As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

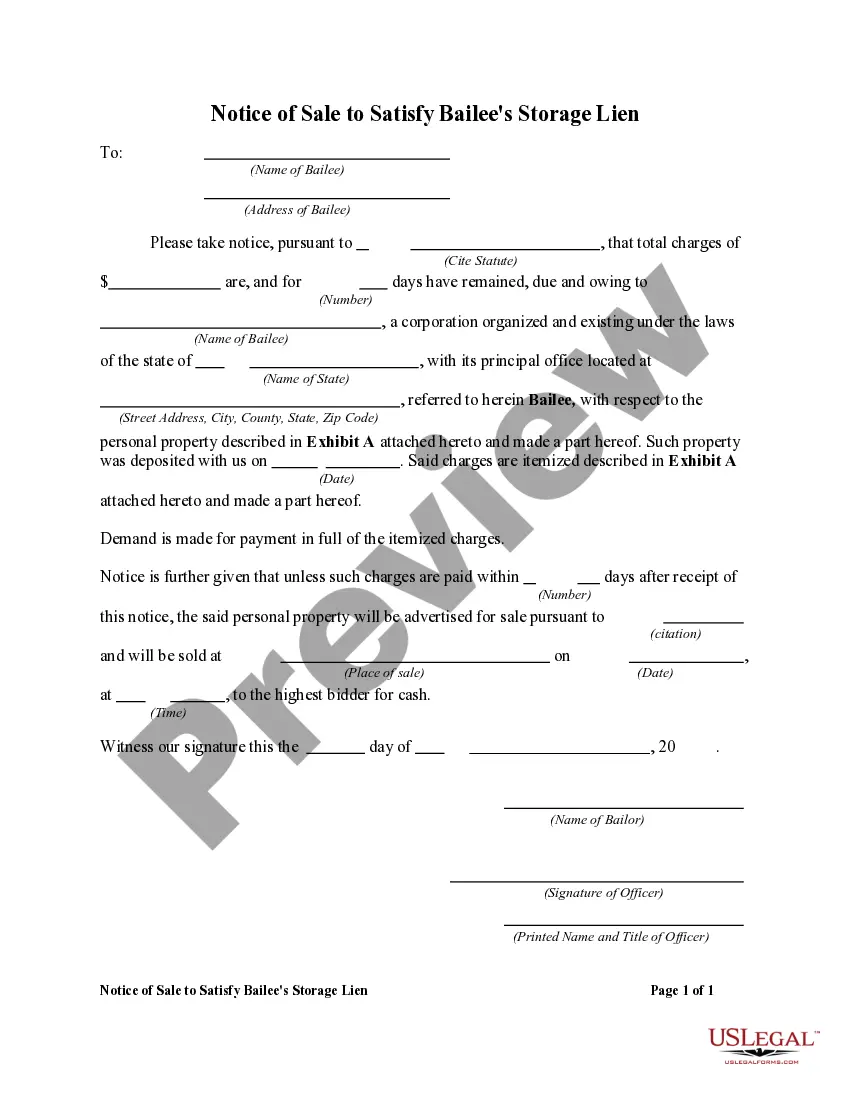

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document designed to outline the terms and conditions for obtaining a business loan in Cuyahoga County, Ohio. This agreement serves as a binding contract between the borrower, typically a business entity, and the lender, such as a bank or financial institution. The Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a detailed framework for the loan application process and the rights and responsibilities of both parties involved. It typically includes the following sections: 1. Purpose: This section explains the purpose of the loan and outlines the specific intended use of funds, whether it be for starting a new business, expanding an existing one, purchasing equipment, or any other valid business need. 2. Loan Application: Here, the borrower must provide comprehensive information about their business, including its legal name, address, tax identification number, and financial details. The application may require additional documentation, such as financial statements, business plans, and personal financial information from the borrower's principals. 3. Loan Amount and Terms: This section specifies the requested loan amount, the proposed interest rate, and the repayment terms. It outlines whether the loan will be repaid in fixed monthly installments or through a flexible payment schedule. The term of the loan, expressed in months or years, is also defined here. 4. Loan Warranties: The borrower is required to provide certain warranties to the lender, which includes statements regarding the accuracy of all information provided in the application and any accompanying documentation. The borrower must warrant that they have the legal authority to borrow funds on behalf of the business. 5. Collateral and Security: If the business loan requires collateral, this section explains the type of collateral accepted by the lender and how it will be used to secure the loan. The collateral may include assets such as real estate, equipment, inventory, or accounts receivable. 6. Default and Remedies: This part of the agreement outlines the consequences of defaulting on the loan and details the actions the lender may take to recover the outstanding debt. It may include provisions for late payment penalties, acceleration of the loan, or the initiation of legal proceedings. 7. Governing Law and Jurisdiction: This section identifies the jurisdiction that governs the loan agreement, typically selecting Ohio law, as well as the specific county within Ohio, namely Cuyahoga County. It also outlines the venue for any disputes that may arise between the borrower and the lender. While there might not be different types of Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower, variations or adaptations of this agreement may occur depending on specific business loan programs or lender requirements within Cuyahoga County. Therefore, it is always recommended consulting legal professionals or lenders to obtain the most up-to-date and accurate documentation for a business loan in this region.Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document designed to outline the terms and conditions for obtaining a business loan in Cuyahoga County, Ohio. This agreement serves as a binding contract between the borrower, typically a business entity, and the lender, such as a bank or financial institution. The Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a detailed framework for the loan application process and the rights and responsibilities of both parties involved. It typically includes the following sections: 1. Purpose: This section explains the purpose of the loan and outlines the specific intended use of funds, whether it be for starting a new business, expanding an existing one, purchasing equipment, or any other valid business need. 2. Loan Application: Here, the borrower must provide comprehensive information about their business, including its legal name, address, tax identification number, and financial details. The application may require additional documentation, such as financial statements, business plans, and personal financial information from the borrower's principals. 3. Loan Amount and Terms: This section specifies the requested loan amount, the proposed interest rate, and the repayment terms. It outlines whether the loan will be repaid in fixed monthly installments or through a flexible payment schedule. The term of the loan, expressed in months or years, is also defined here. 4. Loan Warranties: The borrower is required to provide certain warranties to the lender, which includes statements regarding the accuracy of all information provided in the application and any accompanying documentation. The borrower must warrant that they have the legal authority to borrow funds on behalf of the business. 5. Collateral and Security: If the business loan requires collateral, this section explains the type of collateral accepted by the lender and how it will be used to secure the loan. The collateral may include assets such as real estate, equipment, inventory, or accounts receivable. 6. Default and Remedies: This part of the agreement outlines the consequences of defaulting on the loan and details the actions the lender may take to recover the outstanding debt. It may include provisions for late payment penalties, acceleration of the loan, or the initiation of legal proceedings. 7. Governing Law and Jurisdiction: This section identifies the jurisdiction that governs the loan agreement, typically selecting Ohio law, as well as the specific county within Ohio, namely Cuyahoga County. It also outlines the venue for any disputes that may arise between the borrower and the lender. While there might not be different types of Cuyahoga Ohio Application and Loan Agreement for a Business Loan with Warranties by Borrower, variations or adaptations of this agreement may occur depending on specific business loan programs or lender requirements within Cuyahoga County. Therefore, it is always recommended consulting legal professionals or lenders to obtain the most up-to-date and accurate documentation for a business loan in this region.