As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

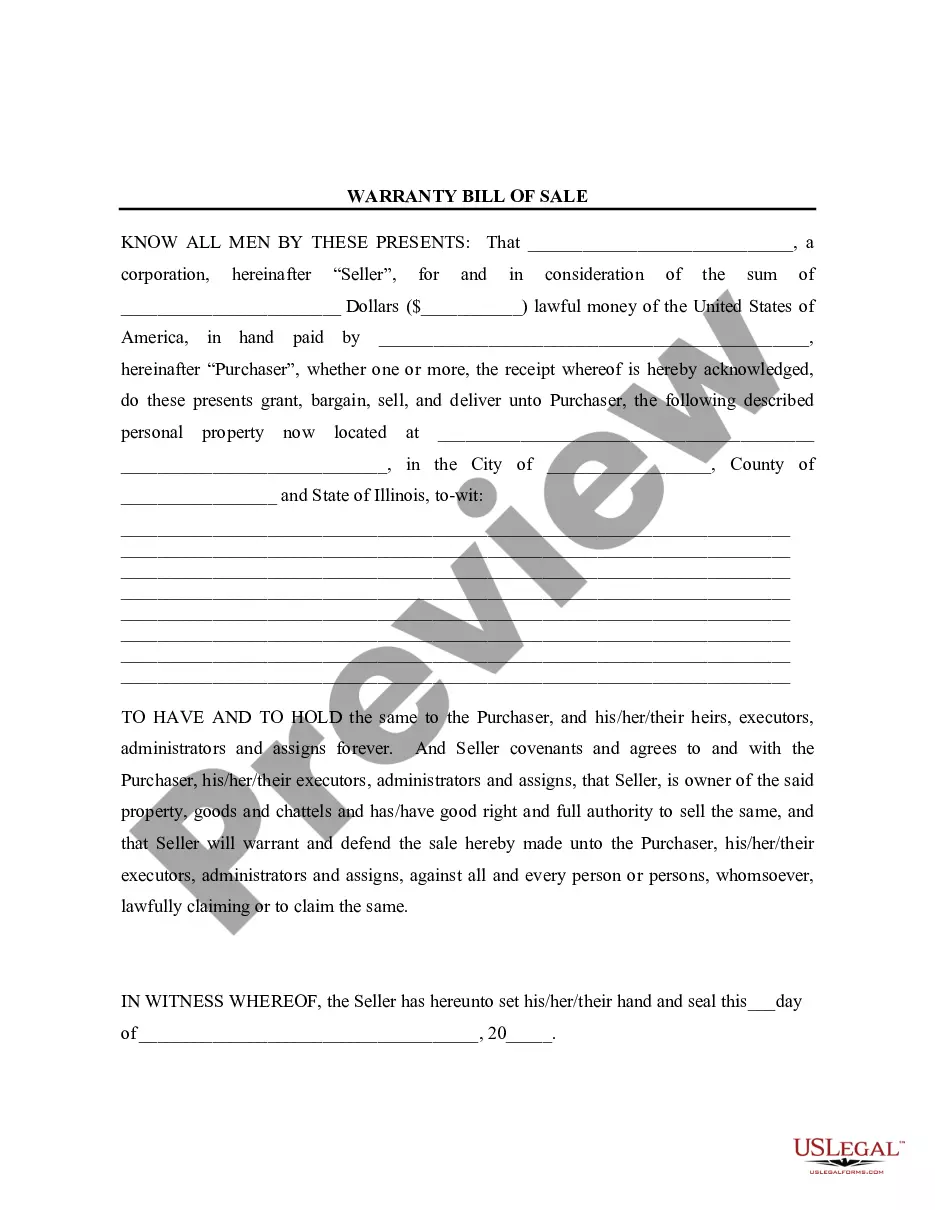

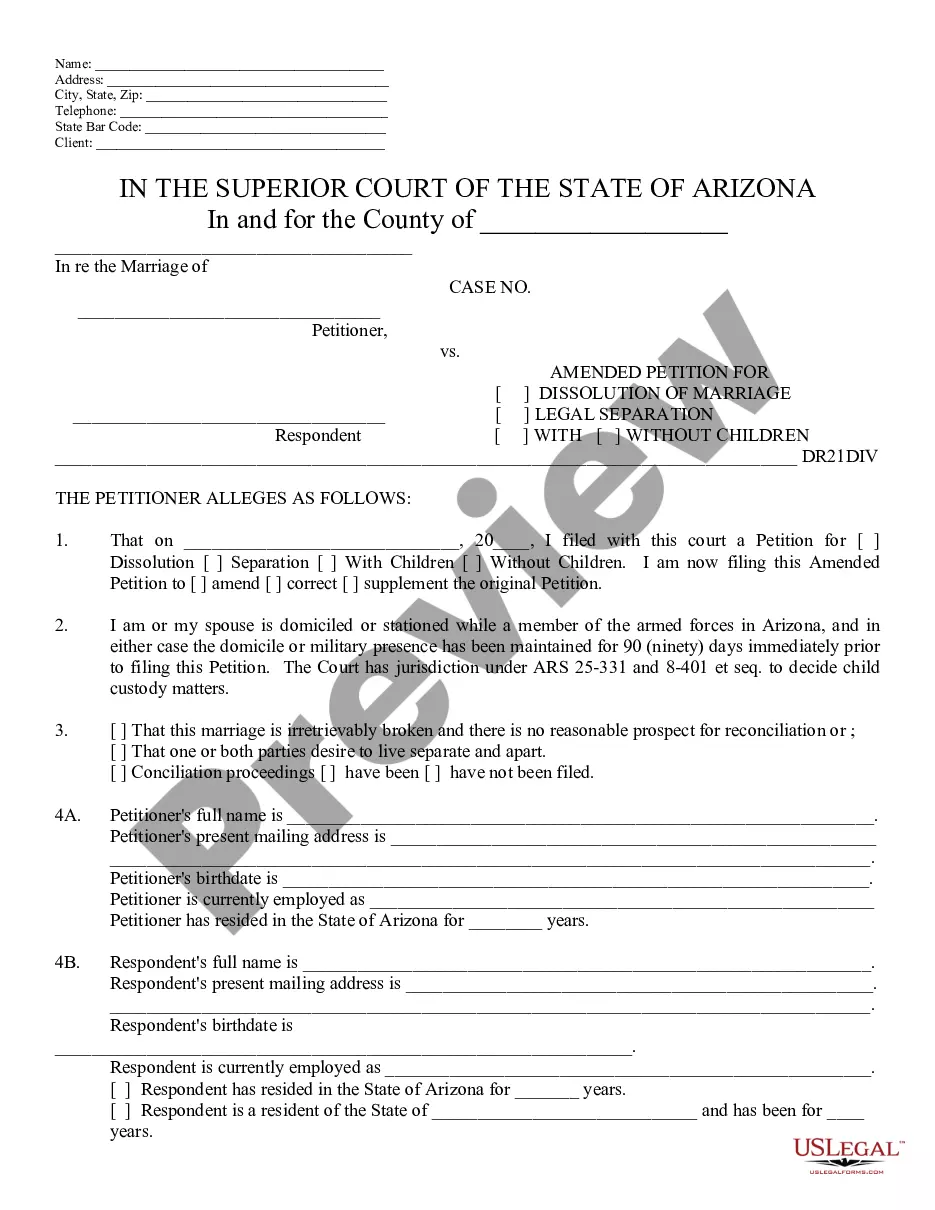

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower — A Comprehensive Overview Hillsborough Florida's Application and Loan Agreement for a Business Loan with Warranties by Borrower offers a comprehensive framework for businesses in Hillsborough, Florida, to secure financial assistance in the form of a loan. This agreement serves as a legal contract between the borrower and the lender, outlining the terms and conditions of the loan, as well as the warranties provided by the borrower. The application process begins with the completion of an application form, which typically requires information about the business, its owners, financial statements, credit history, and any collateral offered for the loan. The application serves as a crucial step for lenders to assess the borrower's creditworthiness and determine the eligibility of the loan. Once the application is submitted and reviewed, both parties can proceed with the Loan Agreement. This agreement encompasses various aspects related to the loan, such as the loan amount, interest rate, repayment terms, utilization of funds, and any specific conditions imposed by the lender. It also highlights the warranties provided by the borrower to assure the lender that certain claims and commitments are valid. The Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower emphasizes the importance of clear and honest communication between the borrower and the lender. The warranties provided by the borrower typically include but are not limited to the following: 1. Accuracy of Information: The borrower warrants that all the information provided in the application and during the loan approval process is accurate, complete, and up-to-date. This covers details about the business, financial statements, and any supporting documentation. 2. Authorization: The borrower warrants that they have the legal authority to enter into the loan agreement. This includes confirming that the borrower is a registered legal entity, has the necessary permits or licenses, and all owners or key decision-makers have consented to the loan. 3. Compliance with Laws and Regulations: The borrower warrants that their business operations comply with all applicable federal, state, and local laws and regulations. This includes having the required permits, licenses, and certifications to conduct business activities lawfully. 