San Antonio, Texas Notice of Default on Promissory Note Installment is a legal document that conveys important information regarding a default on a promissory note installment in San Antonio, Texas. This notice is typically issued by the lender when the borrower fails to make the required payment on time. In San Antonio, Texas, there are primarily two types of Notice of Default on Promissory Note Installment: 1. Judicial Notice of Default: This type of notice is a formal notification served to the borrower by the lender through the court system. It initiates a legal process that allows the lender to take legal action against the borrower for defaulting on their promissory note installment. The lender seeks to enforce their rights to the collateral stated in the promissory note. 2. Non-Judicial Notice of Default: Also known as a Trustee's Sale, this type of notice does not involve the court system. It is a preliminary step before the foreclosure process begins. In this case, the lender notifies the borrower of the default and provides a specific period for the borrower to rectify the default. If the borrower fails to cure the default within the specified time, the lender may initiate foreclosure proceedings. When drafting a San Antonio, Texas Notice of Default on Promissory Note Installment, it is crucial to include specific details to ensure legal compliance. Some relevant keywords that should be incorporated might include: — Borrower's information: Include the borrower's name, address, contact details, and any other identifying information. — Lender's information: Include the lender's name, address, and contact details. — Promissory note details: Provide the date when the promissory note was executed, the principal amount, interest rate, installment terms, and maturity date. — Default details: Clearly state the amount of the missed payment, the specific due date, and the number of days the payment has been outstanding. — Cure period: Specify the number of days within which the borrower must cure the default to avoid further legal actions. — Consequences of default: Explain the potential consequences of continuing to default, such as acceleration of the debt, potential foreclosure, or legal action. — Contact details: Provide the lender's contact information for the borrower to address any concerns or inquiries regarding the default. It is crucial to consult with an attorney experienced in real estate or finance law to ensure the San Antonio, Texas Notice of Default on Promissory Note Installment complies with all local, state, and federal laws, as the specific requirements may vary.

San Antonio Texas Notice of Default on Promissory Note Installment

Description

How to fill out San Antonio Texas Notice Of Default On Promissory Note Installment?

