San Jose, California — Notice of Default on Promissory Note Installment is a legal document that represents a significant step in the foreclosure process. It is issued to a borrower who has failed to make the required payments on their promissory note, signaling the lender's intention to initiate foreclosure proceedings. The Notice of Default serves as a formal notification to the borrower that they are in default on their loan and must take immediate action to rectify the situation. The document outlines the specific terms of the promissory note, such as the original loan amount, interest rate, repayment terms, and installment schedule, as well as the amount of the outstanding balance and arrears. In San Jose, California, there may be various types of Notice of Default on Promissory Note Installment, including: 1. Judicial Notice of Default: This is the most common type of Notice of Default in San Jose, California. It is issued when the lender decides to pursue a foreclosure through the court system. 2. Non-Judicial Notice of Default: In some cases, the promissory note may include a power of sale clause, allowing lenders to foreclose on the property without going through the court system. This type of Notice of Default initiates a non-judicial foreclosure process. 3. Pre-Foreclosure Notice of Default: This Notice of Default is typically sent before the actual foreclosure proceedings begin, giving the borrower a chance to bring their payments current or negotiate a repayment plan. It serves as a warning that legal action is imminent if the borrower does not address the defaulted payments. The issuance of a Notice of Default on Promissory Note Installment is a crucial step for lenders to protect their legal rights and initiate foreclosure proceedings in case the borrower fails to rectify the default. This document is an important legal tool that ensures transparency and gives both parties a clear understanding of the situation. If you find yourself receiving a San Jose, California — Notice of Default on Promissory Note Installment, it is imperative to seek legal advice immediately to explore your options and potentially save your property from foreclosure.

San Jose California Notice of Default on Promissory Note Installment

Description

How to fill out San Jose California Notice Of Default On Promissory Note Installment?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Jose Notice of Default on Promissory Note Installment, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the recent version of the San Jose Notice of Default on Promissory Note Installment, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Jose Notice of Default on Promissory Note Installment:

- Look through the page and verify there is a sample for your area.

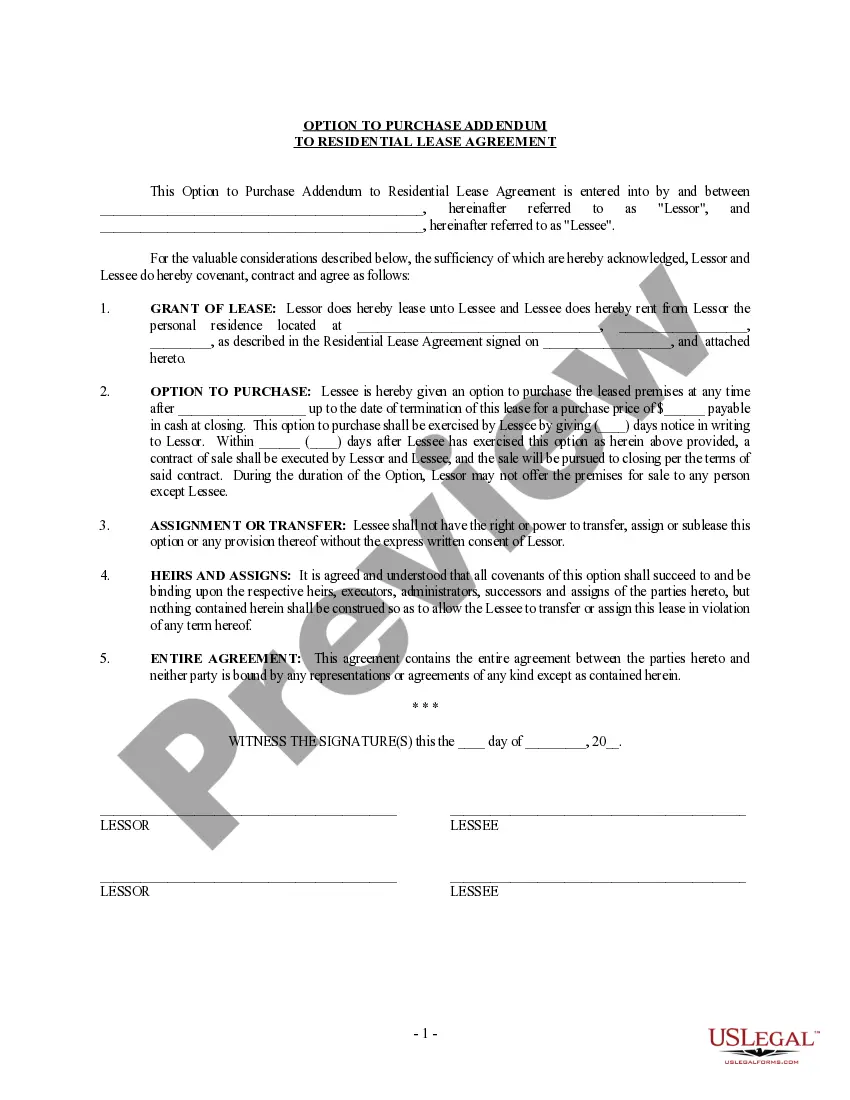

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your San Jose Notice of Default on Promissory Note Installment and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!