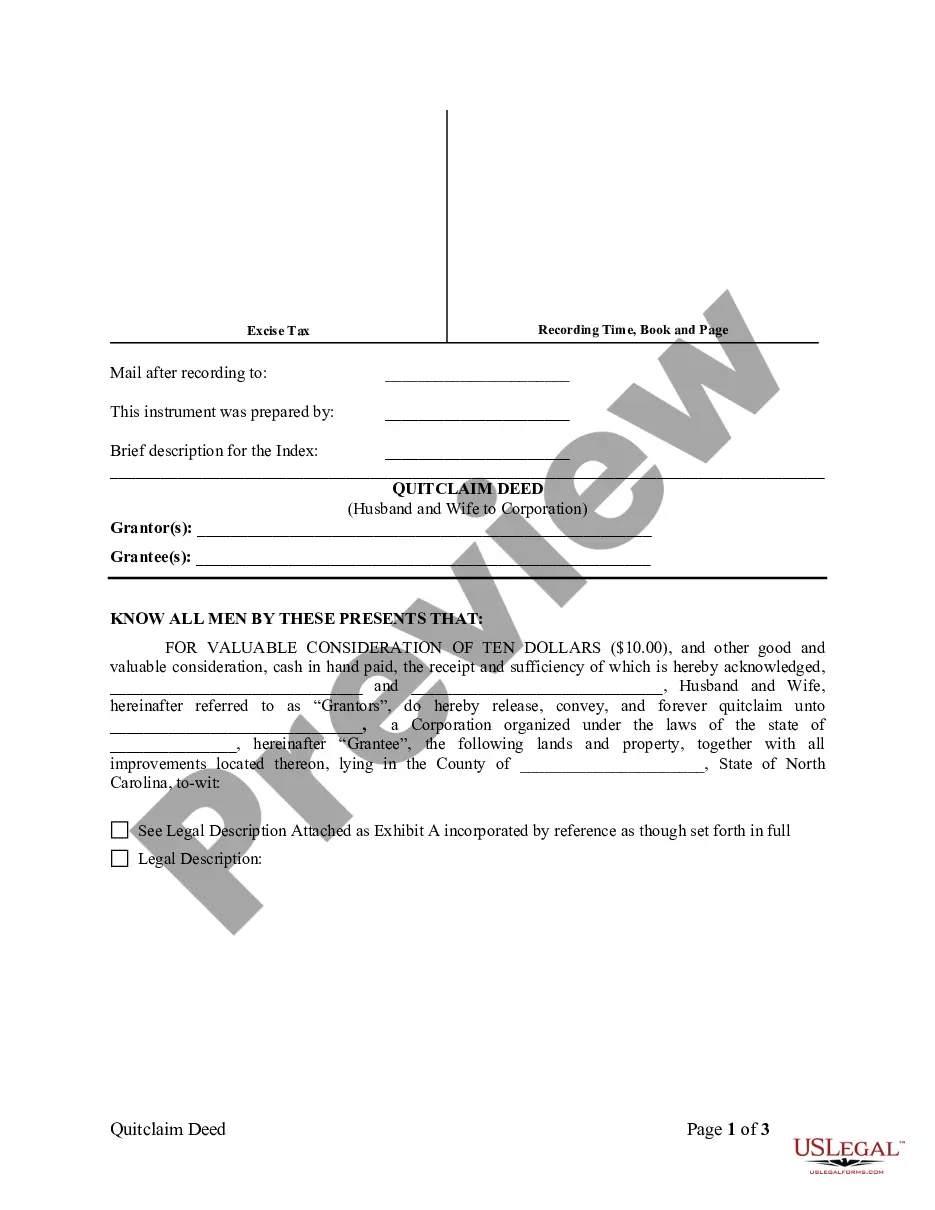

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!