Maricopa Arizona Consumer Credit Application is a comprehensive document designed to collect necessary information from individuals residing in Maricopa, Arizona, who are seeking to apply for consumer credit. Consumer credit refers to the borrowing of funds for personal or household purposes, such as purchasing a car, home appliances, or funding educational expenses. To ensure a smooth and efficient application process, the Maricopa Arizona Consumer Credit Application gathers key details essential for credit assessment and approval. These details typically include the applicant's personal information, contact details, employment information, financial statements, and credit history. The Maricopa Arizona Consumer Credit Application is typically used by various financial institutions, such as banks, credit unions, and lenders, operating within Maricopa, Arizona. These institutions offer different types of consumer credit, tailored to specific needs and preferences. Some common types of consumer credit applications in Maricopa, Arizona, include: 1. Auto Loan Application: This type of application is specifically designed for individuals seeking financing to purchase a vehicle. It collects relevant information on the desired vehicle, including make, model, year, and mileage, along with the applicant's employment history and financial status. 2. Home Loan Application: Individuals looking to buy a home or refinance an existing mortgage can utilize this type of consumer credit application. It involves a more extensive assessment of the applicant's financial standing, including income, assets, expenses, and credit history. 3. Personal Loan Application: A personal loan application is ideal for those seeking funds for various personal purposes, such as debt consolidation, home improvements, or unexpected expenses. This application typically requires information on the desired loan amount, purpose, and the applicant's ability to repay. 4. Credit Card Application: This application is tailored for individuals interested in obtaining a credit card with a financial institution in Maricopa, Arizona. It collects information on the applicant's financial background, including income, employment, and outstanding debts. These are just a few examples of the various Maricopa Arizona Consumer Credit Applications that individuals in Maricopa, Arizona, may encounter. Each application aims to gather specific details necessary for the lender to assess the applicant's creditworthiness and make an informed decision on whether to grant the consumer credit.

Maricopa Arizona Consumer Credit Application

Description

How to fill out Maricopa Arizona Consumer Credit Application?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Maricopa Consumer Credit Application, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Consumer Credit Application from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Consumer Credit Application:

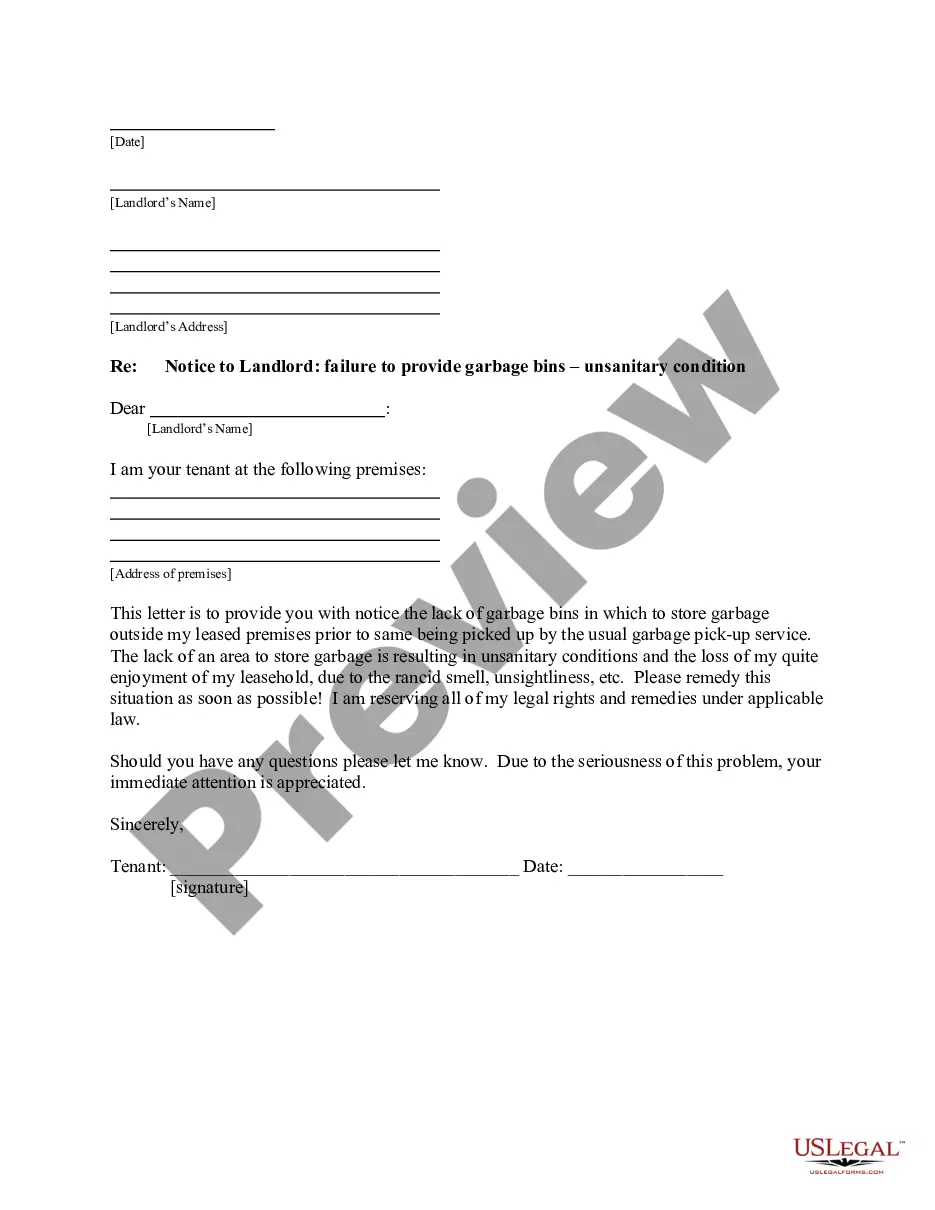

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!