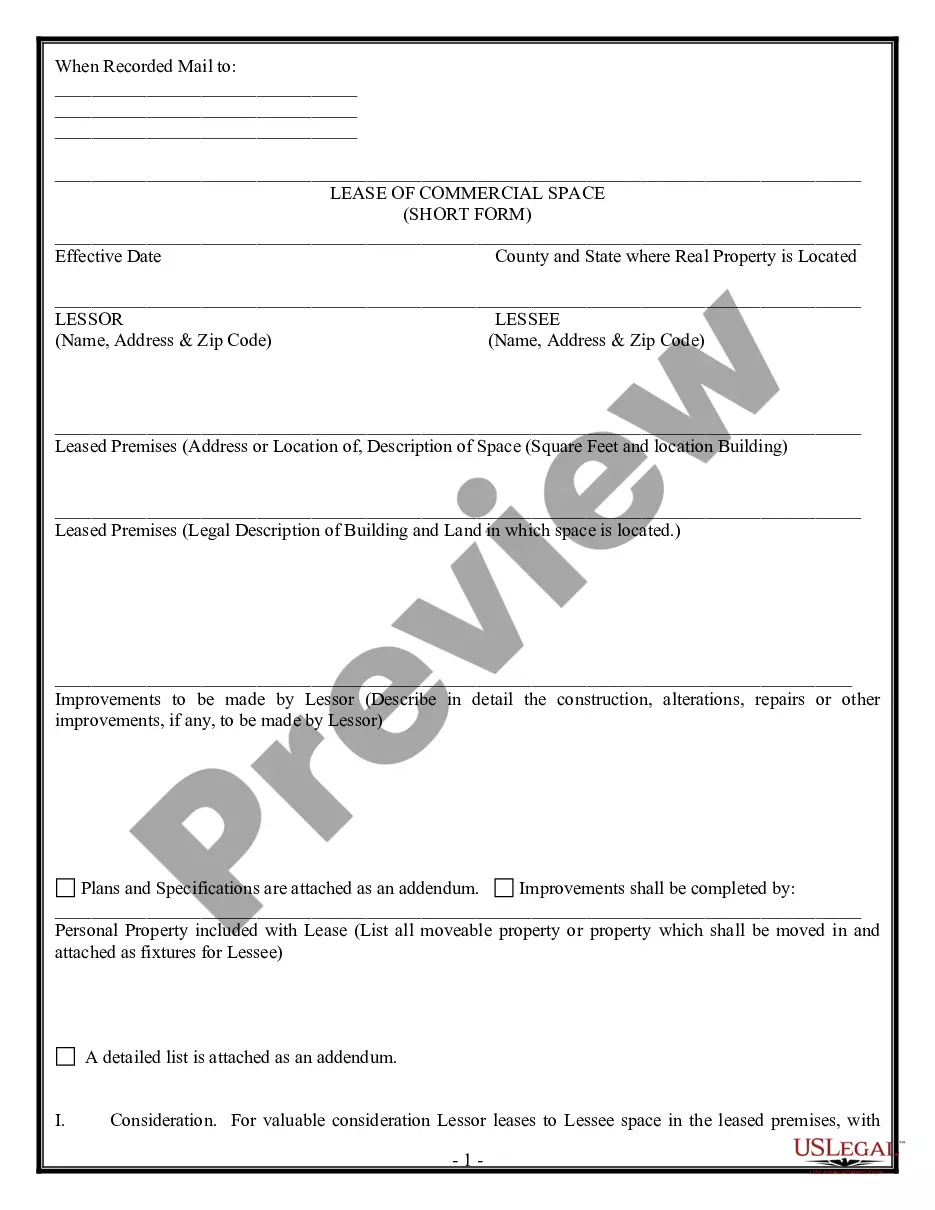

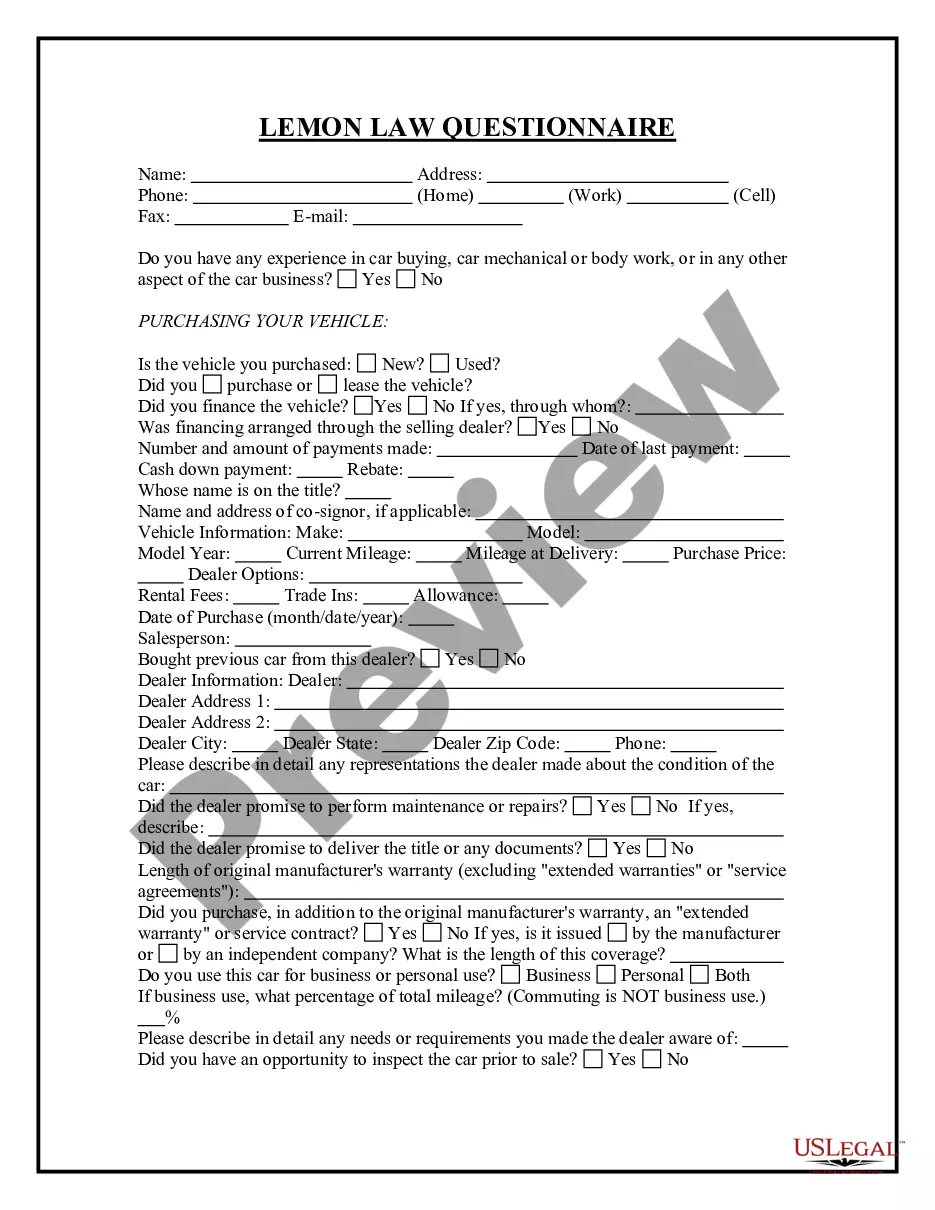

Chicago, Illinois Notice of Default on Promissory Note Installment, also referred to as Notice of Default on Promissory Note, is a legal document that outlines the details and consequences of defaulting on a promissory note installment in the city of Chicago, Illinois. This notice serves as a formal communication to the borrower notifying them of their failure to make the required payments on the promissory note according to the agreed terms. In Chicago, Illinois, there are different types of Notice of Default on Promissory Note Installment, depending on various factors such as the type of loan, the lender's requirements, and the specific terms and conditions of the promissory note. Some common variations include: 1. Residential Notice of Default on Promissory Note Installment: This type of notice is applicable to default cases related to residential properties, such as homes or apartments. It states the outstanding balance, the number of missed payments, and highlights the legal repercussions the borrower may face if the default remains unresolved. 2. Commercial Notice of Default on Promissory Note Installment: This type of notice is specifically designed for default cases related to commercial properties, including office buildings, retail spaces, or industrial properties. It outlines the outstanding debt, details the number of missed payments, and provides information on potential legal consequences and actions that may be taken by the lender. 