Oakland County, Michigan is a vibrant and populous county located in the southeastern part of the state. It is home to several cities, including Auburn Hills, Troy, and Rochester Hills. Oakland County is known for its diverse communities, beautiful landscapes, and thriving economy. The county offers a wide range of attractions, such as parks, recreational activities, shopping centers, and cultural events. In the context of finance, an Oakland Michigan Notice of Default on Promissory Note Installment refers to a legal document issued by a lender to a borrower who has failed to make timely payments on a promissory note installment. This notice serves as a formal warning that the borrower is in default and provides them with an opportunity to rectify the situation before further legal action or foreclosure proceedings are initiated. There are various types of Oakland Michigan Notice of Default on Promissory Note Installment, each serving a specific purpose: 1. Preliminary Notice of Default: This type of notice is typically sent to the borrower before the formal notice of default. It serves as a courtesy reminder and allows the borrower a final chance to bring their payments up to date. 2. Notice of Default: This is the official notice sent by the lender to inform the borrower that they are in default on their promissory note installment. It outlines the specific terms of the default and provides a timeframe within which the borrower must cure the default. 3. Notice of Intent to Accelerate: If the borrower fails to address the default outlined in the notice of default, the lender may issue a notice of intent to accelerate. This notice informs the borrower that the entire outstanding loan balance may become due immediately if the default is not rectified within a specified period. 4. Notice of Default Cure Period Expiration: If the borrower fails to cure the default within the specified timeframe in the previous notices, the lender may send a notice of default cure period expiration. This notice informs the borrower that they have exhausted their opportunity to bring the loan current, and further legal actions, such as foreclosure, may be pursued. It is important for borrowers to understand the consequences of receiving an Oakland Michigan Notice of Default on Promissory Note Installment. Failure to address the default can result in serious outcomes, including foreclosure and damage to one's credit score. Seeking legal advice and exploring options for loan modification or repayment plans can help borrowers navigate through the default process and potentially avoid foreclosure.

Oakland Michigan Notice of Default on Promissory Note Installment

Description

How to fill out Oakland Michigan Notice Of Default On Promissory Note Installment?

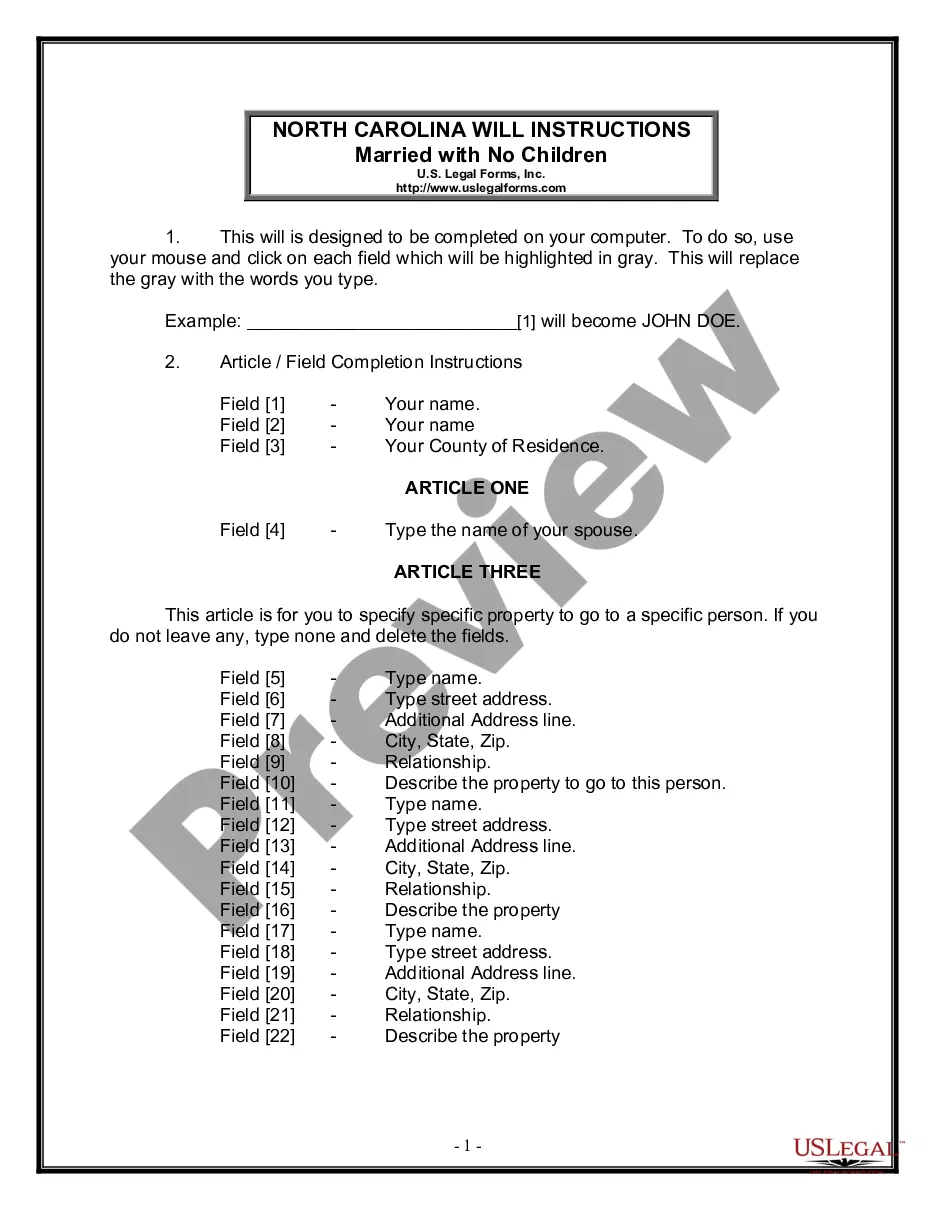

Are you looking to quickly create a legally-binding Oakland Notice of Default on Promissory Note Installment or probably any other form to manage your personal or business matters? You can go with two options: hire a professional to draft a legal paper for you or draft it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific form templates, including Oakland Notice of Default on Promissory Note Installment and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Oakland Notice of Default on Promissory Note Installment is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Oakland Notice of Default on Promissory Note Installment template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!