Hennepin Minnesota Customer Invoice is a document issued by Hennepin County, Minnesota to customers for the purpose of billing and itemizing charges related to various county services or products. It serves as a record of the transaction and outlines the details of the services provided or items purchased. The Hennepin Minnesota Customer Invoice includes essential information such as the customer's name, address, and contact details. Additionally, it incorporates unique identification numbers, invoice date, and a reference number which aids in tracking and managing the invoice. The invoice also features a breakdown of charges, including the description of services or items, quantity, unit price, subtotal, and any applicable taxes or discounts. Furthermore, Hennepin Minnesota offers different types of customer invoices based on the services provided or the department involved. Some notable types of Hennepin Minnesota Customer Invoices include: 1. Property Tax Invoice: This type of invoice is specifically issued for property owners for the collection of property taxes and related charges. It encompasses details such as property identification number, tax amount, payment due date, and relevant contact information for inquiries. 2. Vehicle Registration Invoice: Hennepin Minnesota issues invoices to vehicle owners for the registration of their vehicles within the county. It itemizes the registration fees, taxes, and other charges associated with maintaining a valid vehicle registration. 3. Utility Billing Invoice: Invoices of this kind are generated based on the usage of utilities such as water, sewer, and waste management services provided by the county. It outlines the consumption details, unit prices, and calculates the total amount due. 4. Permit Fee Invoice: Hennepin Minnesota invoices customers for various permits such as building permits, plumbing permits, electrical permits, etc. These invoices include the detailed description of the permit, associated fees, and any necessary inspection charges. 5. Licensing Invoice: This type of invoice pertains to licenses issued by Hennepin Minnesota, such as business licenses or professional licenses. It provides a breakdown of the licensing fees, renewal dates, and any additional charges. 6. Court Fine Invoice: In cases where individuals are issued fines or penalties for offenses committed within Hennepin County, the court issues invoices detailing the fines, due dates, and instructions for payment. It is important for customers to carefully review their Hennepin Minnesota Customer Invoice to ensure accuracy and address any discrepancies promptly. Customers are typically provided with multiple payment options, including online payments, mail-in payments, or in-person payment at designated county offices.

Hennepin Minnesota Customer Invoice

Description

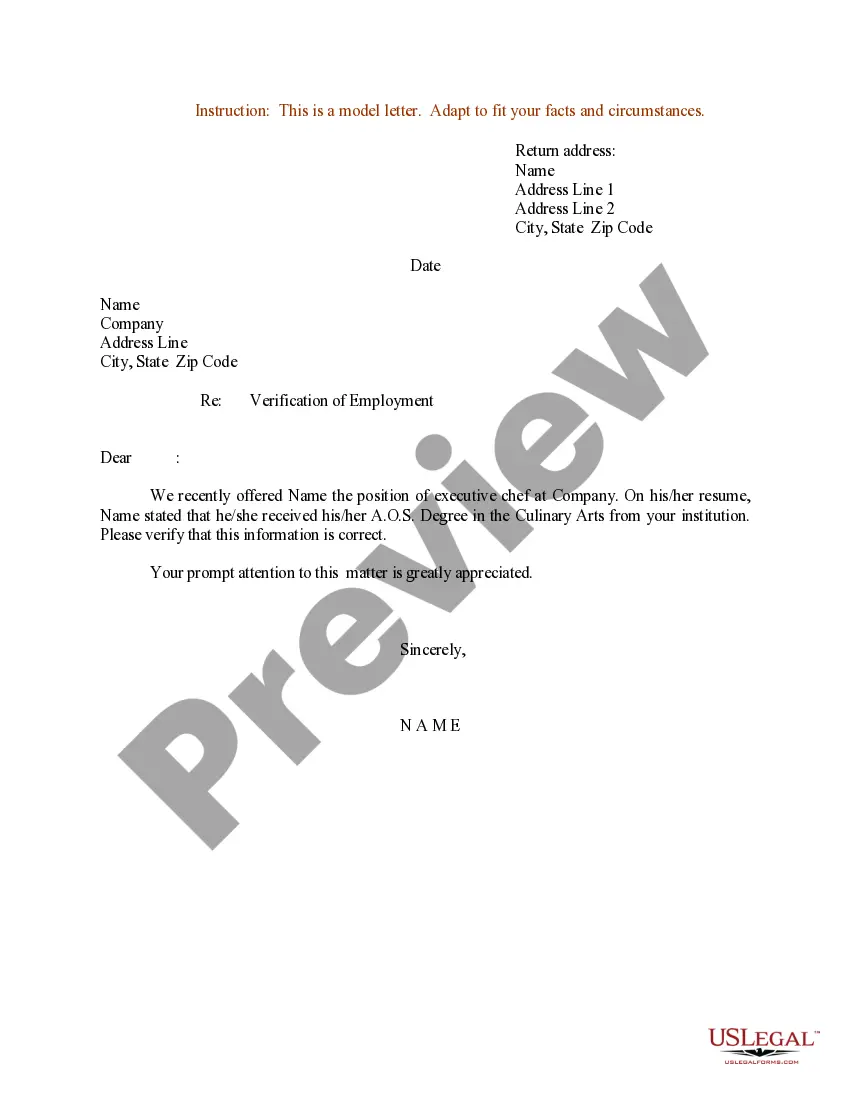

How to fill out Hennepin Minnesota Customer Invoice?

Drafting papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Hennepin Customer Invoice without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Hennepin Customer Invoice by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Hennepin Customer Invoice:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!