3. Vehicle Loan Notice of Default on Promissory Note Installment: This type of notice is applicable to borrowers who have defaulted on their vehicle loan installments. It includes information about the amount in default, the number of missed payments, and notifies the borrower of potential actions that can be taken by the lender, such as repossession of the vehicle. 4. Education Loan Notice of Default on Promissory Note Installment: This type of notice is specifically related to education loans, such as student loans. It informs the borrower about the outstanding balance, the number of missed payments, and the potential consequences of defaulting, which may include wage garnishment, a negative impact on credit score, or legal action. A Chicago, Illinois Notice of Default on Promissory Note Installment is an important legal document that protects the rights and interests of lenders while informing borrowers about their obligations. As defaulting on a promissory note installment can have serious consequences, it is crucial for borrowers to understand the terms and conditions of their loan agreements and take appropriate actions to prevent default.

Chicago Illinois Notice of Default on Promissory Note Installment

Description

How to fill out Chicago Illinois Notice Of Default On Promissory Note Installment?

Draftwing forms, like Chicago Notice of Default on Promissory Note Installment, to manage your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for a variety of scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Notice of Default on Promissory Note Installment form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Chicago Notice of Default on Promissory Note Installment:

- Make sure that your template is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Chicago Notice of Default on Promissory Note Installment isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!