4. No Material Adverse Change: The borrower warrants that there have been no significant negative changes affecting the business's financial condition or solvency since the completion of the loan application. This ensures that the borrower's financial health hasn't deteriorated unexpectedly. 5. No Misrepresentation: The borrower warrants that there have been no deliberate omissions, misrepresentations, or false statements made during the loan application process. This is crucial to maintain transparency and integrity throughout the agreement. It's important to note that the Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower may have different variations or specifications based on the type of loan being requested. Some common types include: 1. Working Capital Loan Agreement 2. Equipment Financing Loan Agreement 3. Real Estate Mortgage Loan Agreement 4. Business Expansion Loan Agreement 5. Construction Loan Agreement Each of these loan agreements may have specific terms and conditions tailored to the particular purpose and nature of the loan. To ensure the best outcome, borrowers should carefully review the terms and warranties provided in each agreement variant and consult legal professionals, if necessary. In conclusion, the Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a standardized, legally binding framework for businesses seeking financial assistance. It aims to protect the interests of both the borrower and the lender while ensuring transparency and accountability throughout the loan process.Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower — A Comprehensive Overview Hillsborough Florida's Application and Loan Agreement for a Business Loan with Warranties by Borrower offers a comprehensive framework for businesses in Hillsborough, Florida, to secure financial assistance in the form of a loan. This agreement serves as a legal contract between the borrower and the lender, outlining the terms and conditions of the loan, as well as the warranties provided by the borrower. The application process begins with the completion of an application form, which typically requires information about the business, its owners, financial statements, credit history, and any collateral offered for the loan. The application serves as a crucial step for lenders to assess the borrower's creditworthiness and determine the eligibility of the loan. Once the application is submitted and reviewed, both parties can proceed with the Loan Agreement. This agreement encompasses various aspects related to the loan, such as the loan amount, interest rate, repayment terms, utilization of funds, and any specific conditions imposed by the lender. It also highlights the warranties provided by the borrower to assure the lender that certain claims and commitments