As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

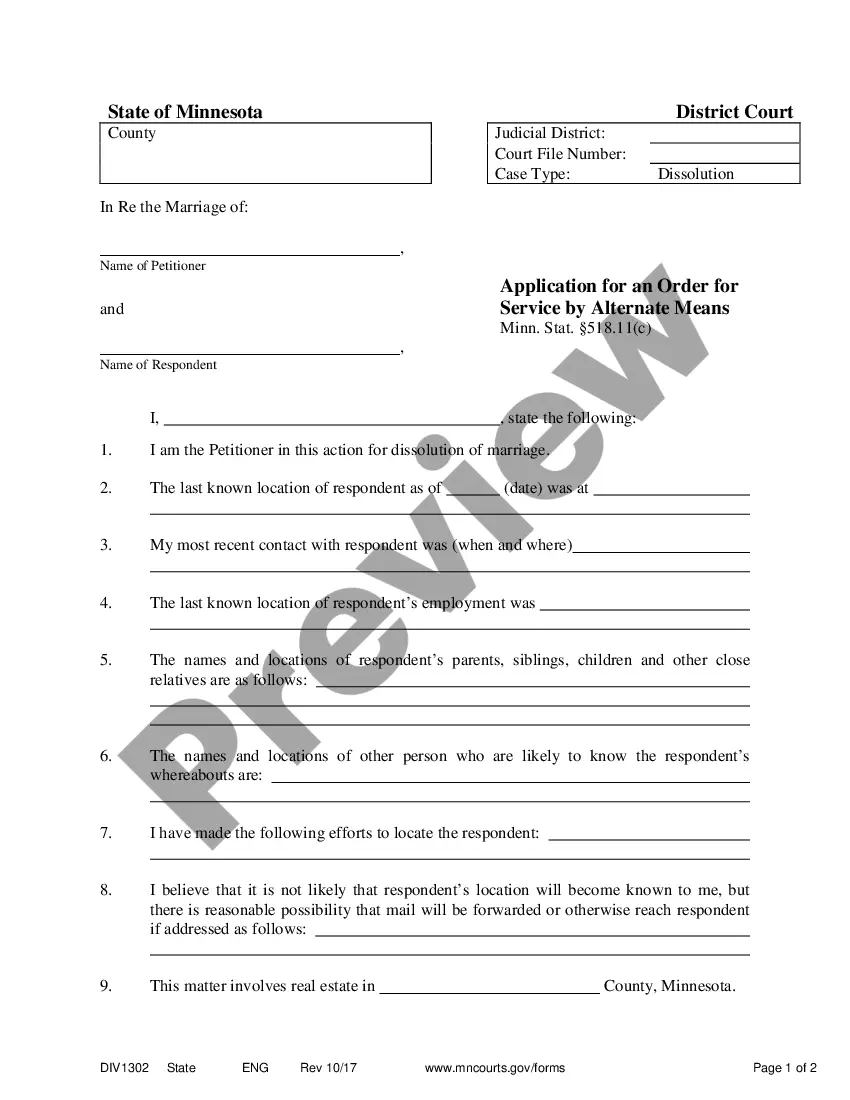

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions of a business loan agreement in Houston, Texas. It includes various warranties made by the borrower which are crucial for the lender's protection. The agreement ensures that both parties understand their rights and obligations throughout the loan term. Houston, Texas, being a major financial center, offers various types of Application and Loan Agreement for a Business Loan with Warranties by Borrower tailored to different business needs. These can include: 1. Small Business Loan Agreement: This specific loan agreement is designed for small businesses in Houston, Texas, seeking financial assistance. It typically covers a smaller loan amount and may have specific terms catering to the unique requirements of small business owners. 2. Commercial Loan Agreement: This agreement caters to larger businesses in Houston, Texas, requiring substantial capital for commercial purposes, such as real estate investments or business expansion. The terms and conditions outlined in this agreement are typically more in-depth and tailored to the specific nature of commercial loans. 3. SBA Loan Agreement: The Small Business Administration (SBA) offers loan programs to support small businesses. Houston, Texas, businesses can utilize these programs, and the loan agreement will outline the specific terms and conditions regarding SBA-guaranteed loans. 4. Startup Loan Agreement: For entrepreneurs and startups in Houston, Texas, embarking on new ventures, this type of loan agreement provides specific clauses and considerations unique to startups, such as proof of concept, development milestones, and limitations on fund usage. The Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower typically includes key sections such as: 1. Loan Amount and Purpose: Clearly outlining the amount of funds being borrowed and the purpose for which they will be used. 2. Interest Rate and Repayment Terms: Detailing the agreed-upon interest rate, repayment schedule, and any penalties or additional fees associated with late or missed payments. 3. Warranties by Borrower: The borrower agrees to provide various warranties, ensuring the accuracy of financial statements, absence of undisclosed liabilities, and compliance with all applicable laws and regulations. 4. Collateral and Security: If required, the agreement may include provisions regarding collateral or assets provided by the borrower as security for the loan. 5. Default and Remedies: Outlining the scenarios that constitute default and the actions that the lender can take in case of default, including acceleration of the loan or initiation of legal proceedings. 6. Governing Law and Jurisdiction: Specifying that the agreement is governed by the laws of Houston, Texas, and any disputes arising from it will be resolved in the appropriate Houston, Texas, court. It is important to note that the specifics of the Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower may vary depending on the lender, the borrower, and the unique circumstances of each loan agreement. Therefore, it is advisable for both parties to seek legal counsel to ensure that all relevant terms and conditions are adequately covered.Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions of a business loan agreement in Houston, Texas. It includes various warranties made by the borrower which are crucial for the lender's protection. The agreement ensures that both parties understand their rights and obligations throughout the loan term. Houston, Texas, being a major financial center, offers various types of Application and Loan Agreement for a Business Loan with Warranties by Borrower tailored to different business needs. These can include: 1. Small Business Loan Agreement: This specific loan agreement is designed for small businesses in Houston, Texas, seeking financial assistance. It typically covers a smaller loan amount and may have specific terms catering to the unique requirements of small business owners. 2. Commercial Loan Agreement: This agreement caters to larger businesses in Houston, Texas, requiring substantial capital for commercial purposes, such as real estate investments or business expansion. The terms and conditions outlined in this agreement are typically more in-depth and tailored to the specific nature of commercial loans. 3. SBA Loan Agreement: The Small Business Administration (SBA) offers loan programs to support small businesses. Houston, Texas, businesses can utilize these programs, and the loan agreement will outline the specific terms and conditions regarding SBA-guaranteed loans. 4. Startup Loan Agreement: For entrepreneurs and startups in Houston, Texas, embarking on new ventures, this type of loan agreement provides specific clauses and considerations unique to startups, such as proof of concept, development milestones, and limitations on fund usage. The Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower typically includes key sections such as: 1. Loan Amount and Purpose: Clearly outlining the amount of funds being borrowed and the purpose for which they will be used. 2. Interest Rate and Repayment Terms: Detailing the agreed-upon interest rate, repayment schedule, and any penalties or additional fees associated with late or missed payments. 3. Warranties by Borrower: The borrower agrees to provide various warranties, ensuring the accuracy of financial statements, absence of undisclosed liabilities, and compliance with all applicable laws and regulations. 4. Collateral and Security: If required, the agreement may include provisions regarding collateral or assets provided by the borrower as security for the loan. 5. Default and Remedies: Outlining the scenarios that constitute default and the actions that the lender can take in case of default, including acceleration of the loan or initiation of legal proceedings. 6. Governing Law and Jurisdiction: Specifying that the agreement is governed by the laws of Houston, Texas, and any disputes arising from it will be resolved in the appropriate Houston, Texas, court. It is important to note that the specifics of the Houston Texas Application and Loan Agreement for a Business Loan with Warranties by Borrower may vary depending on the lender, the borrower, and the unique circumstances of each loan agreement. Therefore, it is advisable for both parties to seek legal counsel to ensure that all relevant terms and conditions are adequately covered.