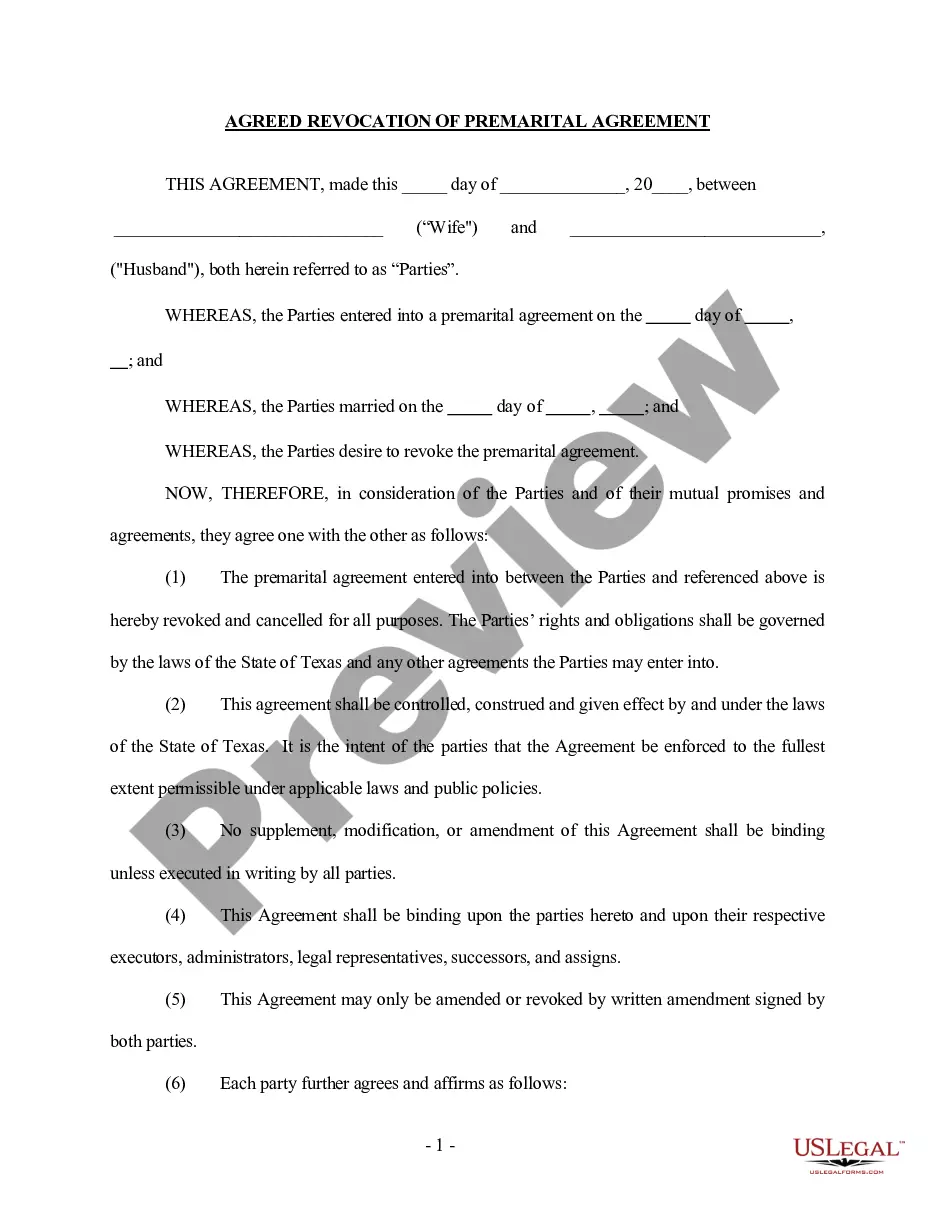

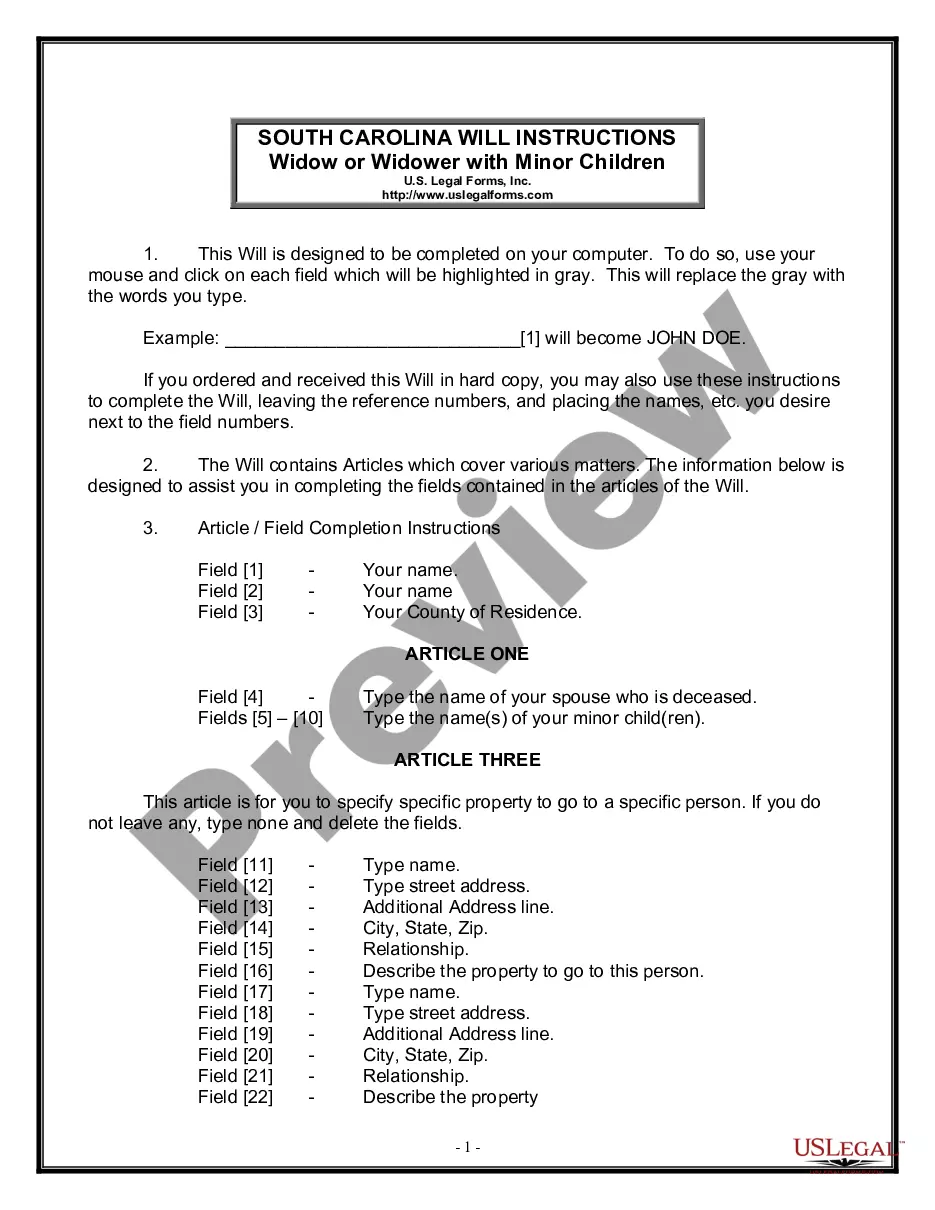

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Antonio Notice of Default on Promissory Note Installment, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the current version of the San Antonio Notice of Default on Promissory Note Installment, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Notice of Default on Promissory Note Installment:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your San Antonio Notice of Default on Promissory Note Installment and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!