are valid. The Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower emphasizes the importance of clear and honest communication between the borrower and the lender. The warranties provided by the borrower typically include but are not limited to the following: 1. Accuracy of Information: The borrower warrants that all the information provided in the application and during the loan approval process is accurate, complete, and up-to-date. This covers details about the business, financial statements, and any supporting documentation. 2. Authorization: The borrower warrants that they have the legal authority to enter into the loan agreement. This includes confirming that the borrower is a registered legal entity, has the necessary permits or licenses, and all owners or key decision-makers have consented to the loan. 3. Compliance with Laws and Regulations: The borrower warrants that their business operations comply with all applicable federal, state, and local laws and regulations. This includes having the required permits, licenses, and certifications to conduct business activities lawfully. 4. No Material Adverse Change: The borrower warrants that there have been no significant negative changes affecting the business's financial condition or solvency since the completion of the loan application. This ensures that the borrower's financial health hasn't deteriorated unexpectedly. 5. No Misrepresentation: The borrower warrants that there have been no deliberate omissions, misrepresentations, or false statements made during the loan application process. This is crucial to maintain transparency and integrity throughout the agreement. It's important to note that the Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower may have different variations or specifications based on the type of loan being requested. Some common types include: 1. Working Capital Loan Agreement 2. Equipment Financing Loan Agreement 3. Real Estate Mortgage Loan Agreement 4. Business Expansion Loan Agreement 5. Construction Loan Agreement Each of these loan agreements may have specific terms and conditions tailored to the particular purpose and nature of the loan. To ensure the best outcome, borrowers should carefully review the terms and warranties provided in each agreement variant and consult legal professionals, if necessary. In conclusion, the Hillsborough Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a standardized, legally binding framework for businesses seeking financial assistance. It aims to protect the interests of both the borrower and the lender while ensuring transparency and accountability throughout the loan process.